Gold Non-Commercial Speculator Positions:

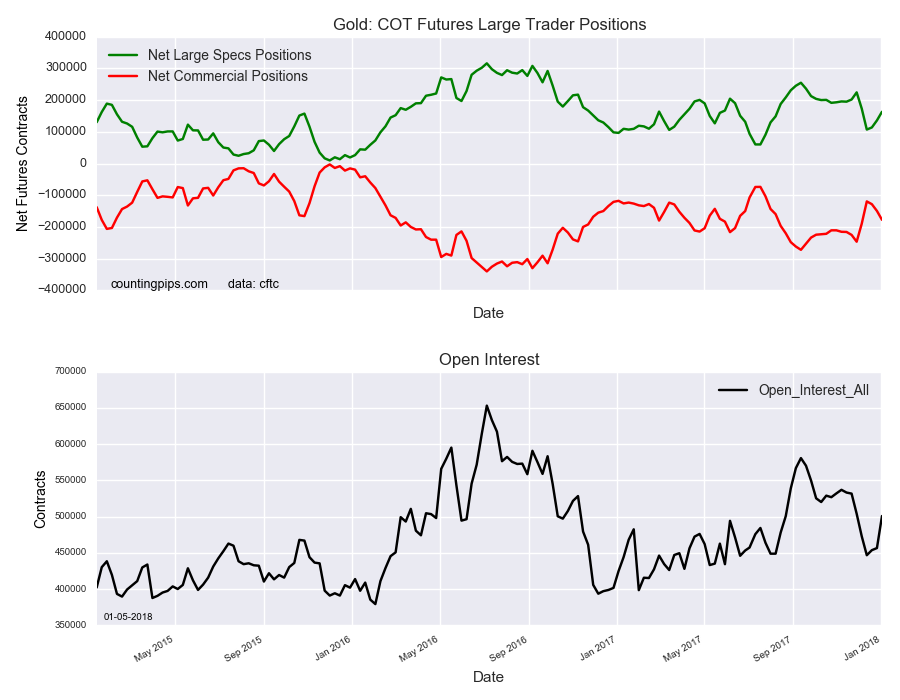

Large precious metals speculators lifted their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 163,268 contracts in the data reported through Tuesday January 2nd. This was a weekly advance of 27,320 contracts from the previous week which had a total of 135,948 net contracts.

Speculative positions are now higher for a third week after two gigantic declines in weekly bets on December 5th and 12th, respectively. The current net position level is at the highest standing in five weeks.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -177,600 contracts on the week. This was a weekly decline of -28,131 contracts from the total net of -149,469 contracts reported the previous week.

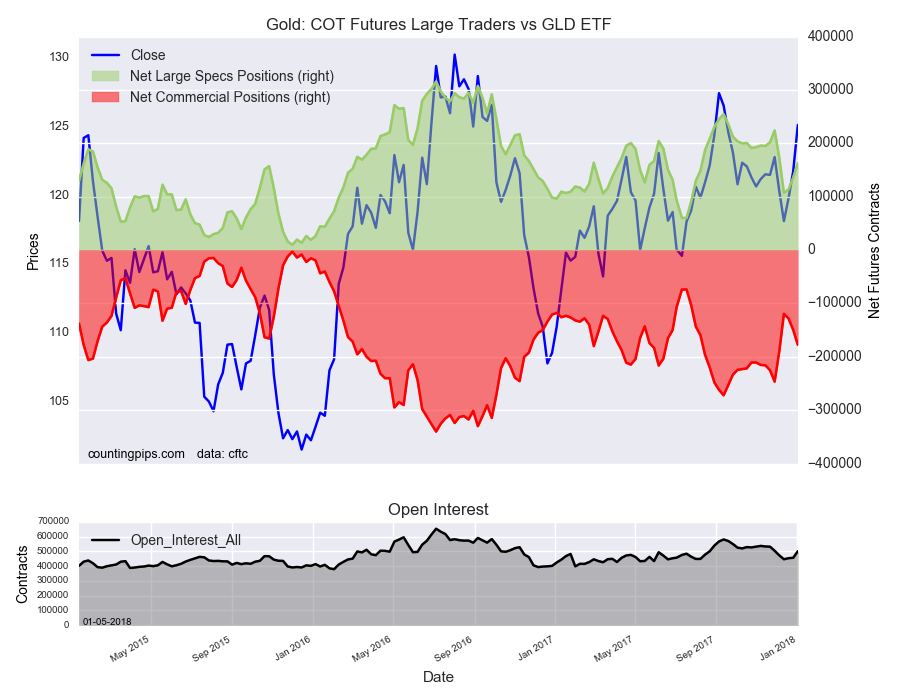

GLD (NYSE:GLD) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $125.15 which was a gain of $3.38 from the previous close of $121.77, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI