Fundamental Forecast for Gold:Bullish

- Crude Oil Collapses, Gold At Risk On Positive Top-Tier US Data

- Crude At Risk On Inventories, Gold Rudderless Amid Light US Docket

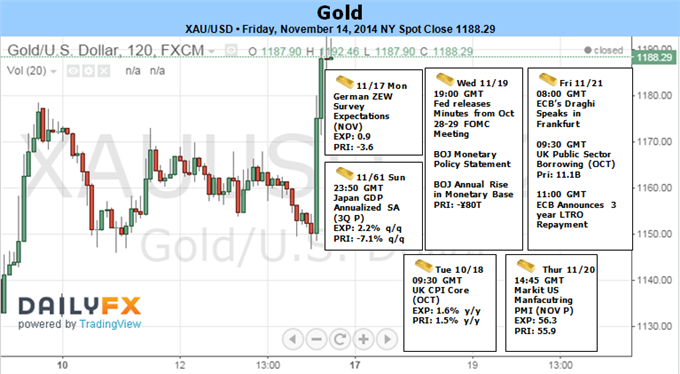

Gold prices are higher this week with the yellow metal rallying 1.11% to trade at $1189 ahead of the New York close on Friday. Bullion traded to fresh monthly highs on the back of broad-based US Dollar Index weakness and the precious metal may extend the recent recovery as Fed officials remain reluctant to move away from the zero-interest rate policy (ZIRP).

The Federal Open Market Committee’s (FOMC) policy meeting minutes highlights the biggest event risk for gold especially as the central bank halts its asset-purchase program. Despite expectations of seeing higher borrowing-costs in 2015, the policy statement may continue to show central bank hawks Charles Plosser and Richard Fisher dissent against the majority amid the ongoing improvement in the labor market. Nevertheless, it seems as though the committee is in no rush to normalize monetary policy as subdued wage growth paired with easing commodity prices dampens the outlook for inflation. In turn, the precious metal may continue to retrace the sharp decline from the previous month should we see a more dovish twist to the forward-guidance for monetary policy.

Last week we noted that, “gold looks poised for further topside in the near-term with Friday’s price action posting a massive outside reversal candle. The snap-back from extremes in the momentum signature suggests this is likely to be a simple bear market rally with topside objectives eyed at $1180, 1192 & 1206/07 (where we would be looking for favorable short entries).” This week’s rally failed just ahead of our second objective at 1190 and our outlook remains unchanged as the pair posted yet another massive outside day reversal again this Friday. Bottom line: looking higher near-term for favorable short entries with only a breach above $1207 invalidating our broader bearish directional bias.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.