Michael Burry buys puts on Nvidia, Palantir

Services data also came in a broadly better level, with the Eurozone, UK and US measures all beating expectations. Germany continued to show off its economic prowess by putting in a number 10pts better than the likes of France and Italy – which suffered its sharpest drop in 7 months. This divergence is key to our thoughts around a revival for GBPEUR in Q2. The Eurozone problems persist, and they are very likely to come back into focus sooner rather than later.

Here in the UK the better than expected services PMI figure makes up slightly for the frankly horrific manufacturing and construction numbers we’ve had recently. The overall macroeconomic picture does remain a significant concern. Inflation issues, alongside weak consumer and business confidence, suggest that the path of the UK economy will remain one of stagnant and slight improvements, mixed with oscillation around the zero growth mark.

The big questions is; will the better than expected number and the expectation that we are indeed growing in Q1 now prevent the Bank of England’s from adding more quantitative easing (QE) at tomorrow’s meeting? I reckon that the members of the MPC that voted for the increase in QE last month will once again vote for one this month, and the question now remains has the data got materially worse since?

The answer to that is ‘no’, but the publication of this week’s Funding for Lending scheme numbers that showed a £2.4bn drop in lending by banks may just be the thing that tips the balance in favour of further easing.

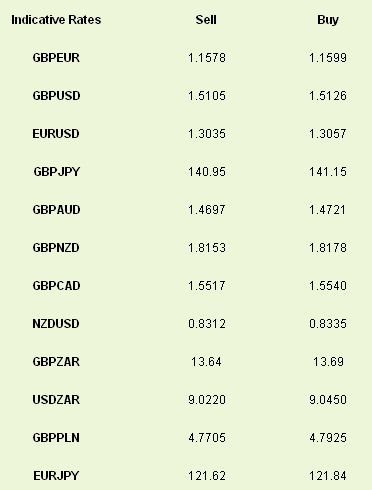

Sterling ran higher in the minutes before and after the PMI announcement and got as high as 1.52 against the USD before the US release stiffened the greenback.

Today’s revision to Eurozone GDP for Q4 should be confirmed at the -0.6% mark we had seen previously. With tomorrow’s ECB meeting now in investors’ mind-sets, the euro should remain pinned around these levels until Mario Draghi decides to pipe up again.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!