Stock market today: S&P 500 ekes out gain as Trump says open to deals on tariffs

In this past weekend's newsletter I stated with:

"There it is. I am calling it. The long awaited correction is coming during the month of March."

Yesterday, at least as of the time of this posting, the S&P 500 had its biggest one day correction of 2012. While that sounds a lot more dramatic than it really is - the question is whether this is the beginning of a bigger correction or just a much needed breather to allow us to add further exposure to portfolios more safely.

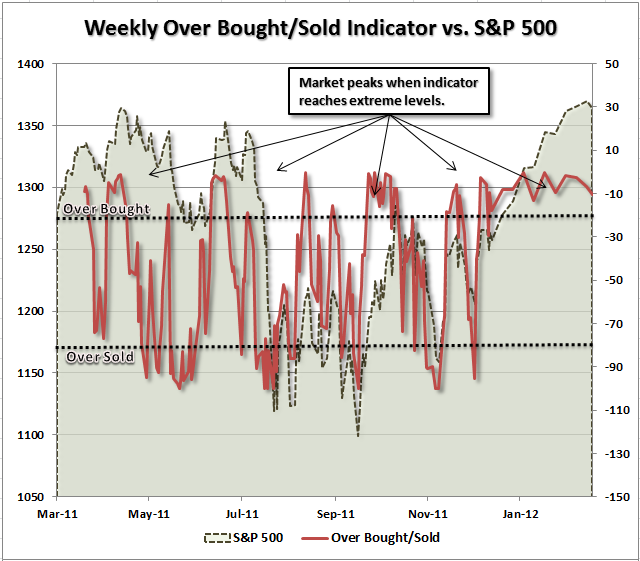

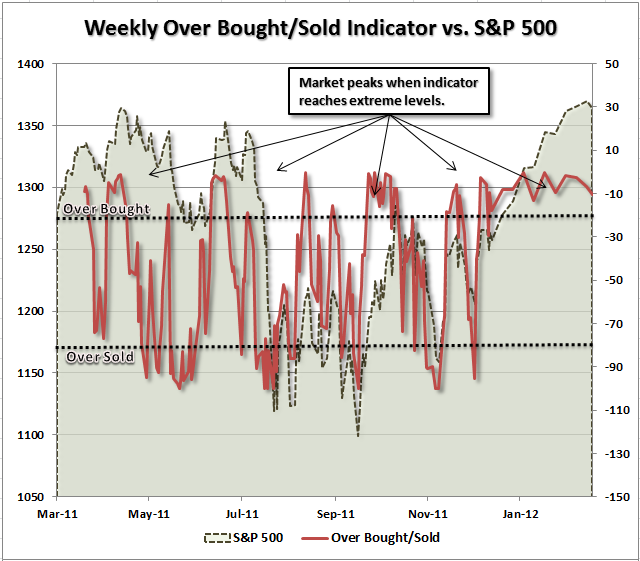

The market has been signaling extreme overbought conditions (on a weekly basis) for the last few weeks which is why we have been ringing a cautionary tone in our weekly missive about chasing the rally. However, with that said, we have also been very clear that we are currently within a bullish trend in the market which dictates adding exposure to risk assets (equities) in portfolios on pullbacks to support.

Therefore, the obvious question is where do we now start looking to rebalance portfolios and increase exposure to equities for the time being. While we look at weekly charts to strip out the day to day volatility of the markets when looking for interim pullbacks during bullish trends - daily charts are more applicable.

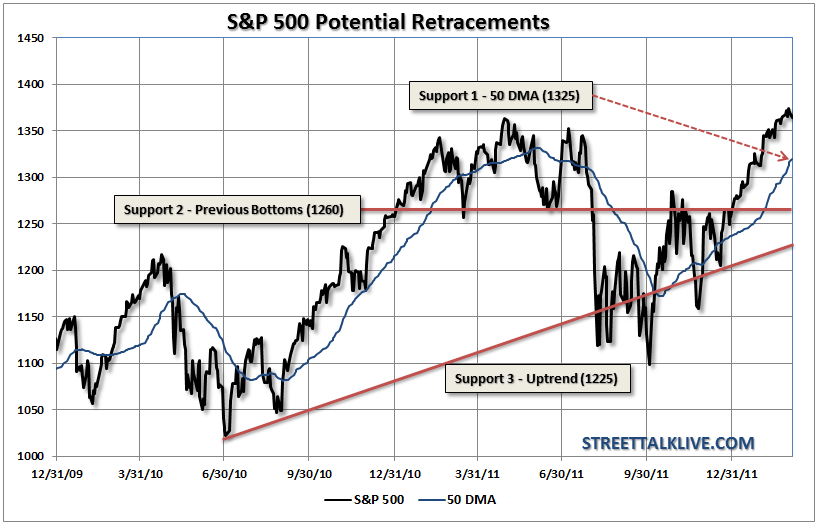

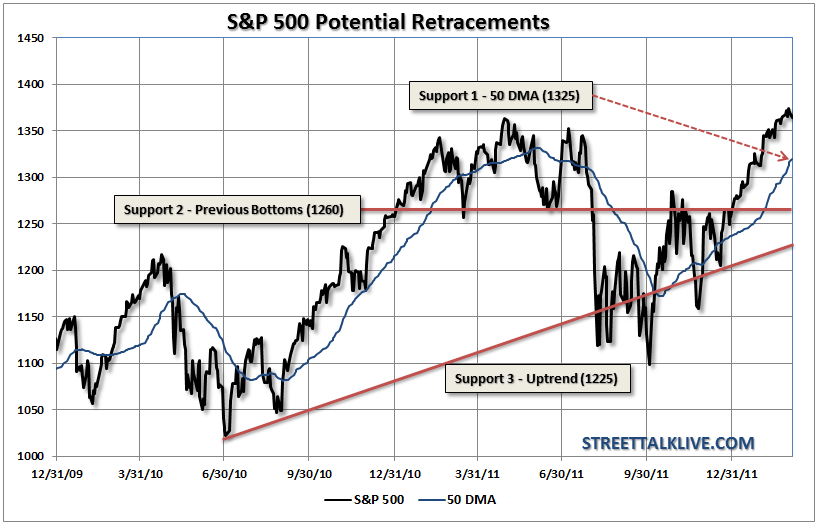

The second chart is the S&P 500 versus the 50 day moving average (dma). During bullish (rising) trends, pullbacks to the 50 dma are extremely common. In the chart I have notated three potential correction levels.

The most likely correction that we could see currently is to the 50 dma which is currently about 1325 as of the March 6th close.This would be a correction of 3.5% from the high close of 1374 on March 1st. This correction process would be very similar to the overbought correction process as we saw in late 2010.The pullback to the 50 dma in November of 2010 provided an entry point for investors with a better risk / reward ratio. From that correction the market then continued its rally into April of 2011.

There is a MAJOR caveat here. The rally that began in the fall of 2010 and pushed into early summer of 2011 was driven by the second round of Quantitative Easing. Today, we have the ECB flooding Europe with capital, the Bank of Japan engaged in Q.E. and the Fed with an unlimited dollar swap window open to European banks. This liquidity has been a major driver up to this point BUT the effectiveness of the liquidity programs are waning. Furthermore, with "economic improvement" being bantered about by the Administration the Fed may be trapped in a box, along with rising oil and gas prices, from further liquidity injections. Therefore, from the low point of this correction I would not jump to the conclusion that the second half of this advance will be as great as the first.

Further Corrections Possible

While I don't expect it at this time; we should be prepared for the markets to correct further than initial support. I have identified in the chart two further correction levels.

The second support level is the neckline of the previous head and shoulders topping pattern from 2010. When that neckline was broken last summer, that had been the trigger to get us out of the market for the summer. We had also said that if the market rallied above this level that would be very bullish. It did and it is.

Today, the previous neckline is now once again a good support level for the market. IF the current correction fails at the 50 dma the market should find support around 1260ish. This would be a deeper correction of 8.3% but would provide an additional area to rebalance portfolios.

The third support is the most critical. This is the support level that is dictated by the rising trend of the market from the summer 2010 and the summer 2011 correction.If the market fails to find support at the 50 dma or the previous neckline then the rising trend is our last line of resistance.This would be a much more serious correction of 10.8% - but what I am about to say next is the SINGLE most important aspect of this entire missive.

Knowing When We're Wrong

If the third level of resistance is broken - the bullish trend will be called into question.This is the point where investors began to make their biggest emotional mistakes. Knowing when you are wrong is critical in the protection of your capital. If you can't sell at a loss - then you shouldn't be investing in the markets at all. If we break the uptrend line and the bullish trend turns negative we will be recommending selling equity positions and raising cash. Yes, that means we will sell the positions that we just purchased at a loss.That is a function of investing money and managing risk.

If you are not okay with losing money - don't invest. Buy bonds, CDs and liquid money markets and sleep well at night. Investors suffer the most damage from emotional trading mistakes such as trying to convince themselves that:

Investing is not much different than gambling and knowing when to "fold" is a key to long term survival at the poker table. Furthermore, when investment decisions that we make don't turn out as planned - we need to cut those losses short so that we have cash available to invest when the next opportunity when it presents itself. This is why having a discipline that forces profit taking when markets rise, and loss reduction when markets are declining, is critical to long term investment success.

What To Do Next

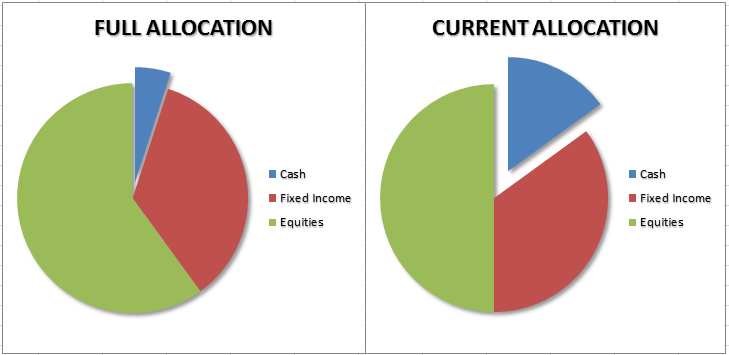

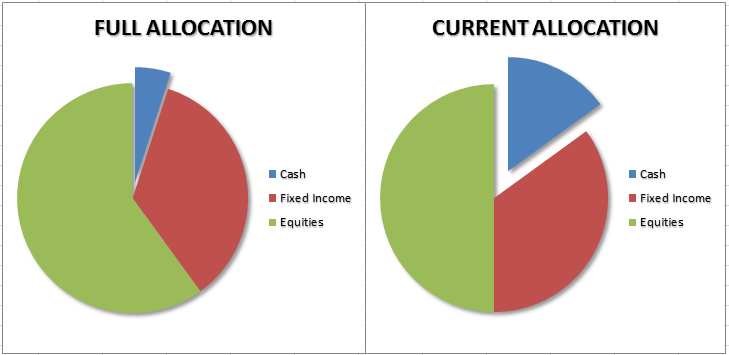

Now that we have covered what to expect to occur we need to translate that to a set of instructions. Each week in the newsletter we update our portfolio allocation model. I have simplified the model for this missive to a basic stock/bond/cash allocation. The "full allocation" is where you would be at your maximum allocation . The "current allocation" is where we are today. We use a 60% equity / 40% bond/cash model as this allocation has been the best performing of all asset allocation models over the last 130 years.

This past week we gave the following instructions to implement during this correction process. The instructions below are for general guidance suggestions between how you may be currently allocated today and the model above. If you want to be more aggressive or conservative with your allocation, depending on your personal risk tolerance, simply adjust percentages accordingly.

Situation A) I Am Overweight Equities

Patience Is A Virtue

Remember that investing is not a competition. There are no trophies for first place. If you miss a rally - another opportunity will present itself about as often as seeing a taxicab in New York City. However, the much bigger risk to your financial future is chasing markets. Chasing an all equity benchmark index requires you to take on much more risk than most investors realize. As my mom used to say "it's all fun and games until someone gets their eye put out." The losses that are derived from excessive risk taking are the losses that can be much larger than you can imagine.

Making up lost capital is NOT an investment strategy. You lose out to inflation but most importantly you lose the one commodity that you can never regain - time. For most of us the option of living forever is not available. We have a finite time horizon with which to invest our money and make it grow so that those savings can hopefully fund our retirement. Every time you suffer major setbacks from the markets - the longer it will take to reach your retirement goal.

So, while the guys in the media slap buttons to "buy...buy...buy" remember that it is not their money at risk. It is yours. Only you can make the decision to invest it in a manner to garner some gains when the market rises but, more importantly, protect it from when the market falls. Patience is a virtue and being a successful long term investor requires a strong investment discipline, rational expectations and the patience to wait for the right opportunities to present themselves.

If all else fails - just remember Warren Buffett's investment rules.

1) Never lose money

2) Refer to rule #1

"There it is. I am calling it. The long awaited correction is coming during the month of March."

Yesterday, at least as of the time of this posting, the S&P 500 had its biggest one day correction of 2012. While that sounds a lot more dramatic than it really is - the question is whether this is the beginning of a bigger correction or just a much needed breather to allow us to add further exposure to portfolios more safely.

The market has been signaling extreme overbought conditions (on a weekly basis) for the last few weeks which is why we have been ringing a cautionary tone in our weekly missive about chasing the rally. However, with that said, we have also been very clear that we are currently within a bullish trend in the market which dictates adding exposure to risk assets (equities) in portfolios on pullbacks to support.

Therefore, the obvious question is where do we now start looking to rebalance portfolios and increase exposure to equities for the time being. While we look at weekly charts to strip out the day to day volatility of the markets when looking for interim pullbacks during bullish trends - daily charts are more applicable.

The second chart is the S&P 500 versus the 50 day moving average (dma). During bullish (rising) trends, pullbacks to the 50 dma are extremely common. In the chart I have notated three potential correction levels.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The most likely correction that we could see currently is to the 50 dma which is currently about 1325 as of the March 6th close.This would be a correction of 3.5% from the high close of 1374 on March 1st. This correction process would be very similar to the overbought correction process as we saw in late 2010.The pullback to the 50 dma in November of 2010 provided an entry point for investors with a better risk / reward ratio. From that correction the market then continued its rally into April of 2011.

There is a MAJOR caveat here. The rally that began in the fall of 2010 and pushed into early summer of 2011 was driven by the second round of Quantitative Easing. Today, we have the ECB flooding Europe with capital, the Bank of Japan engaged in Q.E. and the Fed with an unlimited dollar swap window open to European banks. This liquidity has been a major driver up to this point BUT the effectiveness of the liquidity programs are waning. Furthermore, with "economic improvement" being bantered about by the Administration the Fed may be trapped in a box, along with rising oil and gas prices, from further liquidity injections. Therefore, from the low point of this correction I would not jump to the conclusion that the second half of this advance will be as great as the first.

Further Corrections Possible

While I don't expect it at this time; we should be prepared for the markets to correct further than initial support. I have identified in the chart two further correction levels.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The second support level is the neckline of the previous head and shoulders topping pattern from 2010. When that neckline was broken last summer, that had been the trigger to get us out of the market for the summer. We had also said that if the market rallied above this level that would be very bullish. It did and it is.

Today, the previous neckline is now once again a good support level for the market. IF the current correction fails at the 50 dma the market should find support around 1260ish. This would be a deeper correction of 8.3% but would provide an additional area to rebalance portfolios.

The third support is the most critical. This is the support level that is dictated by the rising trend of the market from the summer 2010 and the summer 2011 correction.If the market fails to find support at the 50 dma or the previous neckline then the rising trend is our last line of resistance.This would be a much more serious correction of 10.8% - but what I am about to say next is the SINGLE most important aspect of this entire missive.

Knowing When We're Wrong

If the third level of resistance is broken - the bullish trend will be called into question.This is the point where investors began to make their biggest emotional mistakes. Knowing when you are wrong is critical in the protection of your capital. If you can't sell at a loss - then you shouldn't be investing in the markets at all. If we break the uptrend line and the bullish trend turns negative we will be recommending selling equity positions and raising cash. Yes, that means we will sell the positions that we just purchased at a loss.That is a function of investing money and managing risk.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

If you are not okay with losing money - don't invest. Buy bonds, CDs and liquid money markets and sleep well at night. Investors suffer the most damage from emotional trading mistakes such as trying to convince themselves that:

- "If I get back to even I will sell..."

- "On the next bounce I will get out..."

- "I am a long term investor...so I will eventually be alright"

Investing is not much different than gambling and knowing when to "fold" is a key to long term survival at the poker table. Furthermore, when investment decisions that we make don't turn out as planned - we need to cut those losses short so that we have cash available to invest when the next opportunity when it presents itself. This is why having a discipline that forces profit taking when markets rise, and loss reduction when markets are declining, is critical to long term investment success.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

What To Do Next

Now that we have covered what to expect to occur we need to translate that to a set of instructions. Each week in the newsletter we update our portfolio allocation model. I have simplified the model for this missive to a basic stock/bond/cash allocation. The "full allocation" is where you would be at your maximum allocation . The "current allocation" is where we are today. We use a 60% equity / 40% bond/cash model as this allocation has been the best performing of all asset allocation models over the last 130 years.

This past week we gave the following instructions to implement during this correction process. The instructions below are for general guidance suggestions between how you may be currently allocated today and the model above. If you want to be more aggressive or conservative with your allocation, depending on your personal risk tolerance, simply adjust percentages accordingly.

Situation A) I Am Overweight Equities

- Reduce equity exposure immediately to align with model.

- Hold cash raise from liquidations until correction is complete.

- Raise fixed income allocation to 35% of portfolio.

- Keep equity exposure at current levels. When correction is complete align equity exposure with model.

- Keep cash at current levels and hold until correction is complete.

- Adjust bonds to 35% of portfolio.

- When correction is complete align equity exposure with model.

- Keep cash at current levels and hold until correction is complete

- Raise bonds to 35% of portfolio.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Review this weekend's newsletter at the website for an updated set of instructions depending on how this week ends.Patience Is A Virtue

Remember that investing is not a competition. There are no trophies for first place. If you miss a rally - another opportunity will present itself about as often as seeing a taxicab in New York City. However, the much bigger risk to your financial future is chasing markets. Chasing an all equity benchmark index requires you to take on much more risk than most investors realize. As my mom used to say "it's all fun and games until someone gets their eye put out." The losses that are derived from excessive risk taking are the losses that can be much larger than you can imagine.

Making up lost capital is NOT an investment strategy. You lose out to inflation but most importantly you lose the one commodity that you can never regain - time. For most of us the option of living forever is not available. We have a finite time horizon with which to invest our money and make it grow so that those savings can hopefully fund our retirement. Every time you suffer major setbacks from the markets - the longer it will take to reach your retirement goal.

So, while the guys in the media slap buttons to "buy...buy...buy" remember that it is not their money at risk. It is yours. Only you can make the decision to invest it in a manner to garner some gains when the market rises but, more importantly, protect it from when the market falls. Patience is a virtue and being a successful long term investor requires a strong investment discipline, rational expectations and the patience to wait for the right opportunities to present themselves.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

If all else fails - just remember Warren Buffett's investment rules.

1) Never lose money

2) Refer to rule #1

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI