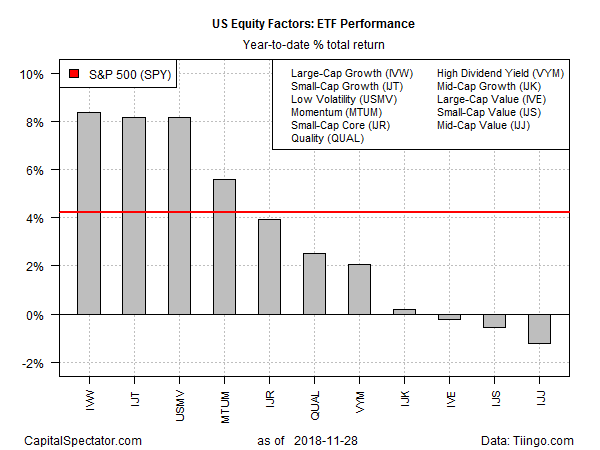

Despite a turbulent run for the US stock market over the past two months, the growth factor’s edge is intact by a solid margin relative to value, based on a set of ETFs. Although year-to-date equity returns generally have been trimmed recently, the growth-value divide remains stark, with the former still posting a healthy gain in 2018 while the latter has deteriorated to a slight loss.

Large-cap growth remains in first place by a nose for year-to-date performance through yesterday’s close (Nov. 28). The iShares S&P 500 Growth (IVW) is up a solid 8.4% so far in 2018. Second place for this year is currently split between iShares S&P Small-Cap 600 Growth (IJT) and iShares Edge MSCI Minimum Volatility USA (USMV) – each fund is ahead by 8.2%.

On the flip side, three value-factor ETFs have slipped into the red for year-to-date results, posting mildly negative returns for the small-, mid- and large-cap buckets. The iShares S&P Mid-Cap 400 Value ETF (IJJ), a mid-cap portfolio, suffers the deepest setback, falling 1.2% so far in 2018.

Interested In Learning R For Portfolio Analysis?

By James Picerno

Whatever’s driving value stocks down this year, no one can blame a broad definition of equity beta. The SPDR S&P 500 (NYSE:SPY), a widely followed benchmark of US equities, is up 4.2% year to date.

Some investors have been encouraged by value’s modestly firmer performance over the past month relative to growth. Is that a sign that a leadership transition is underway? Perhaps, but it could easily be noise. Indeed, the year-to-date profile at the moment still favors growth by a substantial degree. As the chart below suggests, the upside momentum in large-cap growth stocks (IVW), for instance, remains considerable vs. its value counterpart (IVE).

Growth’s sizable edge in the large-cap space holds up for the trailing three-year period, too.

The growth factor’s performance leadership won’t last forever, but for the moment it’s not yet obvious that a sustainable renaissance in value has arrived

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.