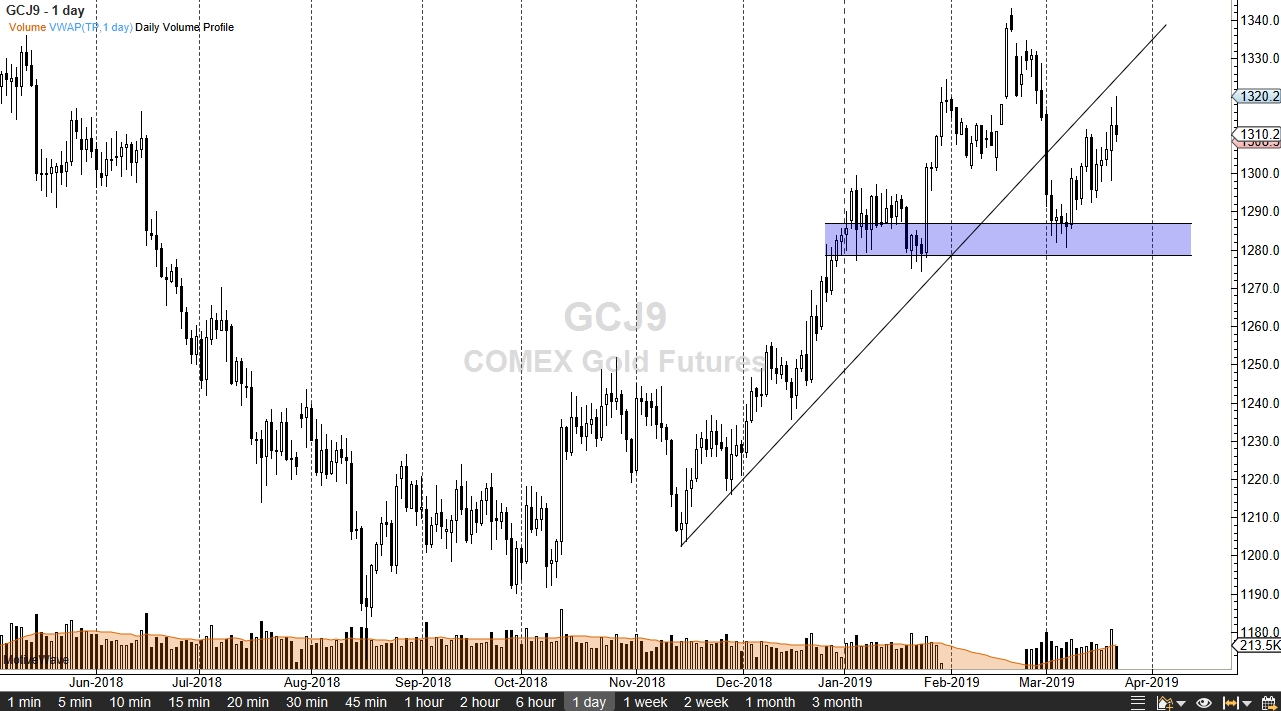

Gold markets initially shot higher during the trading session on Thursday, reaching as high as $1320 during early trading. However, we gave back quite a bit of the gains and it looks as if we could end up forming a bit of a shooting star. Another thing to pay attention to is that we are just below a previous uptrend line, and that should cause a bit of resistance. With all of that in mind, it looks as if Gold markets are ready to roll over a bit.

Going into Friday, it could make sense for profit taking to occur in Gold markets that have had a couple of good days, but another thing that should be paid attention to is that the EUR/USD pair has rolled over pretty significantly during the session as well. That is a bit surprising considering that the Federal Reserve came out and did everything they could to kill the dollar during the previous session. If that’s going to be the case, then gold may still have some stagnation to it above.

Looking below, the $1280 level should be supportive, just as the 50 day EMA, pictured in red on the chart, should be also. To the upside, it looks very likely that the $1325 area is significant resistance as well, so it’s very likely we drop from here just to fill the overall consolidation area. Short-term trading will continue to be the main thrust of market participants, as gold will move countercyclical to the US dollar in general. Pay attention to the US Dollar Index, or at the very least the EUR/USD pair for guidance on with the greenback selling. Gold in theory should do the exact opposite, but it doesn’t have to an absolute sense. In general, there is a negative correlation and it looks like the markets are respecting it.