After installing the latest investment technology in my new home office, I find myself thinking a lot more like Warren Buffett. And he is right, a good soak does wonders for the thinking process. But maybe i am getting a little too close to his thinking. The chart for Coca-Cola is looking good to me. On the daily timeframe it has been in a very tight sideways range between 40.40 and 41.10 since April 21st. And over that time period the RSI that was overbought has worked off that condition and the MACD has pulled back and is now level and about to make a positive cross. The RSI is starting to rise and never left the bullish range.

over the top to get interesting. Moving out to the weekly chart shows the 41.10 level has been important before. It has knocked it back twice before in the the past 12 months. The double bottom in between forms a ‘W’ pattern and it sits at the top consolidating. The question now is if it moves up or falls back to add a ‘V’. The RSI on the weekly chart is on the edge of a move into the bullish zone and the MACD is rising.

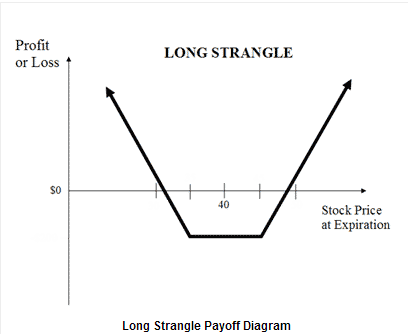

If you are interesting in trading the stock alone then there is nothing to do here until it moves out of the range. But in the world of options there is a possible play. I am looking at a strangle. The payoff profile for a Strangle resembles a smile as below.

The Implied Volatility in Coca-Cola, KO, is so low it rivals that of the S&P 500. From the charts a break of the range to the downside has support at 37 and to the upside there is a target of 44. To give it enough time to break the range and move look at the July 41/41 Strangle, priced at about a $1.00. End it there and you have a Coke and a Smile.

You can get fancy from there and notice that there is a lot of open interest between 40 and 41 in June. So selling the June 40/41 Strangle for 35 cents could help fund the trade, looking for the stock to settle between 40 and 41 at June Expiry. The June strangle will either expire or need to be rolled out to the next week or longer.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI