Nvidia shares jump after resuming H20 sales in China, announcing new processor

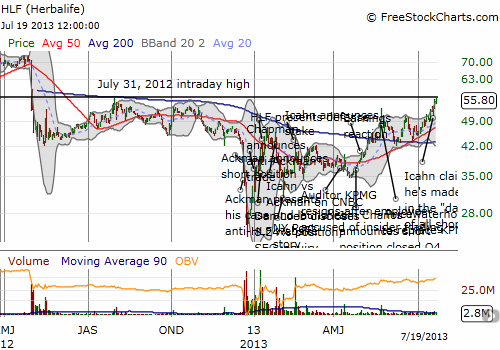

Herbalife (HLF) is on the verge of a major breakout. The stock gained another 2.5% on Friday to close at $55.80, just below the intraday high from July 31, 2012. The charts below show over a year’s worth of trading.

The next chart zooms in a little so that you can read the notes I maintain on various points of interest ever since hedge fund manager Bill Ackman announced his major short position (20 million shares).

As posted on twitter, I made my last exit from this drama on May 22. At the time, it felt like a blow-off top kind of move, and I did not want wait through another several months for the stock to come back. Since then, the stock found perfect support at the 200-day moving average (DMA) and then the powerful combination of the 50 and 200DMAs. I left both alone, and I am now content to watch this one from the sidelines…even as I feel the HLF short squeeze has yet to begin.

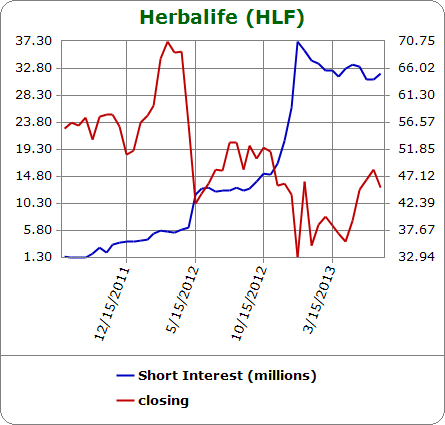

Shares short are currently at 31.97M, 38% of float. It was as high as around 37.3M shortly after Ackman made his disclosure. The largest reductions in the short position came during the first two months or so of the year. The short position has barely budged since then so the current rally cannot be blamed on a short squeeze. If anything, we might pinpoint April 24th when famous short seller James Chanos announced he closed out his short position in the fourth quarter of 2012. Chanos maintained that HLF is not a viable business in the long-term, but he clearly was not as committed as Ackman to waiting this trade out to the end (remember, Ackman started building his short position around May or June, 2012!). The stock had just retested 2013 closing lows and has not looked back ever since.

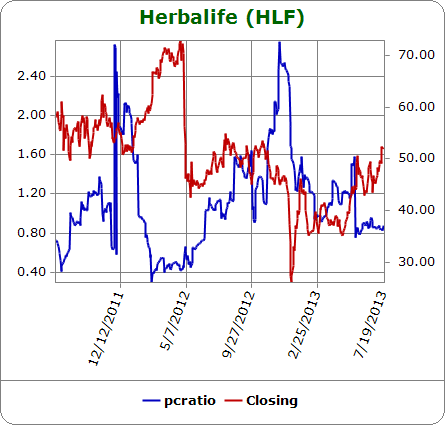

The trends on the open interest put/call ratio also seem to indicate that shorts are not hedging much. The big drop in the ratio in December looks like it was a big close-out into the sell-off at the time. Similar story with the late January to February reduction. Interestingly, the big reduction in May looks like it coincides with the surge in share price the day before and/or the day of HLF’s announcement that PricewaterhouseCoopers would replace disgraced auditor KPMG to look over HLF’s books. It was as if this was a major bullish signal that failed to shake up shorts but ignited a flurry of speculators.

If HLF breaks out, shorts will suddenly face the prospect of a major run-up as momentum traders will likely pile on. The path from there will have to lead to some major climactic move that includes some major short close-out event. Even assuming Ackman keeps his 20M short, the remaining 10M could cause a major move upward over a day or two given HLF averages only 2.4M shares traded per day. From there, it will be all about who blinks first, Ackman or Carl Icahn, the hedgie most vocally lined up against Ackman’s position.

In the very short clip below, we learn that Icahn revealed at CNBC’s Delivering Alpha Conference that he has now made around $250M off his position in HLF. This is astonishing. If Icahn ever decides to lock in his profits, he will surely knock the stock down multiple pegs. For that very reason, he may well decide to just hold onto it until Ackman comes to him to make a deal for his shares. I have my price alerts and popcorn ready for the fireworks. (Could the company even get taken private?!?).

(Click here for the full video)

Be careful out there!

Disclosure: no positions

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.