The precious metals complex rebounded as expected after becoming very oversold just a few weeks ago. The rebound has been aided by weakness in the US dollar, which plunged roughly 2% over several days. However, upon further inspection gold’s rebound has been entirely dollar-centric. Gold has remained weak in real terms and strength in the gold stocks and silver has been rather muted. In short, the lack of much stronger performance in the face of US dollar weakness bodes for increasing downside risk over the near term.

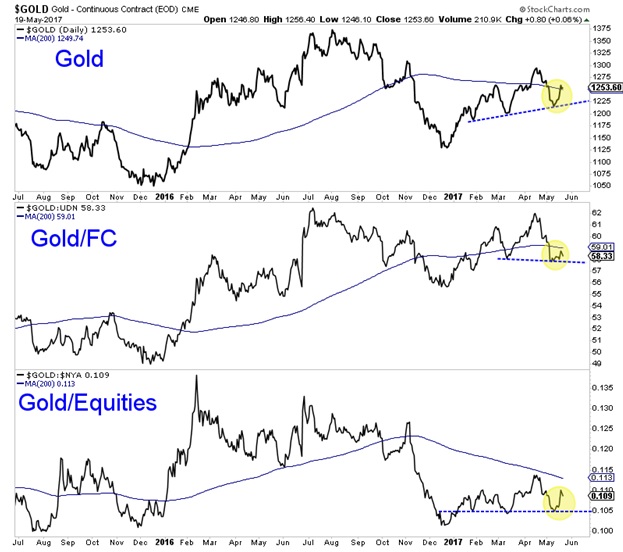

Gold’s recent strength has been driven entirely by euro strength and not due to falling real interest rates, its primary fundamental driver. Macron’s win in France coupled with recent strength in European markets has supported what was an oversold and depressed euro. This has supported gold in US dollar terms but only in those terms. As the chart below shows, gold has been weak when measured against foreign currencies and equities.

The above chart shows that Gold remains well below its spring high near $1300 despite the US dollar breaking its spring lows to the downside. In addition, gold remains rather weak relative to foreign currencies and equities. The one hope for gold would be a falling stock market and sustained strength in the gold/equities ratio. While I expect that eventually, I do not think it is in the cards yet.

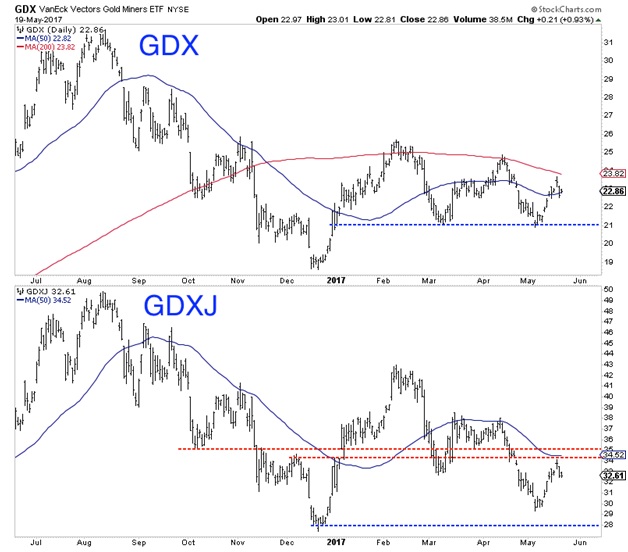

Turning to the gold mining stocks, we see immediate downside risk as the miners appear to have completed their oversold bounce. Over the past few weeks VanEck Vectors Gold Miners (NYSE:GDX) and VanEck Vectors Junior Gold Miners (NYSE:GDXJ) rallied 13% and 17% respectively and retraced a good chunk of their April decline. However, they now appear ready to decline into June and the upcoming Fed meeting.

For the first time in months, GDX was unable to touch its 200-day moving average, which is already sloping down. Support for GDX is at $21 and $18-$19. Meanwhile, GDXJ peaked at its 50-day moving average and strong resistance at $34-$35. Its next strong support level is the December 2016 low.

If precious metals were about to blast off due to US dollar weakness it would have already happened or precious metals would at least be showing much more strength. The greenback fell to a 6-month low yet the entire complex (ex-gold) is nowhere close to 6-month highs and remains well below 200-day moving averages. (Gold is trading right around its 200-dma). This is a warning sign as the sector could be quite vulnerable to a rebound in the US dollar. We continue to wait as we expect lower prices and a good buying opportunity in select juniors at some point this summer.