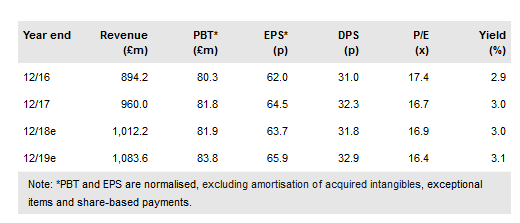

Greggs' (LON:GRG) management has been open in recognising that despite the Beast from the East and other extraordinary weather patterns, there is an underlying softening of demand. We have reduced forecasts, but see earnings growth continuing from a combination of like-for-like sales, shop expansion, and investment in the estate and manufacturing and fulfilment infrastructure. Greggs’ value positioning should place it well in a tight consumer market, and at these levels the valuation is attractive.

18-week trading: Spring storms mask weaker demand

Eighteen-week sales were +4.7% year-on-year, and managed like-for-like sales +1.3%. Against +6.2% and +3.2% respectively at eight weeks, that implies intervening declines, with lower transaction numbers despite higher average spend. It is no surprise that extreme March and April conditions affected trading, with footfall down across the retail sector. Management estimates that weather affected the period by up to 1%, implying that ex-weather, like-for-like growth would have been c 2%. That is not a bad result, although it does imply some overall demand flattening.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.