DSW Inc (NYSE:DSW) Consumer Discretionary - Specialty Retail | Reports March 15, Before Market Opens

Key Takeaways

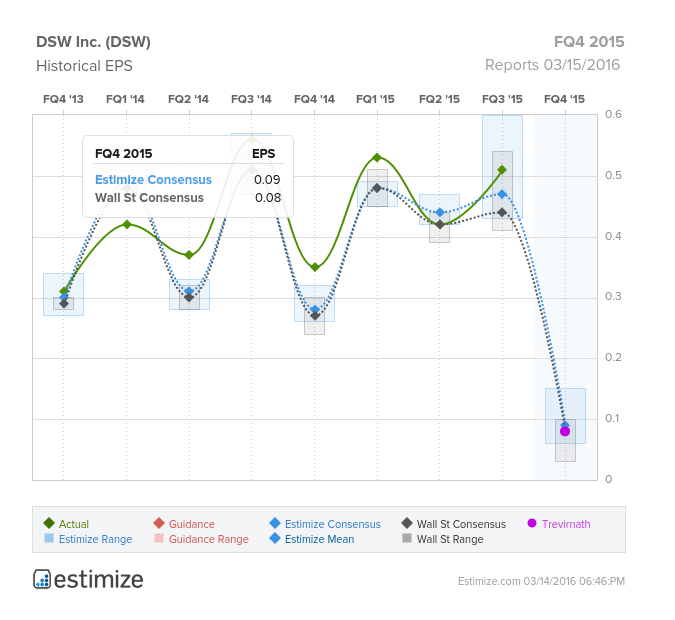

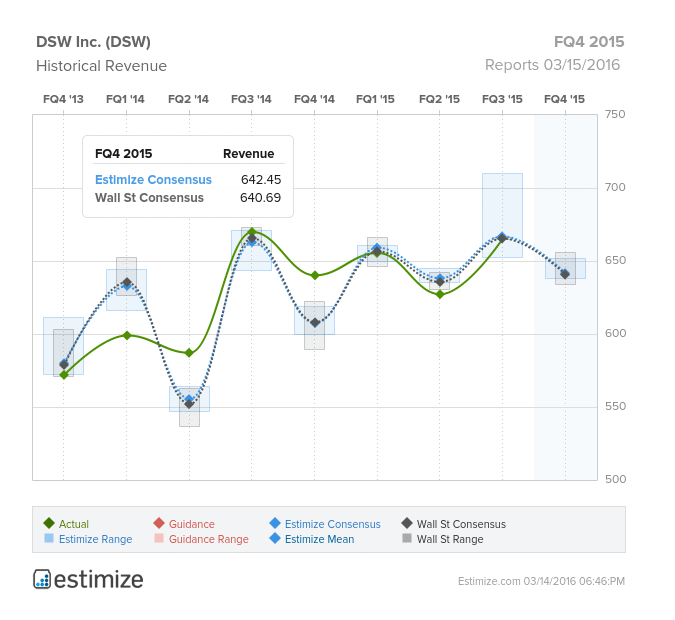

- The Estimize consensus is calling for EPS of $0.09, 14% higher than Wall Street, with revenue expectations of $642.45 million, roughly $3 million higher than the Street

- DSW’s focus on expanding its omni-channel network, smaller format stores and strategic acquisitions will be key to driving growth but also help protect them from internet competition

- On the heels of DSW’s Q4 earnings, Credit Suisse and Goldman Sachs downgraded the shoe retailer’s stock rating

As earnings season winds down, we have a few stragglers who still haven’t reported fourth quarter earnings. Shoe retailer, DSW (DSW) is one of them, as they are scheduled to report fourth quarter earnings tomorrow, before the opening bell. The company is coming off a better than expected third quarter, beating on the bottom line and meeting its sales estimates. This quarter, the Estimize consensus is calling for EPS of $0.09, 14% higher than Wall Street, with revenue expectations of $642.45 million, roughly $3 million higher than the Street. The Select Consensus on the other hand, is showing a more modest beat of $1 million on the top line. The Estimize community has maintained an optimistic stance on DSW, revising EPS estimates up 13% since the company last reported. Compared to the year prior, current estimates predict a decline in profitability of 75%. On average, the company has consistently beat expectations, trumping the Estimize consensus 73% and Wall Street 81% of recorded quarters.

An interesting pattern has emerged in recent weeks, with retailers outperforming the market despite mixed quarterly earnings and weaker guidance. DSW’s upcoming fourth quarter earnings are expected to contribute to this trend. The footwear retailer beat in 2 of the past 3 quarters but consistently falls short of guidance. In the last reported quarter, DSW posted a 0.6% decline in sales while comp sales decreased 3.9% on a year-over-year basis. Yet investors responded positively, boosting shares 11.04% in the past three months. DSW’s focus on expanding its omni-channel network, smaller format stores and strategic acquisitions will be key to drive growth but also help protect them from internet competition. Earlier this year, the footwear retailer agreed to acquire online shoe retailer Ebuys for $62.5 million with a potential $55 earnings bonus on top of that. The acquisition is expected to bolster its position in ecommerce and off-price retail, two high growth areas in the industry. Ahead of tomorrow’s earnings release, Goldman Sachs and Credit Suisse downgraded DSW’s stock, contradicting the current trend retailers are experiencing.

Do you think DSW can beat estimates? There is still time to get your estimate in here!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI