Bitcoin price today: slips to $117k from record peak; US inflation awaited

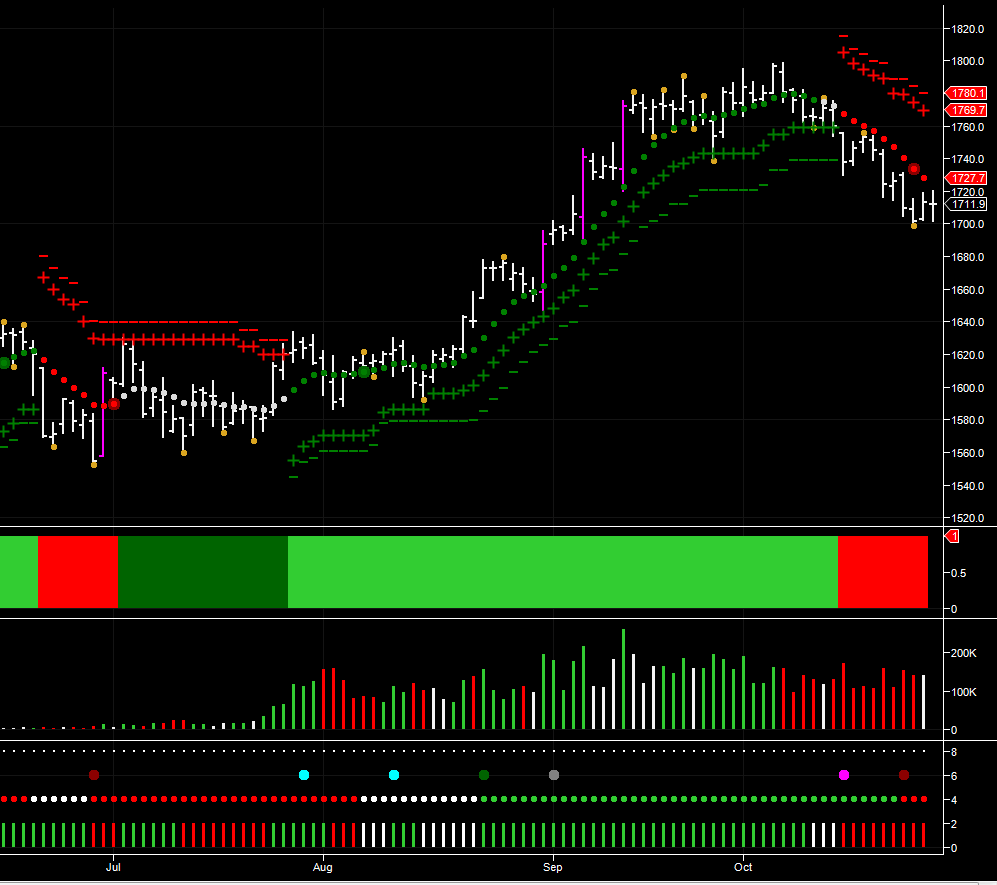

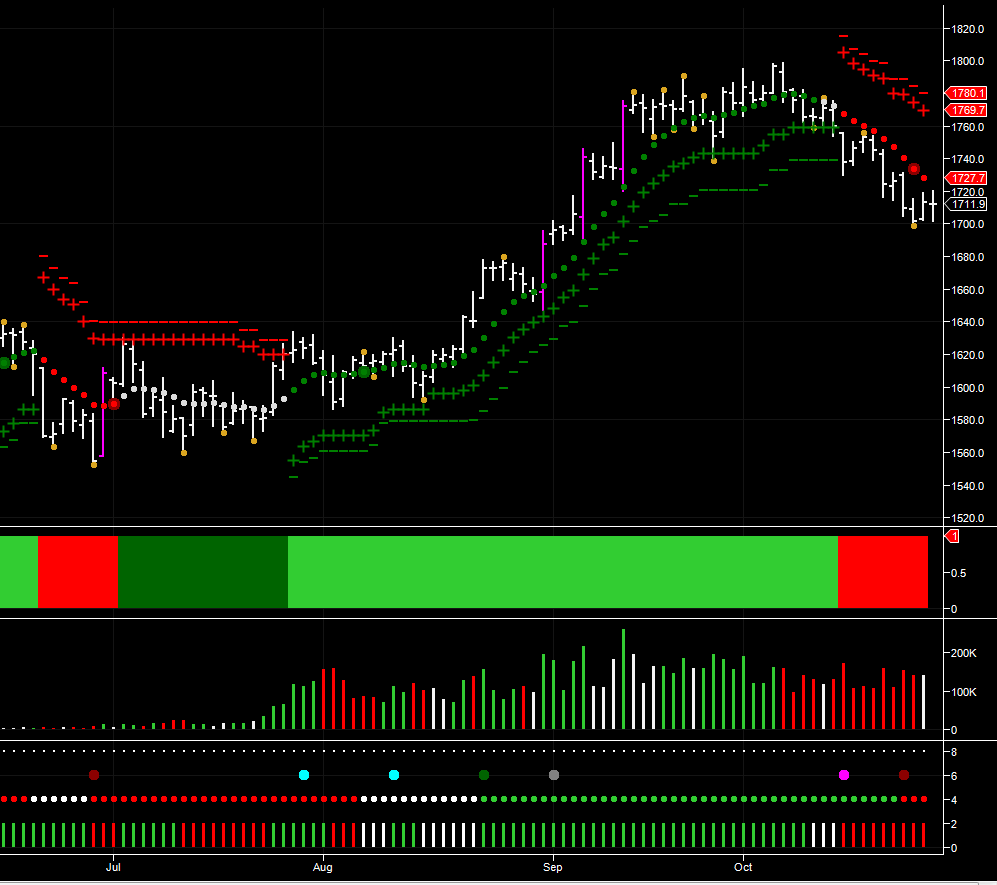

December gold futures closed at $1711.90 per ounce Friday, ending the day and the week in muted tone, reflecting the broader sentiment in other markets. The daily chart for gold however, remains firmly bearish following the sustained period of sideways congestion in the $1740 to $1780 per ounce region, which saw the price of gold test the $1800 per ounce level early in the month, before selling off, and breaking below the platform of support in the $1750 per ounce region. Since then, the move lower has been accompanied by sustained selling volumes on both the daily and the three day chart, with the Hawkeye Heatmap confirming this change in sentiment.

In addition, on Wednesday last week, the three day trend also transitioned from bullish to bearish, giving a clear signal that we can expect to see a further move lower in the medium term. The key for this coming week is a break and hold below the short term platform of support now building in the $1700 per ounce region, which was reinforced in the middle of the week with an isolated pivot low. However, if this is breached, then we can expect to see gold test the $1620 per ounce region in the longer term.

In addition, on Wednesday last week, the three day trend also transitioned from bullish to bearish, giving a clear signal that we can expect to see a further move lower in the medium term. The key for this coming week is a break and hold below the short term platform of support now building in the $1700 per ounce region, which was reinforced in the middle of the week with an isolated pivot low. However, if this is breached, then we can expect to see gold test the $1620 per ounce region in the longer term.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.