Coca-Cola (KO) has had a nice steady grind higher since the market lows in 2009. Helped by a 2.9% dividend yield and the backing of Uncle Warren, all it seems to do is go up. We took a stab at it into February earnings with a no cost structure that ended up giving no return as well. So be it. But it stayed on the radar and here is the reason why.

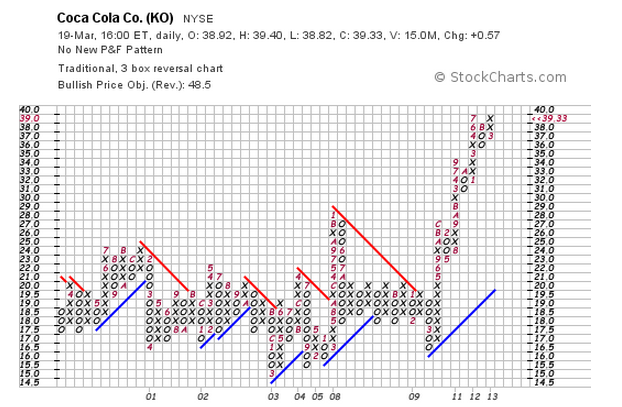

Looking at the weekly chart over the last 25 years from an Elliott Wave perspective, shows the beginning of Wave (5) of Wave iii of Wave III. All of that means that the analysis is looking for upside from the present level. A comparable move to the first wave would take it to 46.15 and 161.8% of that to 52.50. Both work. Additionally the 3 box-reversal Point and Figure Chart (PnF) is showing a price objective of 48.50.

Both of these are longer term views with the PnF unconstrained by time, so we need a trigger. And that came Tuesday in the daily chart. A quick glance shows the price breaking above the 2 week channel at 39.15. This gave the signal to start a long for a play to the target higher.

This is not a set it and forget it trade. We entered buying June and August 40 Strike Calls and will likely trade around them as the price moves to both protect the positions and enhance profits where possible. So why don’t you join us?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.