Trump says he will sue Wall Street Journal, NewsCorp, over Epstein letter report

According to numerous treasury bears, yields would soar out of control once the 3.0% threshold broke. Well?

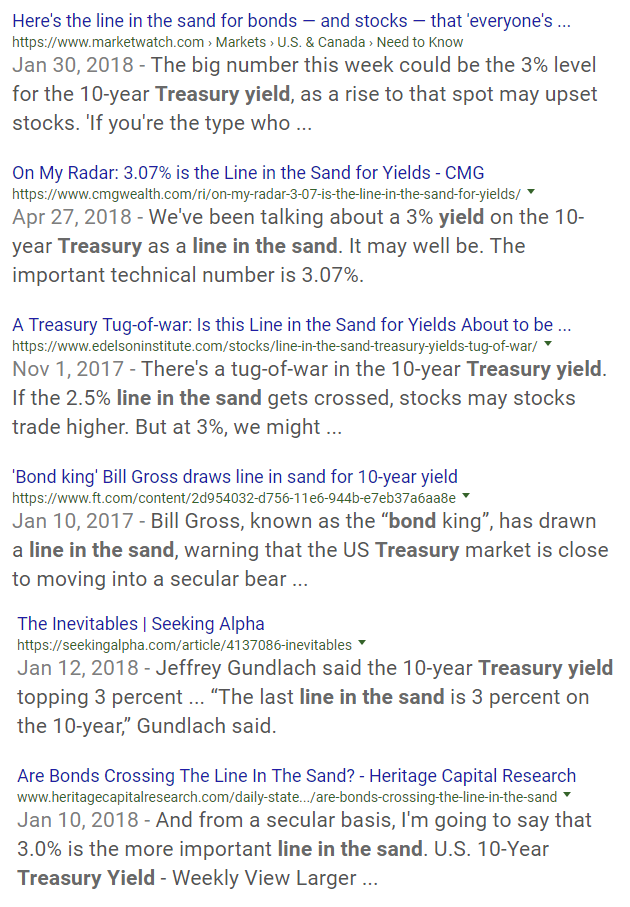

Here are some amusing predictions.

No Such Thing As Lines in the Sand

Note to Bill Gross, MarketWatch, the Edelson Institute, the Financial Times, Jeffrey Gundlach, Heritage Capital, and numerous other forecasters not caught up in that precise search: The is no such thing such as a line in the sand that when breached cannot be crossed back.

Technical lines in the sand are one thing and fundamentals another. This is not like nuclear war which cannot be reversed.

The same people have been calling for the the end of the bond bull market for a decade. Perhaps they have it right, but the fundamentals suggest otherwise.

The economy is slowing and the Fed is hiking. The stock market is likely headed for another bust. There is a new worry in Europe. China is slowing.

Yes, we have late stage inflation, but so what?

There is no magic line in the sand. Neither the economy nor the bond market work that way.

Related Articles

- Reflections on Late-Stage Inflation

- Economic Recovery in Italy: NY Times vs. Alhambra Investments' Zombification

- Rate Hike Expectations Dive On Housing Data

- Grave Consequences: Italy Bond Yields Soar, Protests Called, Euro Referendum

Treasury bears, please not that asset bubble burstings are inherently deflationary. If you think an asset bubble burst is likely, then you should believe that treasury yields will sink.

Of course, if you think the economy is on the verge of overheating, be my guest, short treasuries.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.