Greggs (LON:GRG)’ sales growth has accelerated through each quarter, in defiance of the summer 2018 heatwave conditions that turned many retailers’ performances on their heads. Greggs has passed the scorch test, thanks to the change strategy that the brand has quietly achieved: a change in its locations, its value menus, its customers and its trading dayparts. This result is significant and should help challenge out-of-date assumptions about Greggs. We retain our 1,360p valuation.

Revenue growth rate accelerates

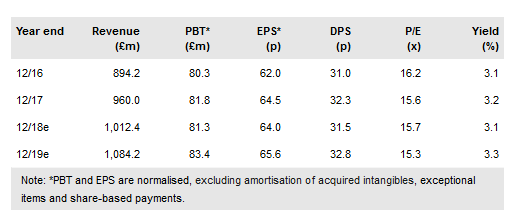

Total revenue grew 7.3% y-o-y in Q3, an acceleration of growth against H1’s 5.2%. Similarly, managed store like-for-like sales growth was 3.2%, higher than Q2’s 1.8%, which in turn was higher than Q1’s 1.1%. Remarkably, the improvement in all three quarters’ like-for-like growth took place against increasingly strengthening comparative growth in the equivalent three quarters of 2017.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.