There's something wonderful about waxing eloquent (or otherwise) upon Gold whilst writing from Zürich. Here in the largest of Swiss cities, vibrant as 'tis, one is reminded of common sense, logic and coordination, and revels in witnessing the requisite precision that makes it all work. It is the antithesis of San Francisco, the chaos therein, and the rampant thoughtlessness which makes it all go wrong. Or as a broader analogy, Switzerland is to Gold as California is to bits**t and as the balance of the world is to the 3Ds of Debasement, Debt and Derivatives. Just sayin'...

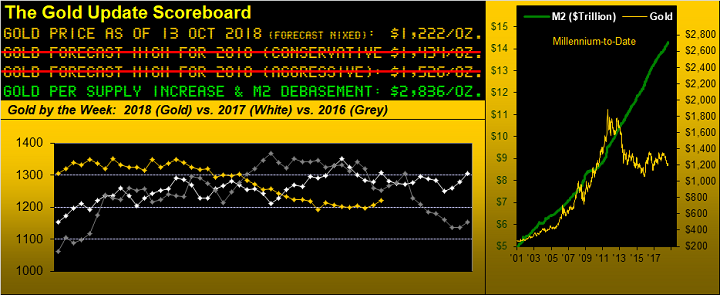

With time again at a premium, let's efficiently dig into Gold. Given what we sense is the beginning of the far overdue (and appropriately pre-midterm elections timed?) correction for the S&P 500, one might have expected Gold to get more than just a +1.2% grip this past week, settling yesterday (Friday) at 1222. The S&P was -4.1% for the week. To be sure, to get Gold to budge upward with any alacrity at all these recent months has been a stark, oft stunning, impossibility.

And yet, history shows us that similar stock market sell-offs don't necessarily send Gold a-soarin': this past week was the 40th millennium-to-date in which the S&P has recorded a net loss of at least -4.1%; for those 40 weeks, Gold's median gain was the same as 'twas this past week: +1.2%. Par for the course.

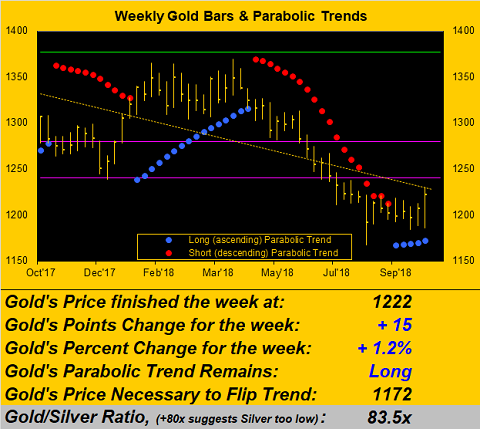

So to turn to Gold's weekly bars, as wee as this past week's up push may seem, the rightmost blue dot of parabolic Long trend is less "flat-lining" than its recent predecessors, and price itself looks poised to penetrate the otherwise declining dashed trendline toward making a run to visit the Box (which as you'll recall is the purple-bounded 1240-1280 zone):

'Course, further fallout in the S&P can be Gold-supportive. Phrases from the past week's Prescient Commentary depicted key S&P levels as follows: "...from the all-time high of 2940 (22 Sep) the 5% correction was passed by yesterday [10 October] at 2793, the 10% correction would arrive at 2646, and 'our' full (once 25% now 27%) correction remains targeted for S&P 2154 ... and [en route] the critical hold area essentially is the 2500s..."

Thus as we go to the Economic Barometer from a year ago-to-date, 'tis somewhat gratifying to see the S&P (red line) starting to come (down) to its senses rather than continuing to defy the declining blue line and still unconscionably high price/earnings levels, (our "live" reading for the S&P presently at 48.9x). It may be Trump in this corner and Powell in that corner, but the Baro was not helped this past week by a buildup in August's Wholesale Inventories, a slowing in September's Consumer Price Index, and October's University of Michigan Sentiment Survey slipping below the vaunted 100-level. Here's the result:

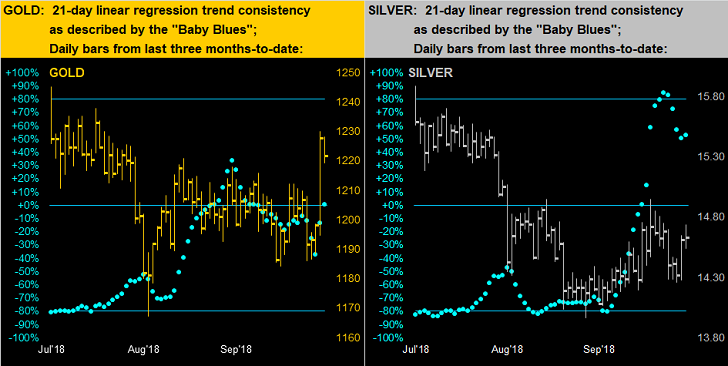

As to how the precious metals are trending we next turn to our three-month panels of the daily bars for Gold on the left and Silver on the right. And in spite of both metals getting a bit of a grip, their respective baby blue dots of linear regression trend consistency appear messy at best, such that should the S&P get a little more respite as it did in closing out the week, hardly can we expect Gold and Silver to maintain smooth gain:

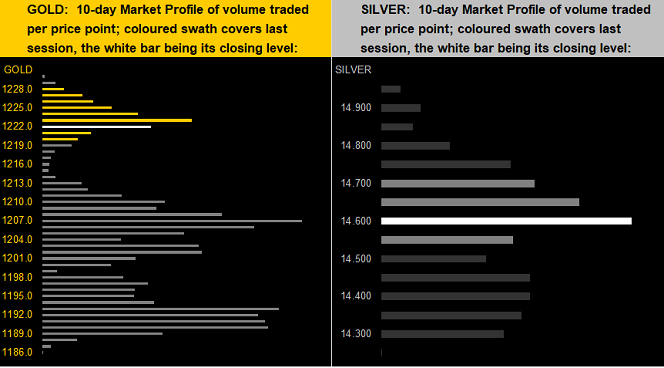

As for the 10-day Market Profiles we find Gold (below left) just shy of the trading resistor of 1223, its two most dominant underlying supporters being 1207 and 1193. Meanwhile, still terribly lagging by her ratio with Gold (83.5x) we find Sister Silver (below right) succinctly centered in her Profile at 14.60.

A broad bevy of incoming Econ Data is due for the Econ Baro in the new week, including the lagging report of September's Leading Indicators for which the consensus is a +0.5% reading ... but by the Baro's declining we believe unlikely. Meanwhile, our overall sense is for the S&P to continue its dip whilst Gold maintains its grip!