Given that the Fed's current expansionary policy is expected to have only a limited effect on US labor markets, the program may end up being in place for years. That's because slow growth will be met with additional asset purchases that become increasingly less effective over time. Here are some reasons for the program's ineffectiveness as applied to the current environment:

1. It is not clear what impact asset purchases will have on consumer confidence.

2. We've had extraordinarily low interest rates for quite some time now, yet improvements in job growth have been limited.

3. Lowering mortgage rates from 3.5% to 3% is not going to have a significant impact on home affordability or materially reduce consumers' interest expense (see this discussion).

4. Raising bank excess reserves is not going to accelerate credit expansion.

5. Fed's unemployment targets are unrealistic - it's going to be an exercise in "squeezing blood from a stone" (see discussion).

6. US real median household income has basically been unchanged since 1994. The Fed' program is unlikely to improve this metric and could actually impair incomes further by elevating inflation levels.

7. The market "euphoria" effect is fleeting.

Central bank balance sheet expansion is a blunt instrument that is simply inappropriate for addressing economic issues the US currently faces. QE is good for dealing with frozen credit markets (such as in 2008) or lowering interest rates. In the current environment however it's the equivalent of using a hammer to chop down a tree - one would need a very large hammer and a great deal of time (to drive this point we include a video of someone actually attempting to do such a thing.) The hammer here is the $2trn increase in Fed's balance sheet and the timeline extends into 2015. In the mean time one can do some "unintended" damage.

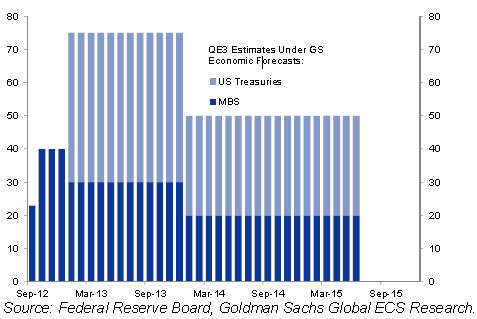

GS: Our analysis suggests that the Fed’s asset purchases work mostly through the stock of announced purchases and only to a lesser degree through the week-to-week flow of actual transactions. This is consistent with the observed impact on bond yields around or in advance of announcement days. It also means that the impact from a cessation of purchases on the level of bond yields and financial conditions should be minor, so long as this cessation does not come as a surprise to the market. While no explicit “stock” of purchases has been announced under QE3 given the open-ended nature of the program, the Fed’s published economic forecasts suggest QE3 would run through mid-2014 and total $1.2trn. Our own less upbeat economic forecasts suggest that QE3 should run through mid-2015 and total just under $2trn.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.