Stock market today: S&P 500 slips amid caution ahead of inflation data

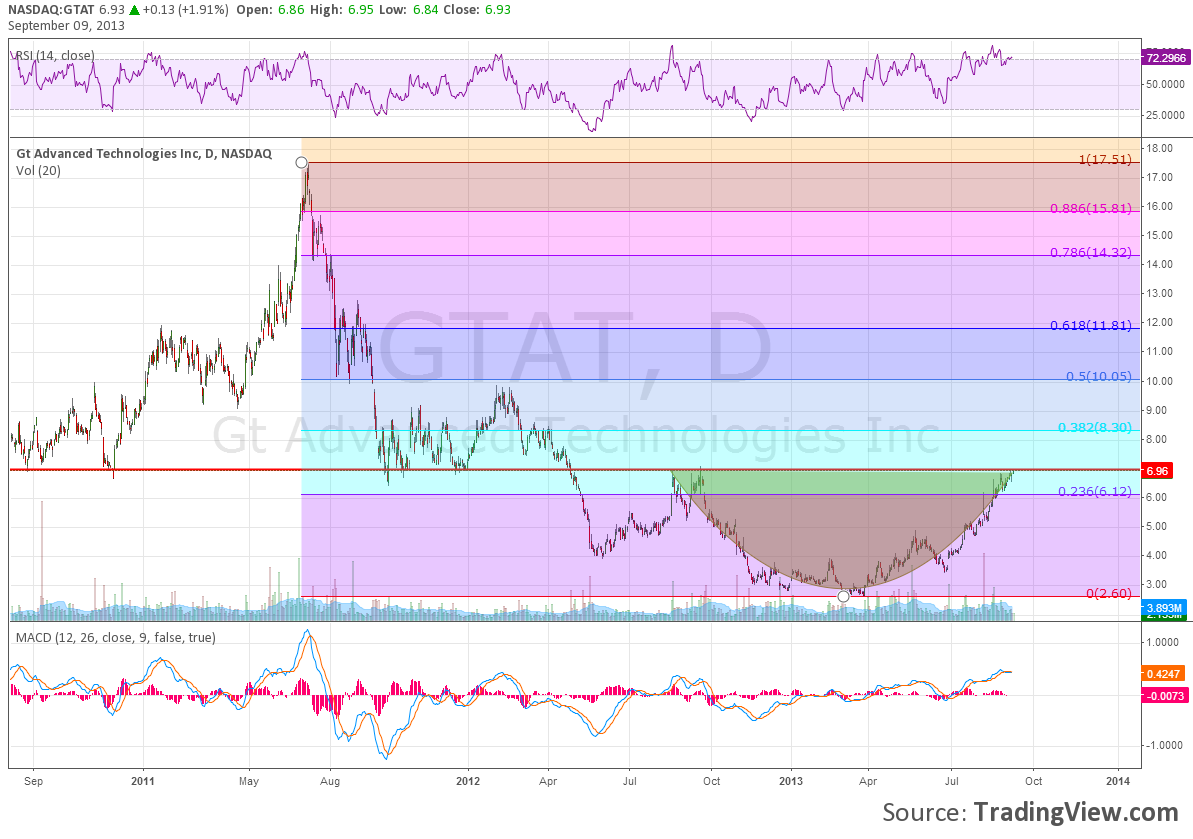

GT Advanced Technologies (GTAT) is showing again that the $7 level is very important to the stock. It has hit resistance 3 times in the last 12 months and was at support 4 times in the 12 months before that. This is how you define a major pivot point. The chart below shows that 7 falls between the 23.6% and 38.2% Fibonacci retracement of the move lower from the spike in May 2012. This time it arrives with a Relative Strength Index that is in the low 70s which could stall it out for a bit or reverse it, and a Moving Average Convergence Divergence indicator (MACD) that is positive but flattening.

These could give a clue that the Cup that has formed will be followed by a Handle lower. The Cup and Handle has a target higher at 11.40. Either way it is one to put on your radar. Either for a break above $7 now or a Handle forming for a future move.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.