Gold Non-Commercial Speculator Positions:

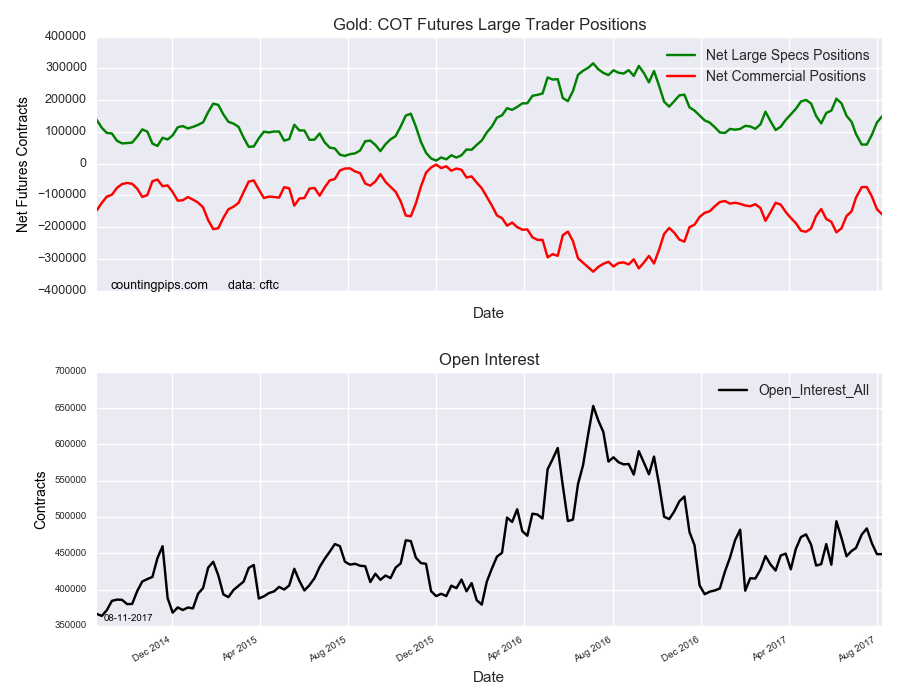

Large speculators strongly boosted their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 148,837 contracts in the data reported through Tuesday August 8th. This was a weekly lift of 19,165 contracts from the previous week which had a total of 129,672 net contracts.

Spec positions rose by over +10,000 contracts for a third consecutive week for a total gain of 88,699 net positions in that period and have now pushed the net position total to a seven week high.

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -159,511 contracts on the week. This was a weekly decline of -16,126 contracts from the total net of -143,385 contracts reported the previous week.

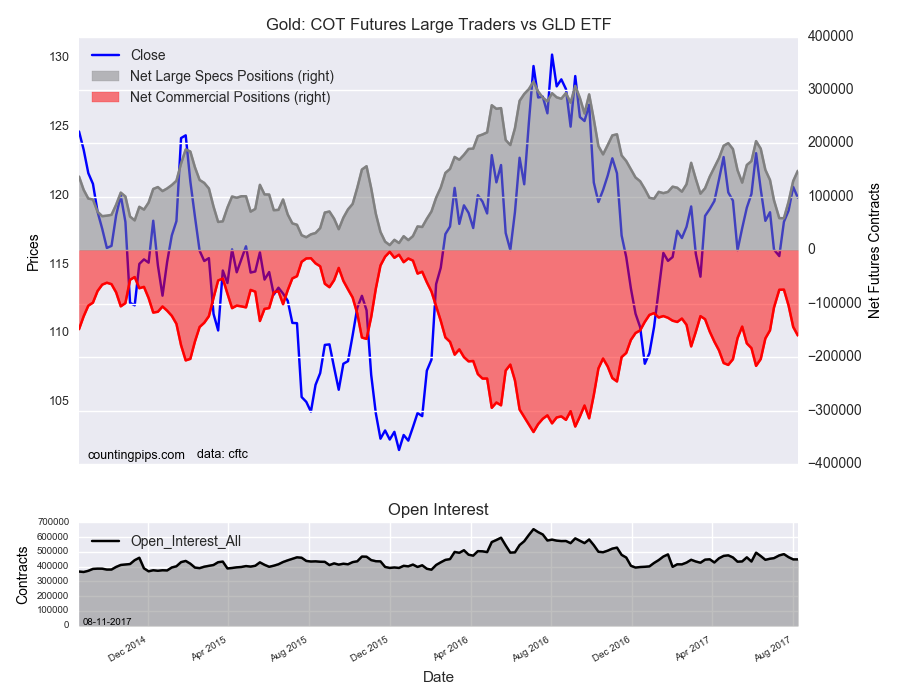

GLD (NYSE:GLD) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $119.86 which was a decline of $-0.79 from the previous close of $120.65, according to unofficial market data.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.