On Sep 1, Zacks Investment Research downgraded H&R Block Inc. (NYSE:HRB) to a Zacks Rank #4 (Sell).

Why the Downgrade?

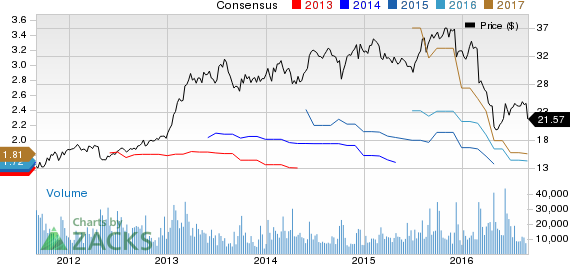

H&R Block witnessed downward estimate revisions after reporting disappointing fiscal first-quarter 2017 results. Shares of this tax preparer have been on a downtrend of late. In fact, the stock dipped 0.4% since the company reported first-quarter results. Given its expected negative earnings growth rates for the upcoming quarters, we anticipate the stock to decline further.

On Aug 30, H&R Block reported loss per share of 55 cents, wider than the Zacks Consensus Estimate of a loss of 53 cents and the year-ago loss of 35 cents. The quarterly results were affected by the divestiture of H&R Block Bank. Revenues too suffered owing to lower return volumes in the tax business and unfavorable currency exchange rates in international business. The impact of divesture was large enough to offset the effect of cost-reduction initiatives and a lower share count.

Also, the company expects the divestiture of H&R Block Bank to hurt the bottom line by 8–10 cents per share annually.

Coming to the insurer’s balance sheet position, its cash and cash equivalents declined year over year, while long-term debt was significantly higher than the year-ago level. Cash and cash equivalents deteriorated largely owing to cash payments made for the transfer of deposit liabilities due to the bank divestiture, changes in capital structure and share buyback. Long-term debt increased owing to issuance of debt. Net cash used in operations also compared unfavorably year over year.

The Zacks Consensus Estimate for 2017 and 2018 moved down by a cent each in the last seven days. The same is currently pegged at $1.72 and $1.81 for 2017 and 2018, respectively, as one-third of the estimates moved south.

Stocks to Consider

Not all consumer discretionary stocks, however, are performing as poorly as H&R Block. Some better-ranked stocks include Central Garden & Pet Company (NASDAQ:CENT) , Deckers Outdoor Corp. (NYSE:DECK) and Outerwall Inc. (NASDAQ:OUTR) , each sporting a Zacks Rank #1 (Strong Buy).

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

CENTRAL GARDEN (CENT): Free Stock Analysis Report

DECKERS OUTDOOR (DECK): Free Stock Analysis Report

BLOCK H & R (HRB): Free Stock Analysis Report

OUTERWALL INC (OUTR): Free Stock Analysis Report

Original post

Zacks Investment Research

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.