Gold has moved higher at the start of the week. In Monday’s North American session, spot gold is trading at $1262.45 an ounce. There are no economic releases out of the US on Monday. The markets are keeping an eye on the Federal Reserve, as four FOMC members will be making appearances. On Tuesday, the US releases New Home Sales.

When the US dollar is in trouble, safe-haven gold is often the beneficiary. This was the case last week, as the political chaos which gripped the Trump administration last week took a toll on the dollar. Gold responded with strong gains of 2.2% and reached its highest levels in 3 weeks. Nervous investors ditched US-denominated assets in favor of gold and other safe-haven assets, and the trend could continue if the crisis continues.

Last week, Trump’s administration was rocked by reports that he had asked former FBI director James Comey to end an investigation into connections between Russia and the Trump campaign team during the US election. If these accusations are true, Trump could be charged with committing obstruction of justice. Trump couldn’t pack fast enough for his first official trip overseas, and he has been warmly received in Saudi Arabia and Israel. With Democrats smelling blood and the noxious term of “impeachment” being thrown around, Trump may face a chilly reception in Congress when he returns from his trip abroad.

Trump Sticks to Script on Saudi Visit

A lack of fundamental data on Monday has given the markets an opportunity to focus on the Federal Reserve, with four FOMC members delivering speeches during the day. The Fed is expected to announce a rate hike at its June 14 meeting, but the markets are having a tough time pricing in a rate hike, as the odds of a hike have been constantly changing. Just one month ago, a rate hike was priced in at 50%.

The odds have jumped higher in May but continue to show movement. Currently, the markets have priced in a hike at 78%, up from 73% on Friday. If the likelihood of a June move continue to fluctuate, gold prices could follow suit, as gold prices are inversely linked to interest rate moves.

XAU/USD Fundamentals

Monday (May 23)

- 10:00 FOMC Member Patrick Harker Speaks

- 10:30 FOMC Member Neel Kashkari Speaks

- 19:00 FOMC Member Lael Brainard Speaks

- 21:10 FOMC Member Charles Evans Speaks

Tuesday (May 24)

- 10:00 US New Home Sales. Estimate 611K

*All release times are EDT

*Key events are in bold

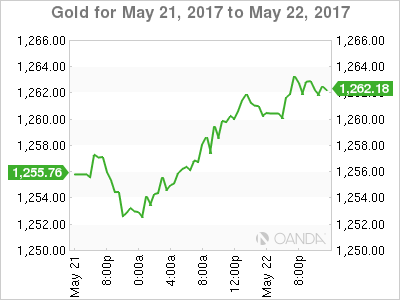

XAU/USD for Monday, May 22, 2017

XAU/USD May 22 at 13:50 EST

Open: 1255.76 High: 1262.68 Low: 1251.86 Close: 1262.45

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1199 | 1232 | 1260 | 1285 | 1307 | 1337 |

- XAU/USD edged lower in the Asian session but recovered these losses in European session. The pair has posted slight gains in North American trade

- 1260 has switched to a support role and remains fluid

- 1285 is the next resistance line

- Current range: 1260 to 1285

Further levels in both directions:

- Below: 1260, 1232, 1199, 1175 and 1146

- Above: 1285, 1307 and 1337

OANDA’s Open Positions Ratio

In the Monday session, XAU/USD ratio is showing long positions with a strong majority (68%), indicative of trader bias towards XAU/USD continuing to move upwards.