Just as hedge funds became net-short gold for the first time, gold began to find its footing against the continuous stream of mediocre economic data. This really confused many on financial media, like CNBC, because the Federal Reserve rate hike was almost inevitable next month.

According to trader Scott Nations, featured here on CNBC Futures Now, the futures market is the collective wisdom of market participants, yet wisdom seems to always give into reality.

Fed funds traders priced in a 58 percent probability of a rate hike in September, but within the last two weeks, the probability has been greatly reduced as traders doubt whether or not the Fed can hike rates given the mercurial climate of both domestic and global economic development.

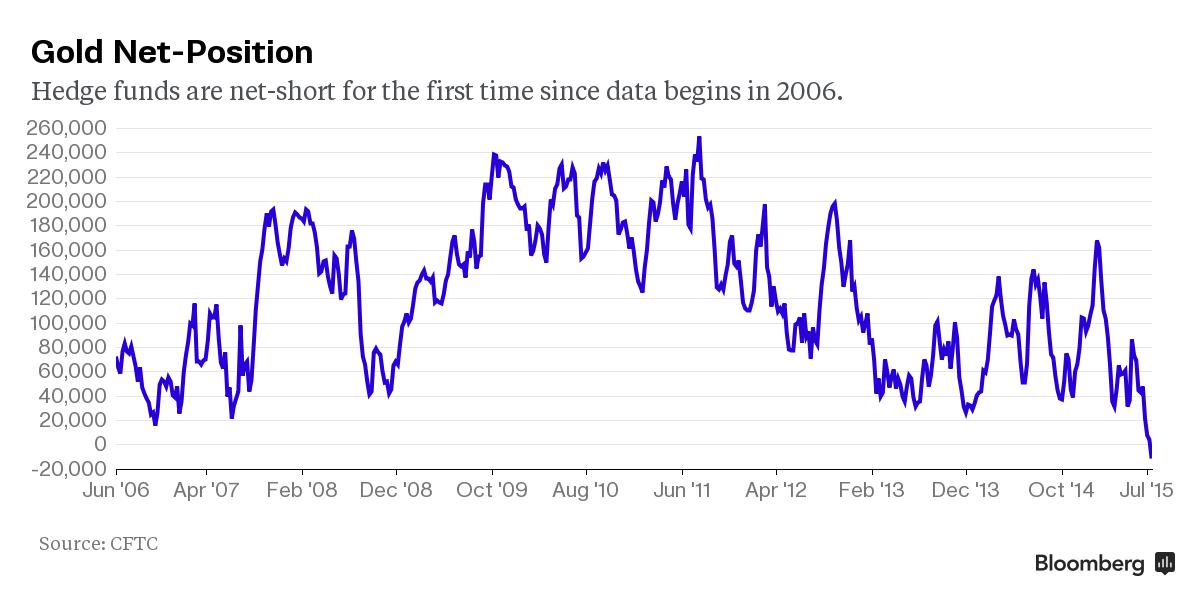

Nations also said, smugly, gold stinks because money mangers are the most net-short gold. How many times must Wall Street get it wrong?

According to Commodity Futures Trading Commission (CFTC) data, money managers were the most net-long as gold peaked out in June/August of 2011 (Chart courtesy of Bloomberg). So, should one trust money managers to get it right by going the most short on failing economic expansion and geopolitical tension?

Today, the Empire State Manufacturing Index completely collapsed to levels not seen since the Great Recession; and this comes at a time where economic growth was suppose to strengthen.

Expecting a 5 on the index, S&P 500 futures sold off quickly on the print of -14.9. The index hit the bearish trifecta: employment, new orders and inventories all sinking lower.

Gold was pushed up to session highs of $1,121.90 per toz. The paradigm of "good news is good, bad news is good" is beginning to breakdown as expectations remain lofty to the actuality of what is going on in the U.S. economy.

Do not be surprised if traders come to buy the dip. Bad habits die hard.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.