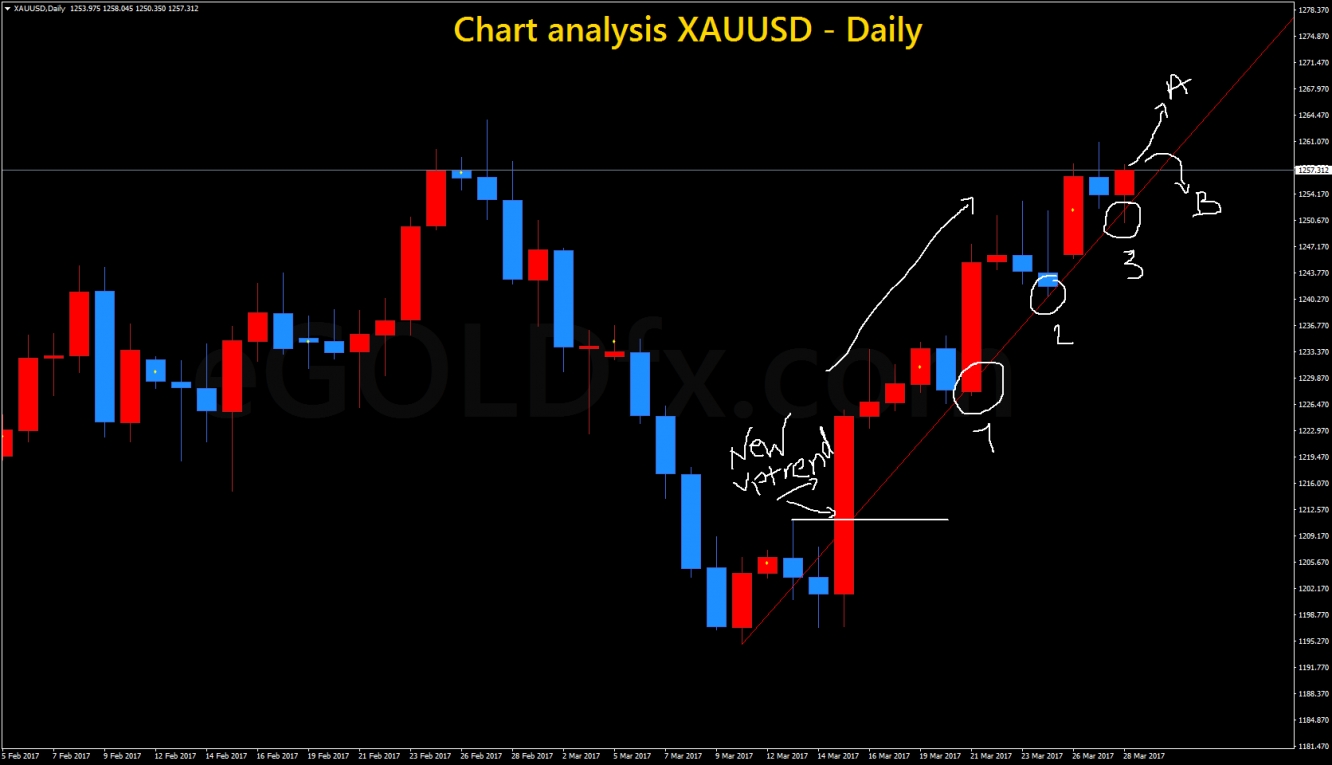

Gold in USD is testing one more time its daily uptrend line (3) that started on march 15,2017 when price broke the high of the 3/13/2017 candle. Since then price has bounced 3 times (1)(2)(3) without any real attempt to break it.

Even though the long term trend is down, the medium term trend is up and thus helping the price to move along this daily uptrend line (A). A close below the uptrend line (B) will send a warning that this uptrend is getting exausted and the short term trend might try to catch up with the current long term down trend. Let see what the eGOLDfx TrendStrength Meter is saying.

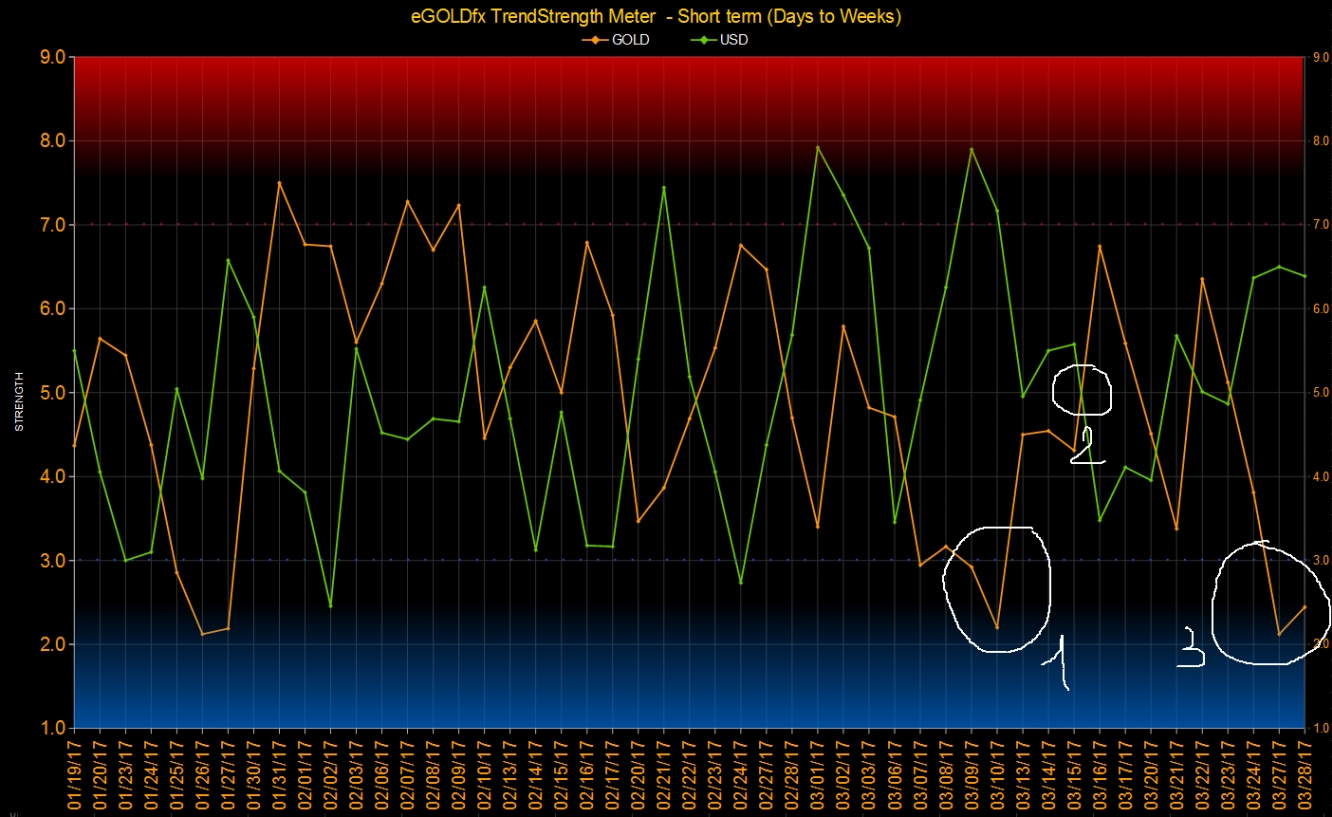

The Short term eGOLDfx TrendStrength Meter is still showing that gold in USD is in an uptrend that started when gold strength line crossed the USD strength line in (2) Since then neither gold or USD have reached their opposite bounce level 3 or 7. Gold strength line is currently bouncing one more time on level 3 (3) indicating that further upward momentum might continue until it reaches its opposite bounce level 7. Only a major news, positive for the USD or negative for gold could quickly change this well settled uptrend.