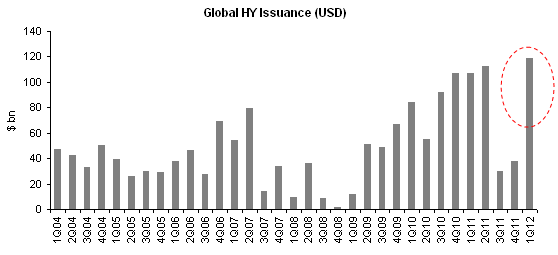

The global high yield bond issuance hit a record during the past quarter. With persistently low rates and tremendous demand for yield from mutual funds and ETFs, companies lined up to get ridiculously cheap financing.

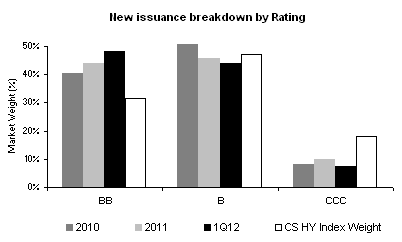

The chase for junk bonds however has been uneven. In the current environment, investors want to make sure that companies have enough of an earnings cushion to withstand another shock. The demand for very high leverage companies has been weaker relative to the rest of the junk bond market. While the CCC issuance has been below previous years and below its weight in the HY index, the BB issuance was materially higher. Buyers have been looking for lower leverage (higher quality) companies that would survive a sharp increase in the debt-to-earnings ratio.

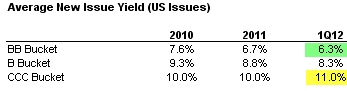

This shift into "quality" resulted in lower yields for new issue BBs while higher yield for CCCs.

This tells us that we continue to have strong demand for yield combined with concerns about "tail risk." But chasing new issue BB bonds yielding 6.3% could be a mistake. There is little upside on such bonds with Treasury yields already at historical lows and spreads at fairly tight levels. Buying bonds like these simply leaves little room for error.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.