As Mr. Market waits for the will-they-or-won't-they news on Greece, he is telling me that worrying about Greece is so...last year. Despite all of the angst about a possible Greek default, the Greek stock market has been rallying and outperforming the Euro STOXX 50 in the past few weeks.

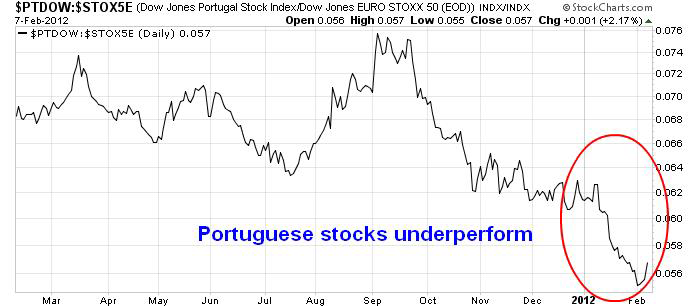

Worries in the eurozone has shifted to Portugal, whose stocks have been dramatically underperforming.

All is not lost for the bulls. The Portuguese market is staging a tactical rally and testing its downtrend line.

In addition, Portuguese 2 year yields, which had spiked above 20%, are now in retreat, perhaps indicating that Mr. Market is anticipating further relief from the ECB's LTRO2 program.

That's why I am relatively sanguine about the risk trade. If this is the worst that Mr. Market is worried about, it's time to get long and stay long.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.