Morgan Stanley’s Wilson says 7200 could be in play for S&P 500 soon

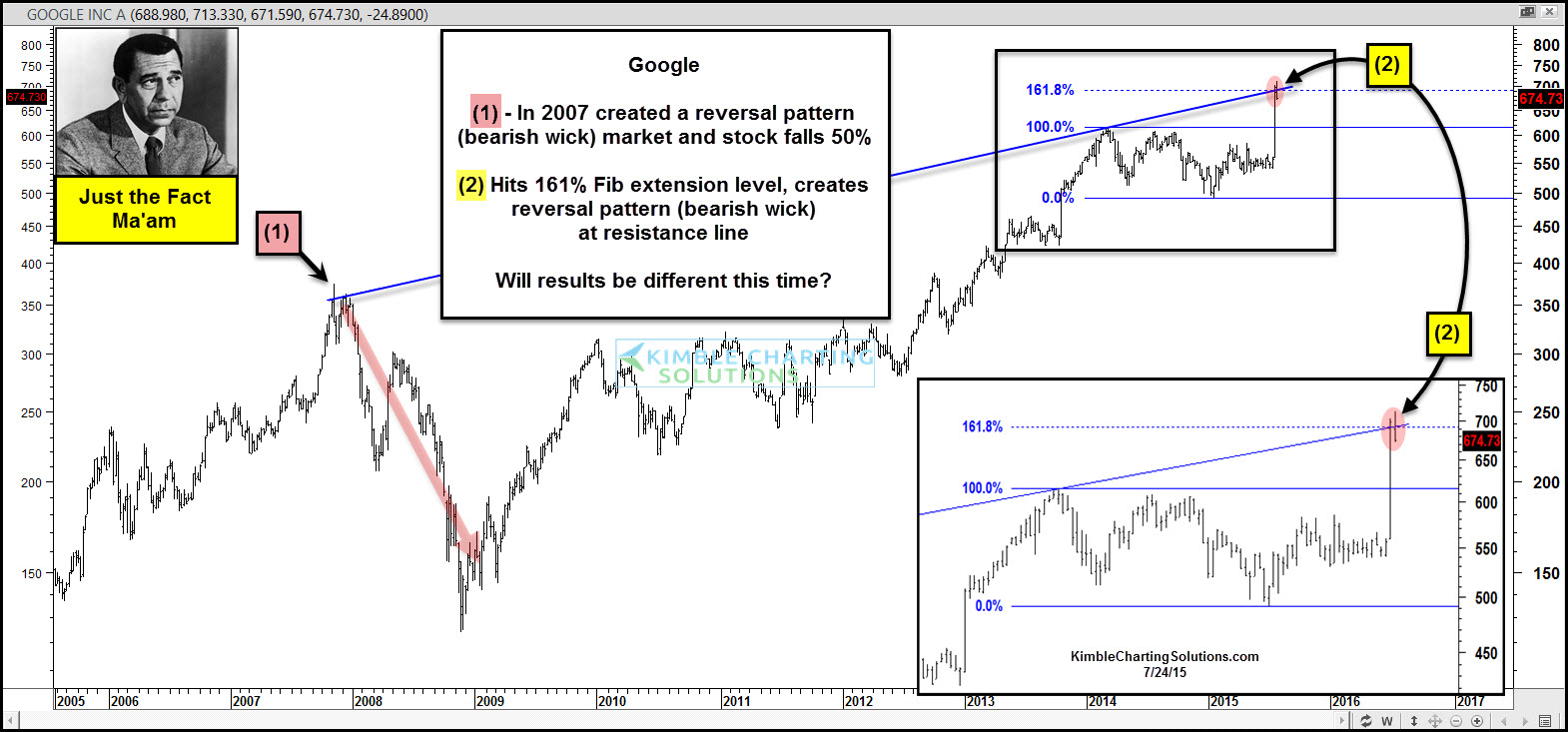

Google (NASDAQ:GOOGL) rallied strongly from 2005 until 2007, gaining over 100% in the short time frame. In 2007, it created a reversal pattern (bearish wick) at (1), which ended up being an important high. After that reversal pattern, Google and the S&P 500 were both cut in half.

Google's strong move higher last week -- following its earnings report -- pushed it to a long-term resistance line and a Fibonacci 161% extension level at (2). As it was hitting the dual resistance, it created a reversal pattern (bearish wick) similar to what it did back in 2007.

Any other key assets acting like they did in 2007?

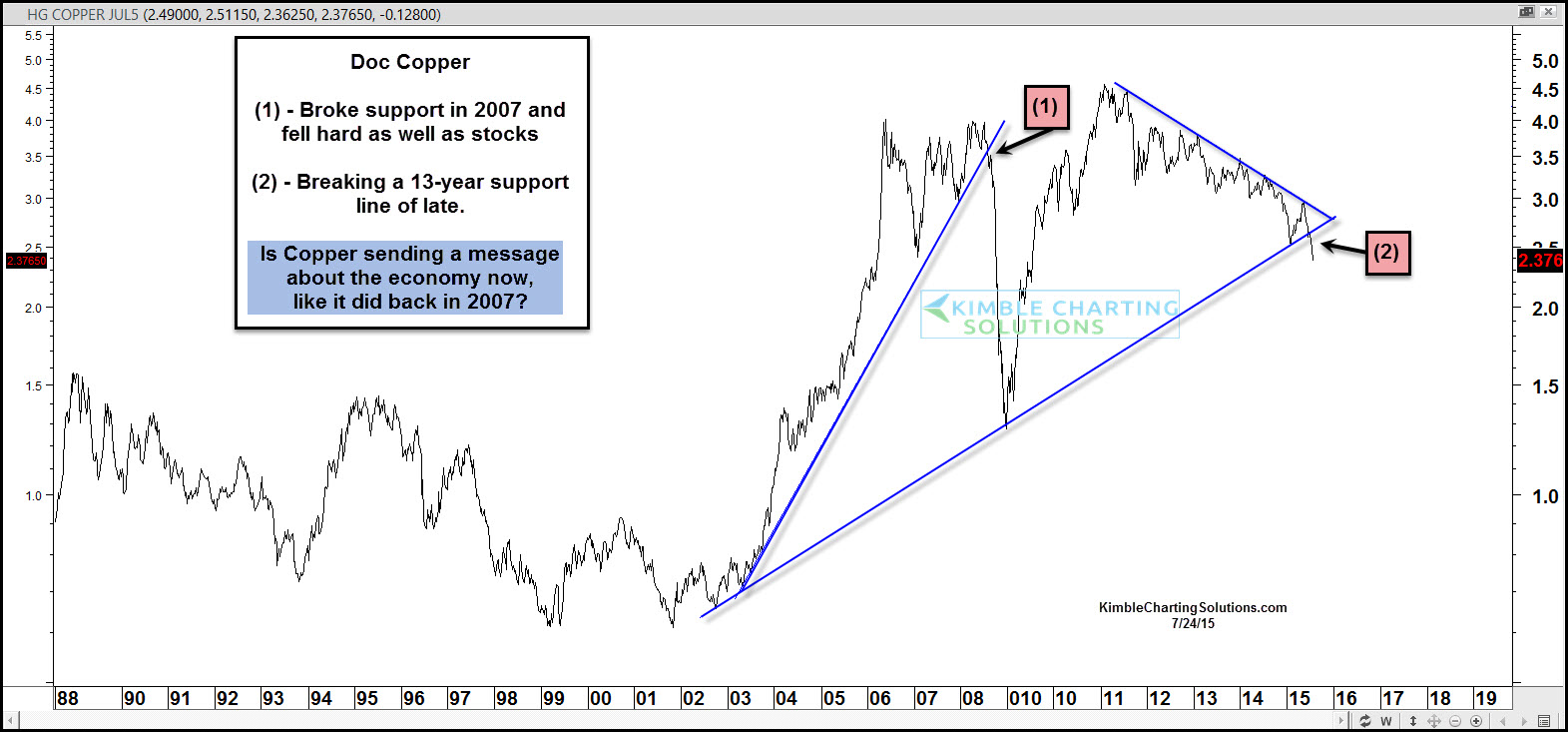

Doc Copper is often viewed as a leading indicator for the global economy. Below is a long-term update on copper's price action.

Copper broke a 4-year support line in 2007 at (1) and fell almost 75% during the financial crisis. In the past couple of months, copper has fallen more than 20% and is breaking a 13-year support line at (2). Is Doc Copper sending a key message about the state of the global economy?

Google and copper broke key support in 2007 and both fell hard. So too did the S&P 500 and markets around the world.

If Google and copper happen to head sharply south together, they could be sending a message that investors might want to heed.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI