Bitcoin hits record high over $123k on rate cut bets, corporate treasury cheer

It’s summer and it’s August; the month when even the Eurocrats take a break. And so the illusion that Greece is fixed is maintained. Here are some assumptions dangerous or otherwise –

- The current total accumulated bailout for Greece is €326 billion

- Greek GDP will remain at €216 billion

- Interest rate on the bailout will be 0%

- Greece can immediately achieve a surplus of 3% of GDP

- Greece will hold that 3% surplus for as long as it takes to pay back €326 billion

- Every penny of Greek debt surplus will go to pay back creditors

Now let’s have a look at the maths courtesy of Mish Shedlock

“Three per cent of €216 billion is €6.48 billion. At €6.48 billion per year, it would take Greece 50 years to pay back €326 billion. But none of those assumptions is true. The interest rate will be small, but it likely won’t be zero. Greece won’t come close to a 3% surplus. 100% of the surplus won’t go to the creditors. The only possible favourable condition in the mix is GDP. Greek GDP will eventually rise above €216 billion, but that will take years. In the meantime, interest expense accrues, adding to the total amount that needs to be paid back. At 1% of GDP (€2.16 billion per year), it would take 150 years.”

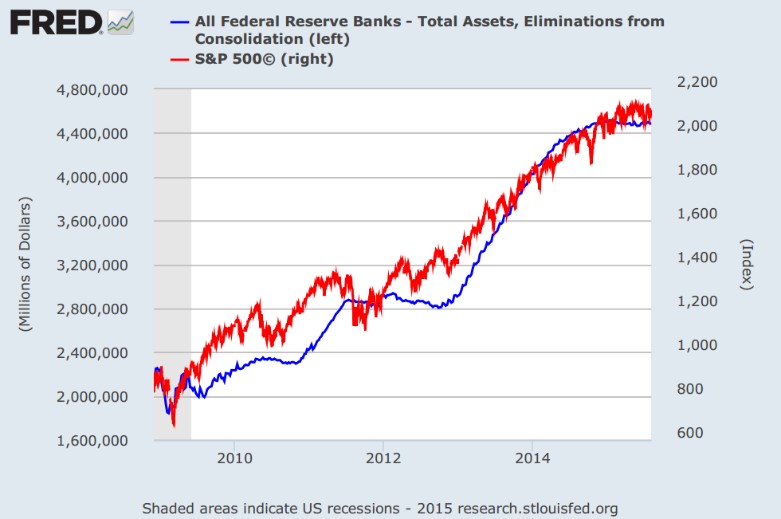

It can’t work can it? No. But for now enjoy the sunshine and hope that the ECB deploys its €1 trillion treasure chest to good use. This chart shows just how effective goosing the Fed’s balance sheet has been for the S&P 500. Could it be the same for euroland?

Note how, as the Fed tapered and then called a halt to QE, the S&P 500 has followed a similar trajectory. A reduction in the Fed balance sheet would not bode well would it? And if they raise rates any time soon then that is just another form of tightening with potentially the same result. The US market, on a cyclically adjusted PE ratio of 26.3 is higher than it’s ever been, other than in 1929 (27.3) and early 2000 (43.0). It could of course emulate the dot com boom, which only got going in 1996 when the PE ratio was the same as it is today; the dénouement came 4 years later. Is there another four years left in this bull market?

And what is happening to gold? No one, with any degree of price sensitivity, distressed seller or not, puts in an order to sell over $1 billion of gold in the overnight market, but that is what happened on July 20th and there have been similar occurrences every month this year. There is unprecedented demand for physical gold (the futures market is in backwardation) yet the paper market keeps getting smashed (short positions are also at a record high). The sums involved are breath taking. Is gold the canary in the coal mine? Maybe the following passage will give pause for thought.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.

The author of this passage? Alan Greenspan in 1966…With China accumulating gold as fast as possible and with Shanghai fast becoming the global trading centre for the barbarous relic the “statists” option of making it illegal to hold gold is receding just as fast! As history has repeatedly shown, gold remains the only sensible currency.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.