Mizuho predicts this is the next $1 trillion stock

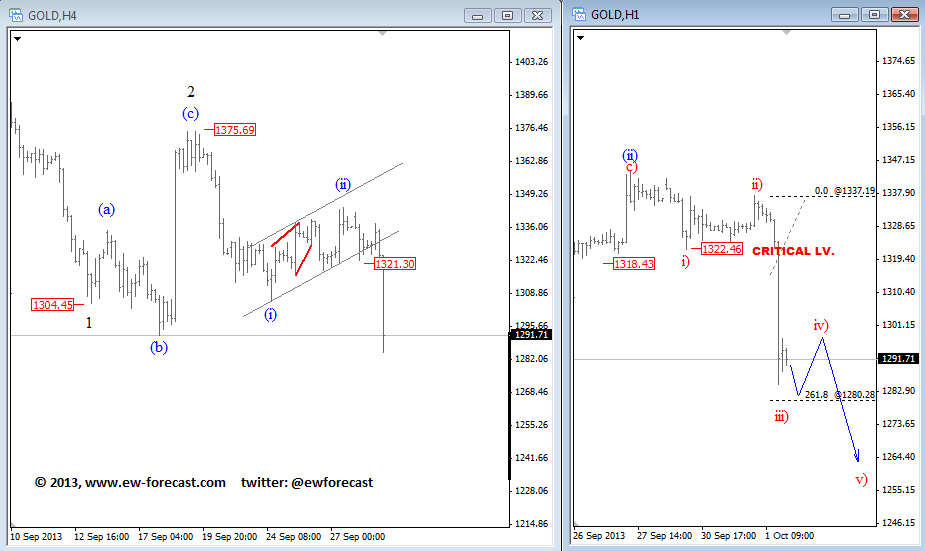

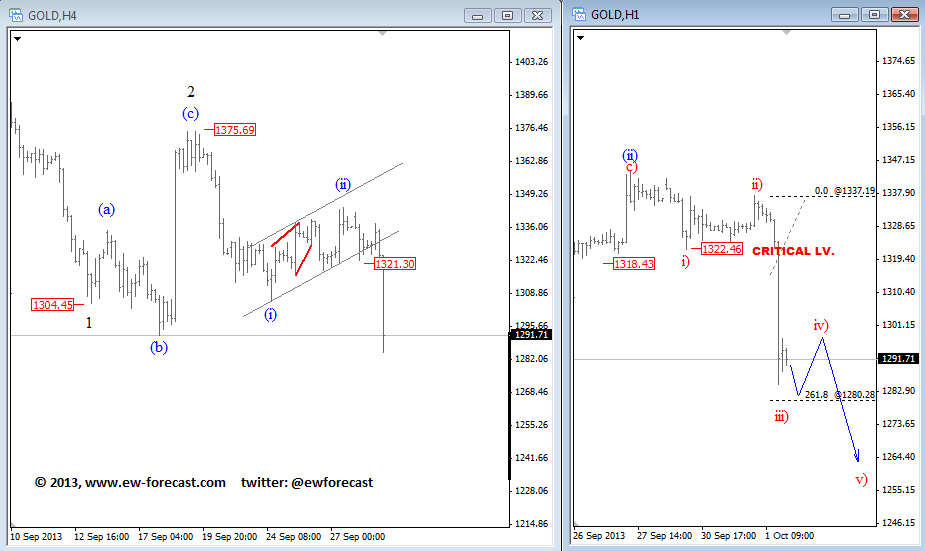

GOLD is moving sharply down and its interesting that this market could not rally much, even after "no taper" decision in September. So if price cannot rally even when there is good news for the market, then it must be a bad sign.

That said, we are tracking a very bearish count after a recent break lower in impulsive fashion. On the 4-hour chart, this could be the start of a sizeable decline, while on the intra-day basis we expect to see a short-term bounce in wave four before downtrend resumes. Wave four could then be a short opportunity. Support for current wave three comes in at 1280, at 261.8% extension level. Critical/invalidation level for GOLD is at 1322.

That said, we are tracking a very bearish count after a recent break lower in impulsive fashion. On the 4-hour chart, this could be the start of a sizeable decline, while on the intra-day basis we expect to see a short-term bounce in wave four before downtrend resumes. Wave four could then be a short opportunity. Support for current wave three comes in at 1280, at 261.8% extension level. Critical/invalidation level for GOLD is at 1322.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI