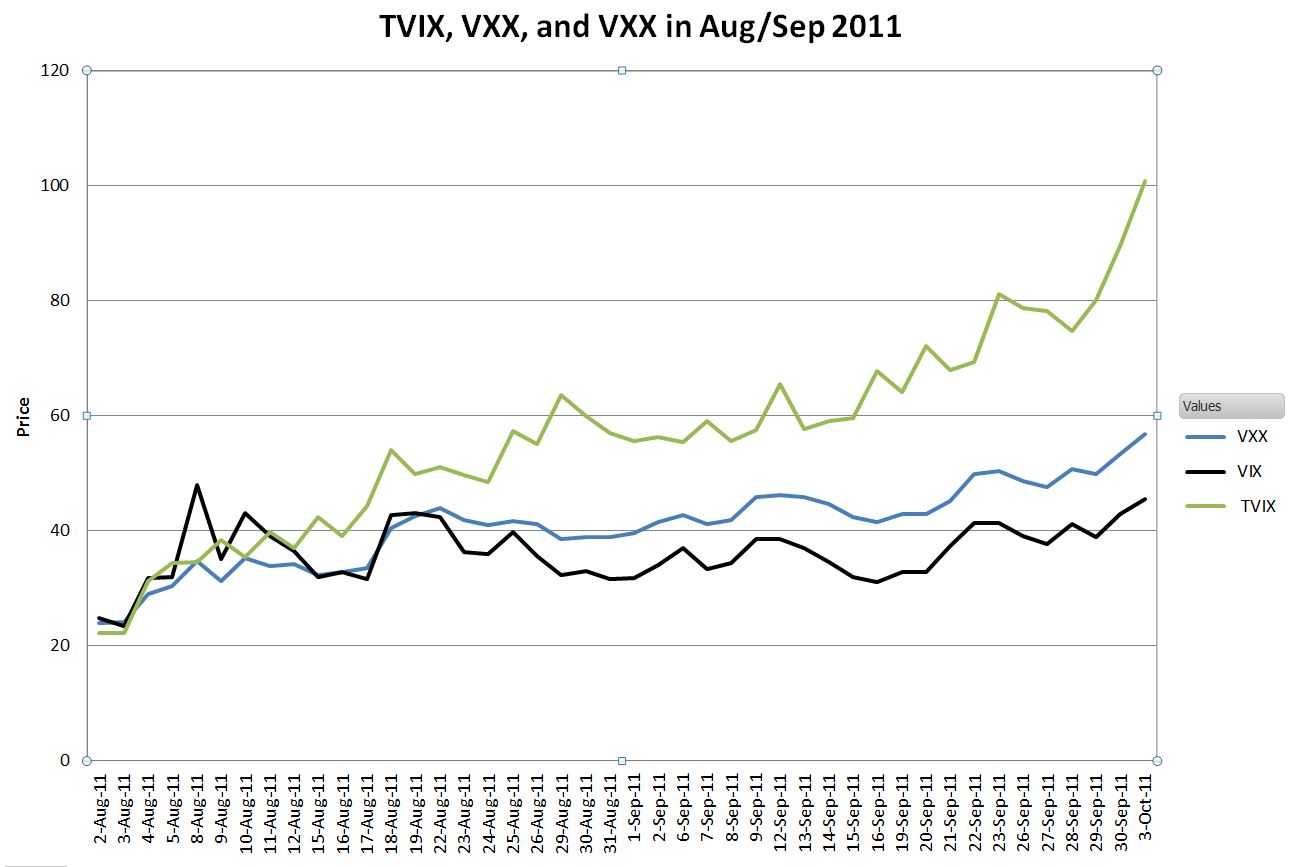

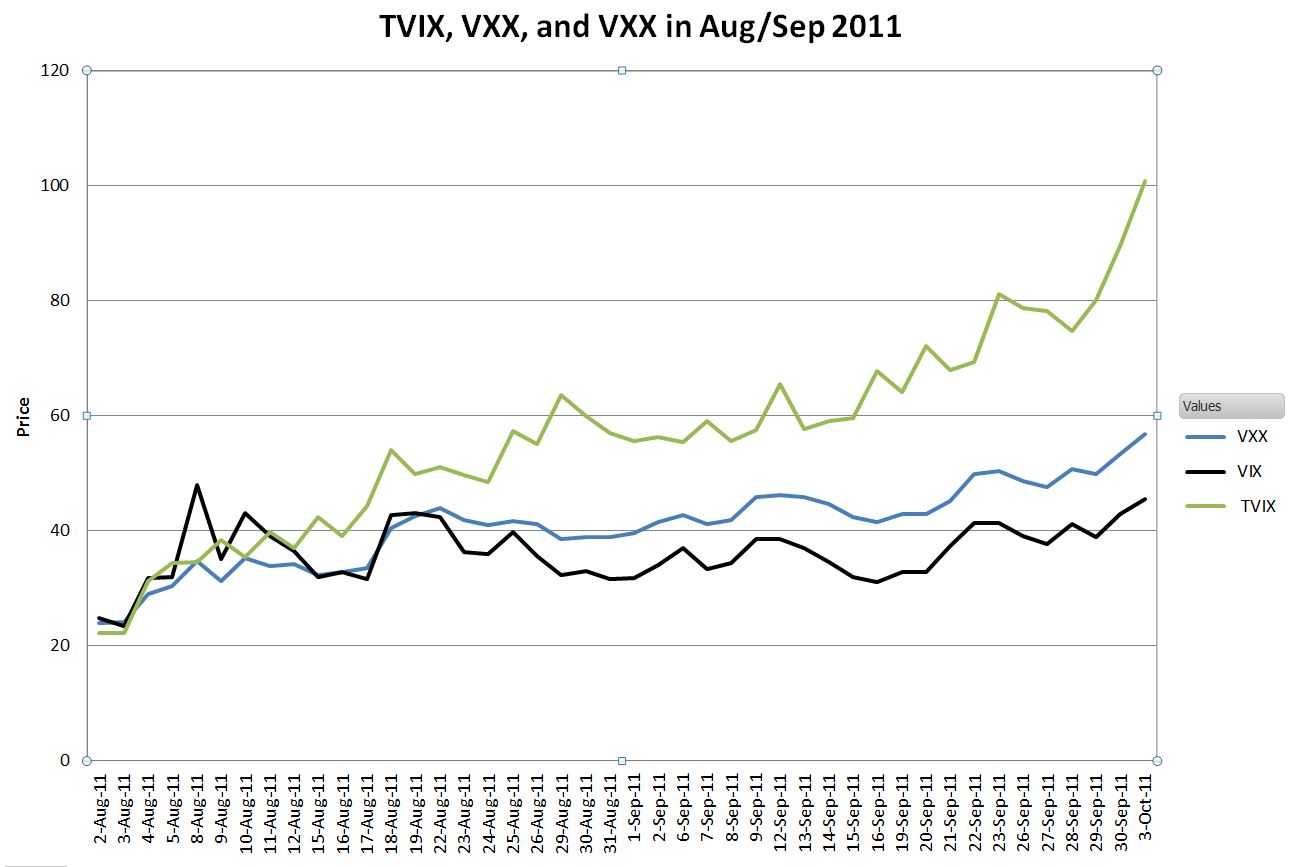

From August 2nd to October 3rd, 2011 Barclays’ S&P 500 VIX Short Term Futures ETN (VXX) had a great 137% runup. In that same period VelocityShares’ TVIX ETN, 2X leveraged on the same index went up an astonishing 348%, 73 percent more than its 2X leverage factor would project. How is that possible? Don’t inverse and leveraged funds always underperform the index they’re tracking?

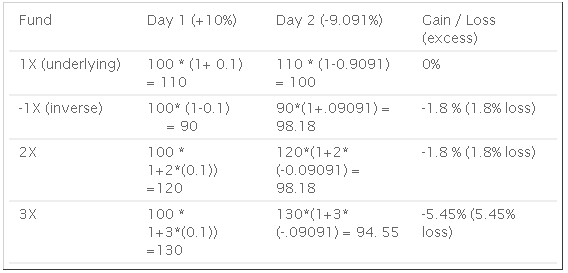

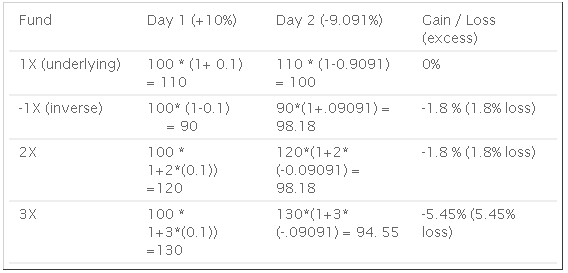

Normal market price action is typically random, with the number of up and down days about equal. This bouncing back and forth is really bad for inverse and leveraged funds. A classic example is a two day sequence of 10% up one day followed by a 9.091% move down.

The non-leveraged fund ends up unchanged. But all the daily rebalanced -1X, 2X and 3X leveraged funds suffer.

There wasn’t much back and forth for TVIX in the Aug/Sept 2011 timeframe.

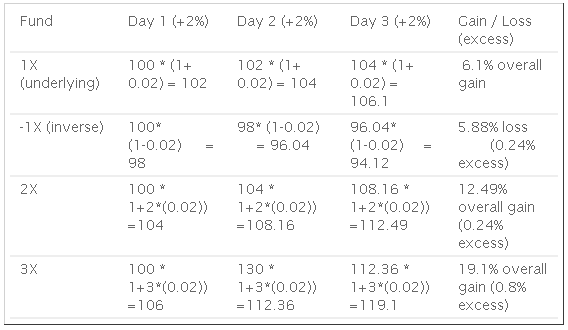

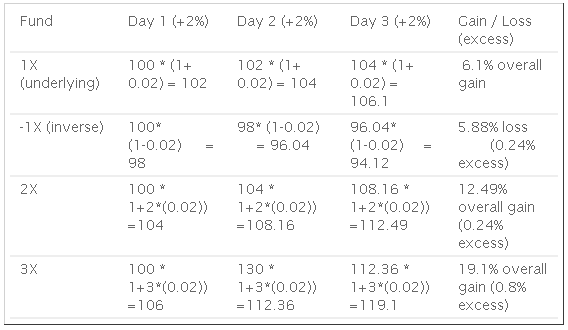

The average daily increase in VXX was 2% —which went on for 44 trading days. Looking at just 3 days of ongoing 2% gains we get the following results:

When carried out for 44 days the projected excess gain for TVIX given a constant +2% daily change in VXX gives a theoretical excess of 288%. The actual excess gain was “only” 73% because VXX did have a few down days along the way.

During this timeframe leveraged funds had 3 things going for them:

On the other hand, these three conditions are considerably more common:

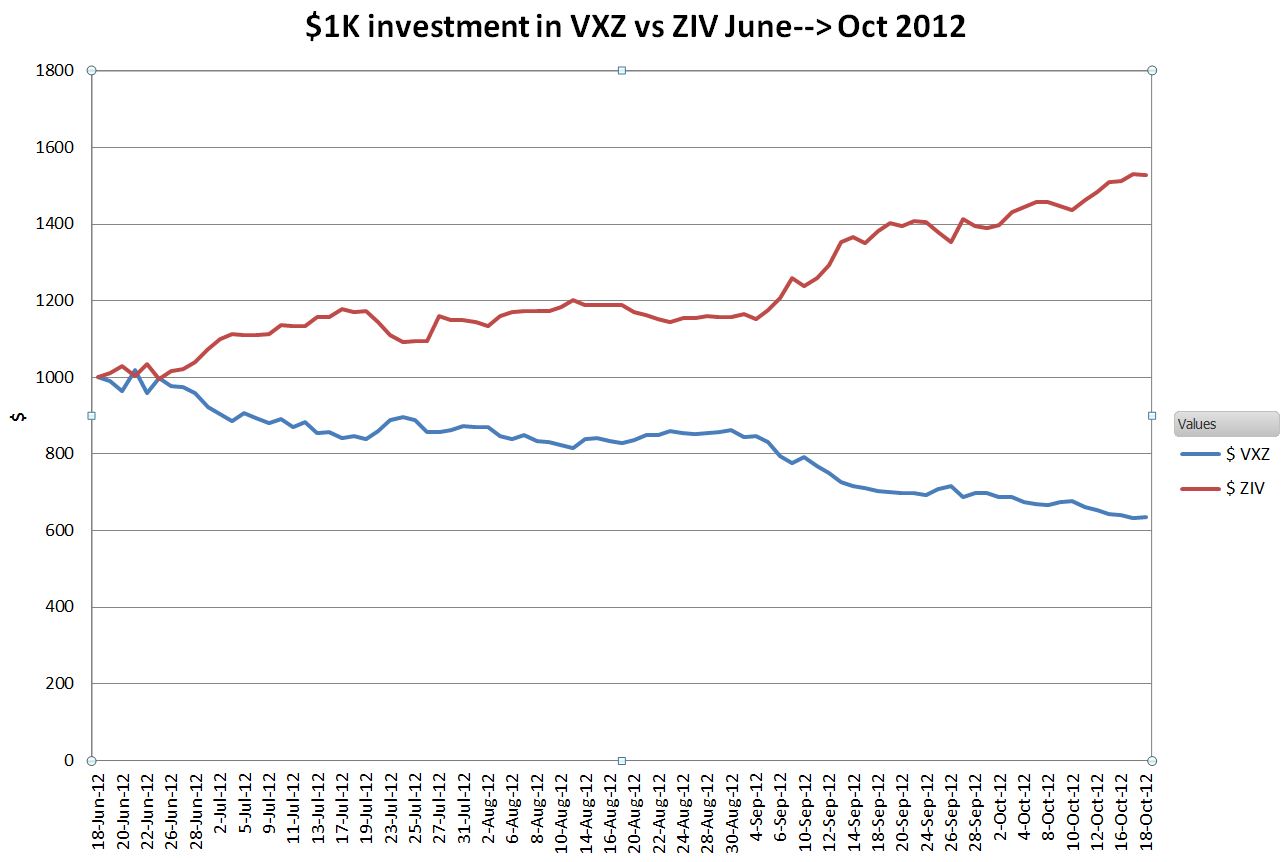

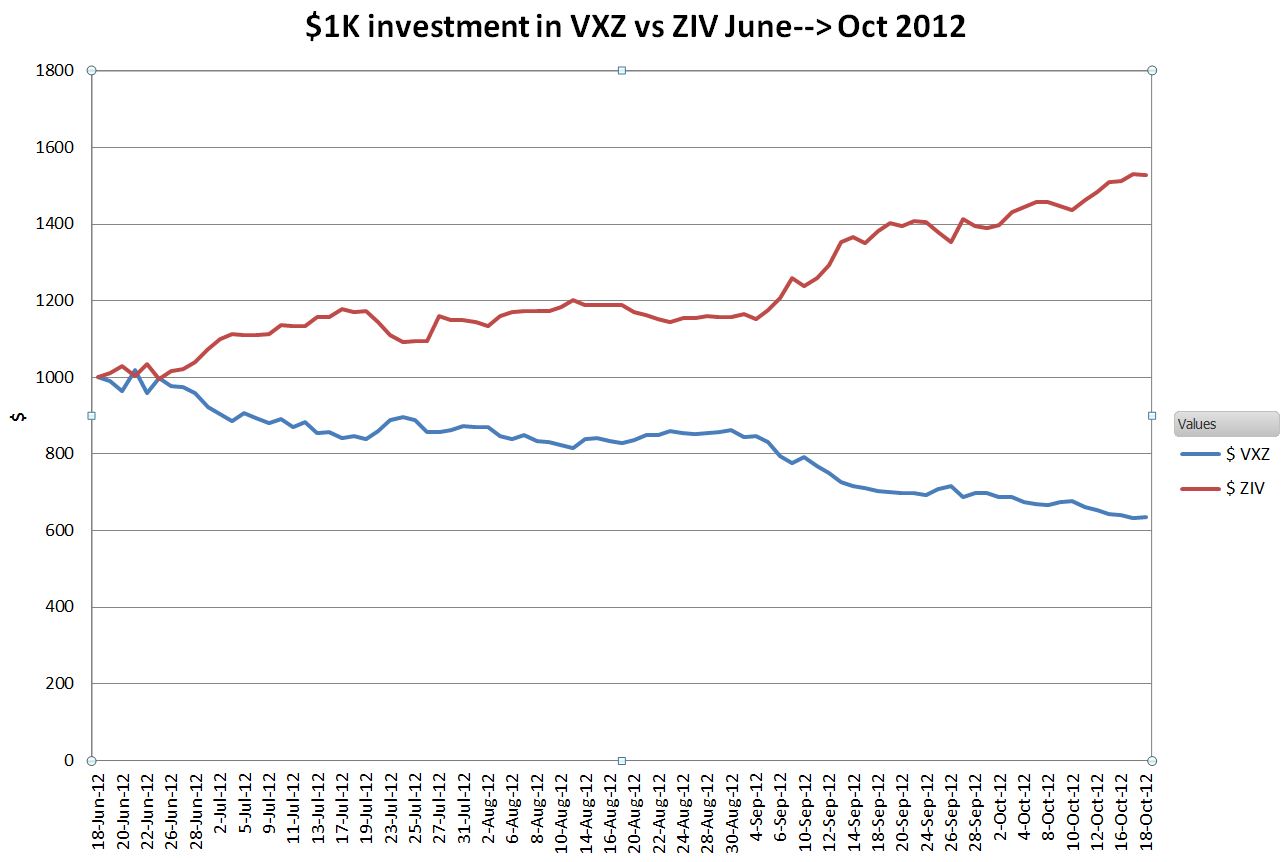

VXZ went down 36.4% during this 3 month period, ZIV was up 52.7%. This hat trick on inverse volatility paid off nicely.

Normal market price action is typically random, with the number of up and down days about equal. This bouncing back and forth is really bad for inverse and leveraged funds. A classic example is a two day sequence of 10% up one day followed by a 9.091% move down.

The non-leveraged fund ends up unchanged. But all the daily rebalanced -1X, 2X and 3X leveraged funds suffer.

There wasn’t much back and forth for TVIX in the Aug/Sept 2011 timeframe.

The average daily increase in VXX was 2% —which went on for 44 trading days. Looking at just 3 days of ongoing 2% gains we get the following results:

When carried out for 44 days the projected excess gain for TVIX given a constant +2% daily change in VXX gives a theoretical excess of 288%. The actual excess gain was “only” 73% because VXX did have a few down days along the way.

During this timeframe leveraged funds had 3 things going for them:

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

- Volatility as measured by VIX trending higher

- Backwardation in the VIX futures was boosting VXX

- The increases in VXX were steady, without a lot of random motion—resulting in a positive compounding effect.

On the other hand, these three conditions are considerably more common:

- Volatility as measured by VIX is trending down

- The VIX futures term structure is in contango

- The decrease in volatility is steady, without a lot of randomness—resulting in a positive compounding effect.

VXZ went down 36.4% during this 3 month period, ZIV was up 52.7%. This hat trick on inverse volatility paid off nicely.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.