Stock market today: S&P 500 in fifth straight record close as earnings shine

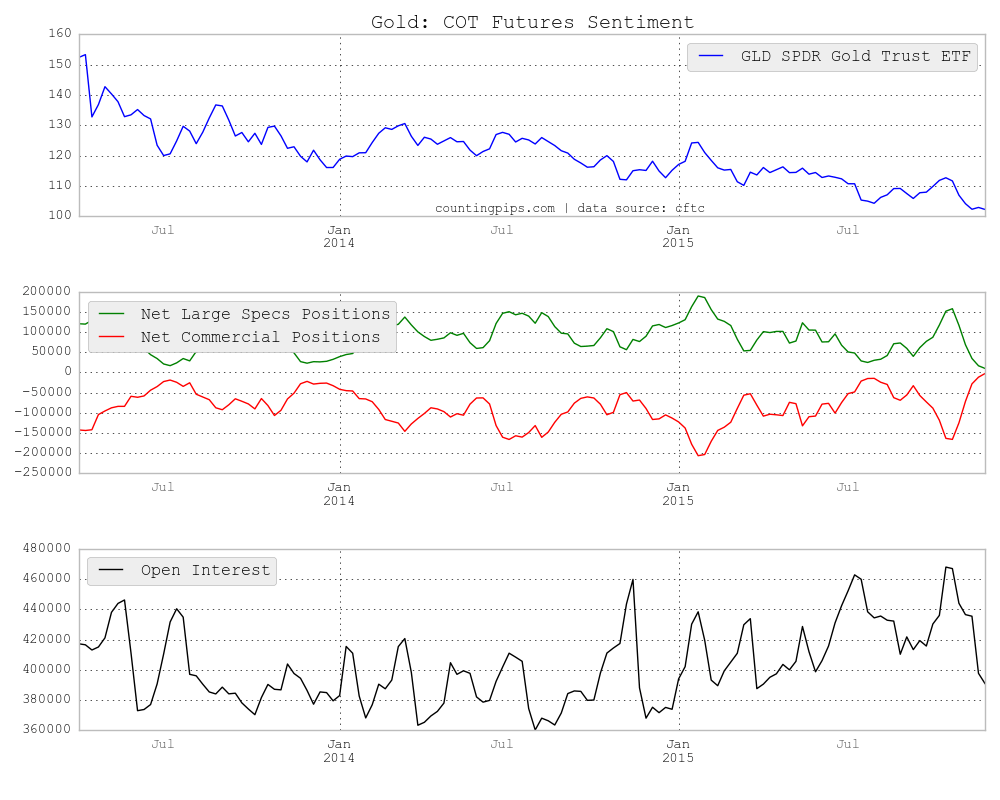

Weekly Large Trader COT Report: Gold

Gold speculative positions remain on downward slide

GOLD Non-Commercial Positions:

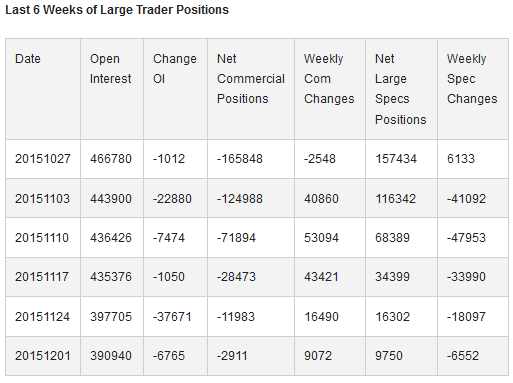

Gold speculator and large futures traders continued to decrease their gold bullish positions last week for a fifth consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +9,750 contracts in the data reported through December 1st. This was a weekly change of -6,552 contracts from the previous week’s total of +16,302 net contracts that was registered on November 24th.

The fall in the weekly net speculator positions (-6,552 net contracts) was due to a small decline in the weekly bullish positions by -648 contracts that combined with a gain in the weekly bearish positions by 5,904 contracts.

Gold Commercial Positions:

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) decreased their overall bearish positions for a fifth week to a net total position of -2,911 contracts through December 1st. This was a weekly change of +9,072 contracts from the total net position of -11,983 contracts on November 24th.

GLD ETF:

Over the weekly reporting time-frame, from Tuesday November 24th to Tuesday December 1st, the price of the (N:GLD) Gold ETF, which tracks the gold spot price, slid from approximately $102.94 to $102.28, according to ETF price data of the SPDR Gold Trust ETF (GLD).

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial advisor should you have any doubts.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.