Trump calls for Intel CEO’s resignation, stock falls

Gold Non-Commercial Speculator Positions:

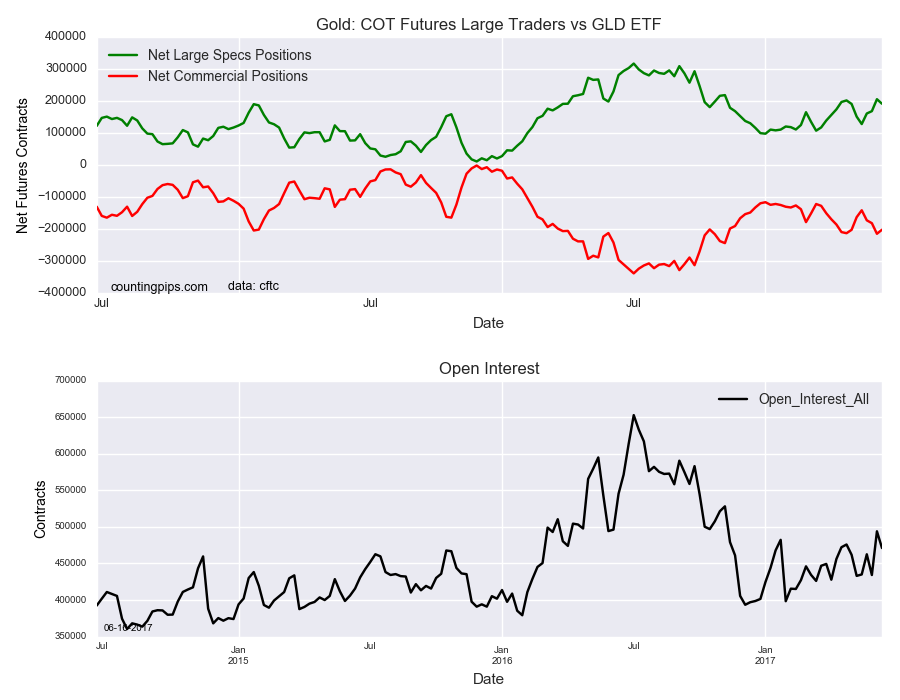

Large speculators reduced their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 190,274 contracts in the data reported through Tuesday June 13th. This was a weekly decrease of -14,191 contracts from the previous week which had a total of 204,465 net contracts.

The gold speculative positions had risen sharply over the previous three weeks (by over +75,000 contracts) before this week’s pullback. Despite the weekly decline, overall gold bullish spec positions are still at their second highest level of the past seven weeks.

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -203,611 contracts on the week. This was a weekly boost of 12,743 contracts from the total net of -216,354 contracts reported the previous week.

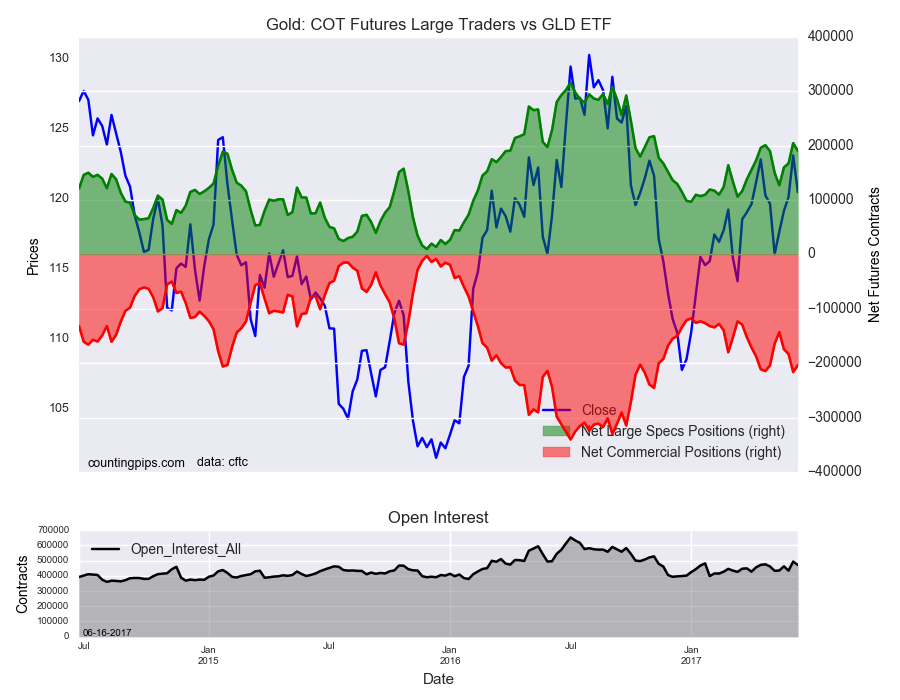

GLD (NYSE:GLD) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $120.48 which was a decline of $-2.62 from the previous close of $123.10, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI