Up 50% since picked by our AI, this chip giant still has significant room to run

Shares of Goldman Sachs (NYSE:GS) are trading at seven year highs heading into the bank’s Thursday morning earnings report. Surprisingly, expectations are tame compared to recent levels which could present further opportunity to the upside if the company beats estimates as it typically does.

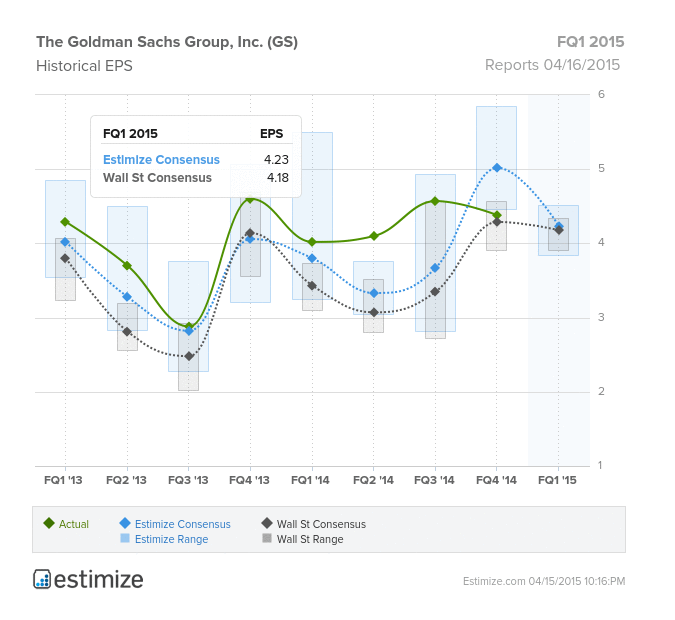

Contributing analysts on Estimize are forecasting $4.23 in earnings per share. The Wall Street estimate is that Goldman will be rake in $4.18 per share. Both groups expect at least a 4% improvement compared to the $4.02 reported for the first quarter of last year.

This quarter, the differential between Wall Street and Estimize is very small compared to historical differences. Over the past year the average separation between consensuses has been 34 cents per share. 7 times out of the past 8 Goldman has beaten both estimates. This quarter we’re only seeing a 5 cent difference, signaling relatively low market expectations.

Goldman Sachs’s only earnings miss in the past two years came in January when Estimize contributors set the bar high only to be disappointed. Goldman failed to reach even the lowest of the 67 estimates submitted last quarter.

Even after factoring in last quarter’s stumble, Goldman has still averaged a 31 cent beat against the Estimize consensus over the past year. Investors normally expect the bulge bracket bank to crush the expectations set forth by other analysts on Wall Street and it almost always does.

Relative to the Wall Street consensus investors are setting their earnings expectations at a 2 year low. This could lead to a dash into positive territory after earnings if Goldman can beat the Wall Street consensus by a margin comparable to what it’s done in 7 of the past 8 quarters.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.