BofA’s Hartnett: Bubble risk looms if stocks dismiss inflation, rising yields

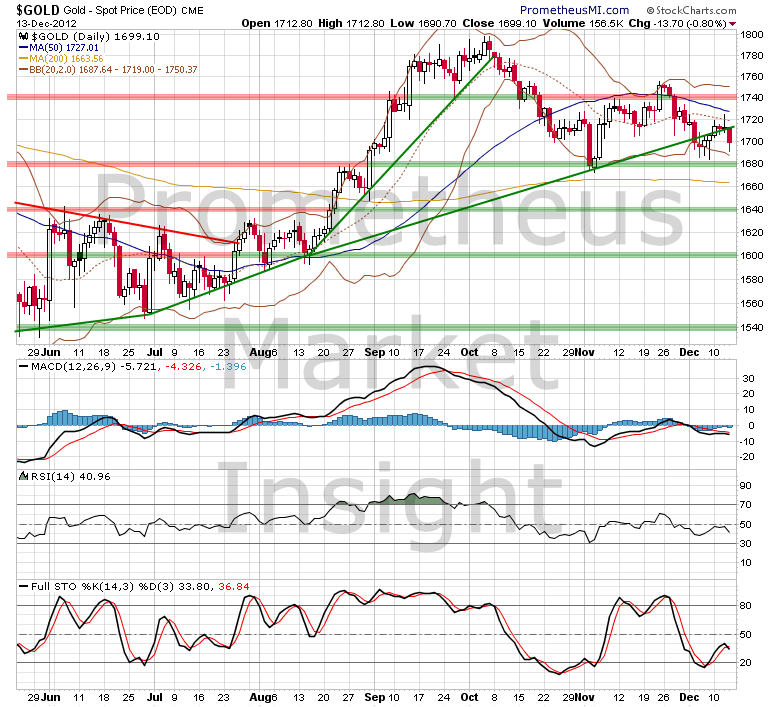

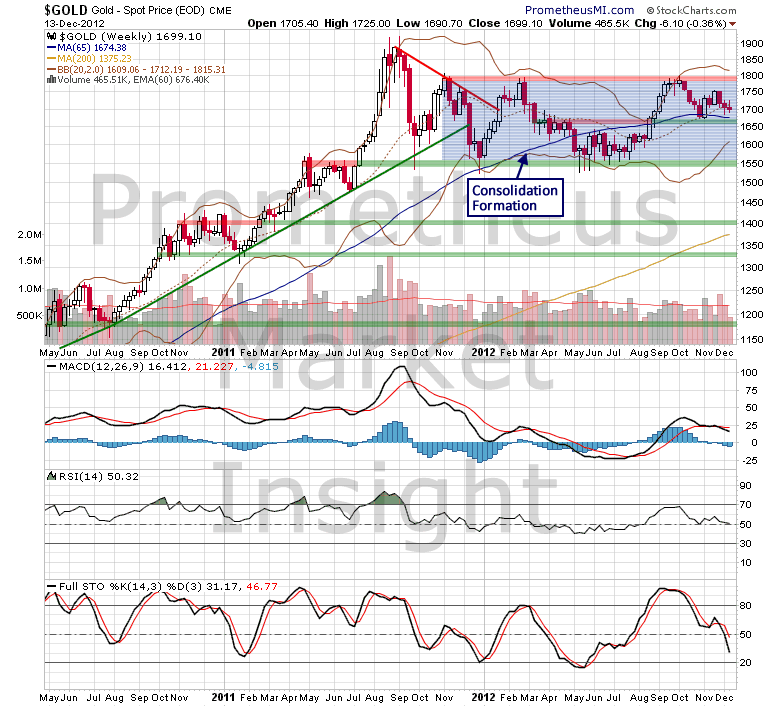

Gold closed moderately lower today, moving well below support at the lower boundary of the uptrend from May. Price behavior has struggled to hold at the lower boundary of the rally since beginning another test of uptrend support last week.

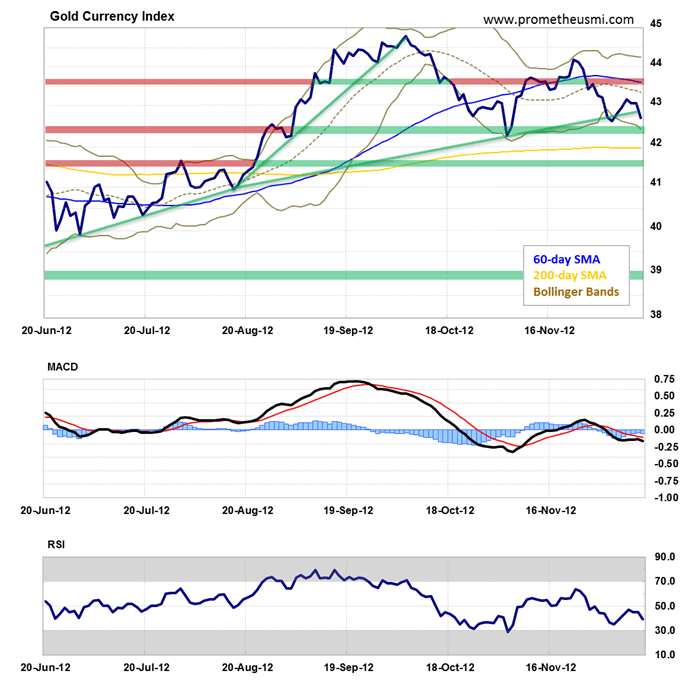

Our Gold Currency Index (GCI), which tracks the intrinsic value of gold as an international currency, has also struggled to hold above its comparable support level during the last two weeks.

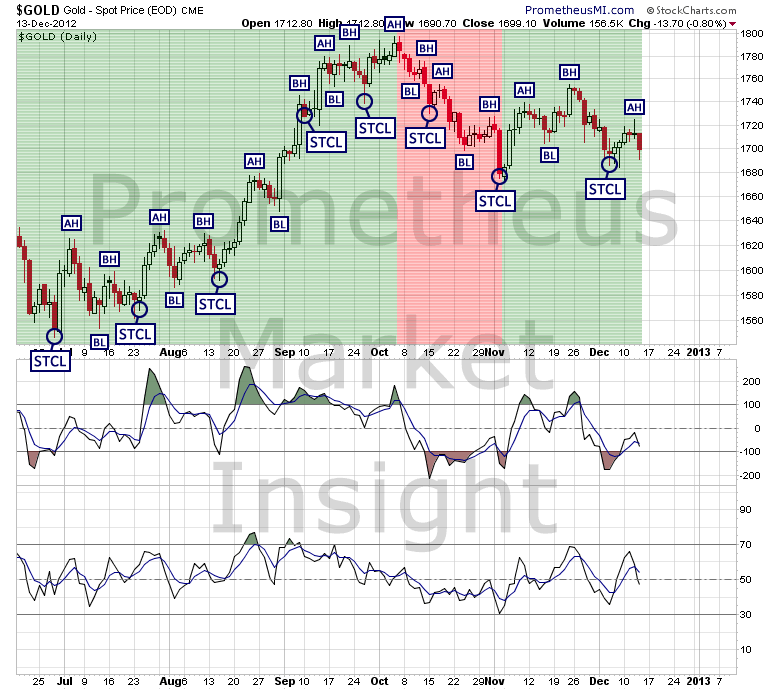

With respect to cycle analysis, translation remains in question and the developing alpha phase decline could provide an important short-term signal sometime during the next few sessions.

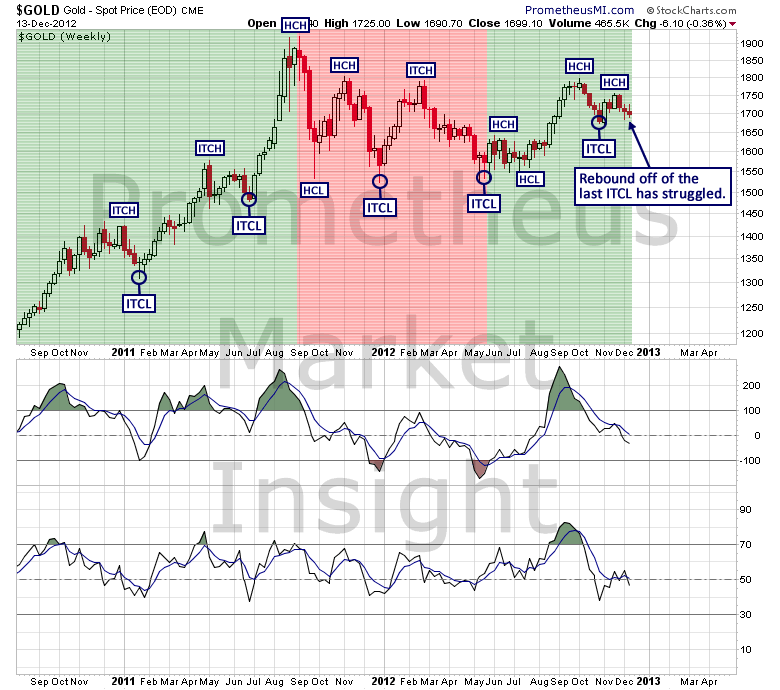

From an intermediate-term perspective, the rebound off of the last intermediate-term cycle low (ITCL) in early November continues to struggle more than expected given the recent transition to a bullish translation. The early formation of a half cycle high (HCH) in late November was the first sign of unexpected weakness and another bearish development could occur as soon as next week.

The consolidation formation on the weekly chart that we have been monitoring since early September continues to track the bullish scenario that we outlined at the time, favoring an eventual resumption of the secular bull market.

However, the consolidation formation remains in a crucial phase of its development and market behavior during the next several weeks will likely signal if the secular bull market is preparing to resume. Therefore, it will be important to continue monitoring gold closely.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.