What Gold Bulls Need: A weaker U.S. dollar, lower U.S. inflation-adjusted real yields, and volatility in the equity space. If there is a slowdown in the U.S. economy, a slowdown in the equity market, and continued geopolitical risk, there is nothing other than Gold that stands out the go-to safe-haven.

The U.S. Dollar has taken safe-haven attention away from Gold and Silver.

Some analysts believe that the U.S. dollar peaked in 2018 and Gold is expected to trade north of the critical 1.300 USD resistance level next year.

After a disappointing year, gold is looking to recover and make new gains in 2019, with the help of dovish comments from Fed members. The below the expectations Nonfarm Payrolls release last Friday, coupled with a weakening stock market, has the market expecting the Fed will turn cautious next week and slow the pace of rate hikes in 2019.

A large part of future U.S. dollar moves will depend on the level of hawkishness or dovishness of the Federal Reserve and the markets will look for a clear sign in the FOMC statement and Powell’s speech on Wednesday. If the Fed chairman indicates a pause in the rate hiking cycle now, a decline in DXY and Dollar Sell-off may start which would help Gold’s recovery.

The Fed has a difficult predicament to contend with regarding the current dot-plot. On one hand, they need to keep moving rates higher in order to try and avert a massive pension crisis building in the state and municipal levels. On the other hand, lobbying is growing intense for the Fed to pause with stock markets in turmoil due primarily to a rising U.S. dollar squeezing global debt as much of this debt is denominated in the world’s reserve currency. “Shortly; the strong USD is killing the stock markets. Stop the rate hikes”. The Fed’s choice will determine the direction of Gold Prices.

Another component of the matter is the political turmoil in Europe. The deadline for a Brexit deal is March 29, 2019 and Italy’s budget battle with Brussels remains a concern as well. With a growing lack of confidence in Europe, more safe-haven bids may continue into both gold and the U.S. dollar. Thus far, investors have turrned toward the USD instead of Gold as a safe haven.

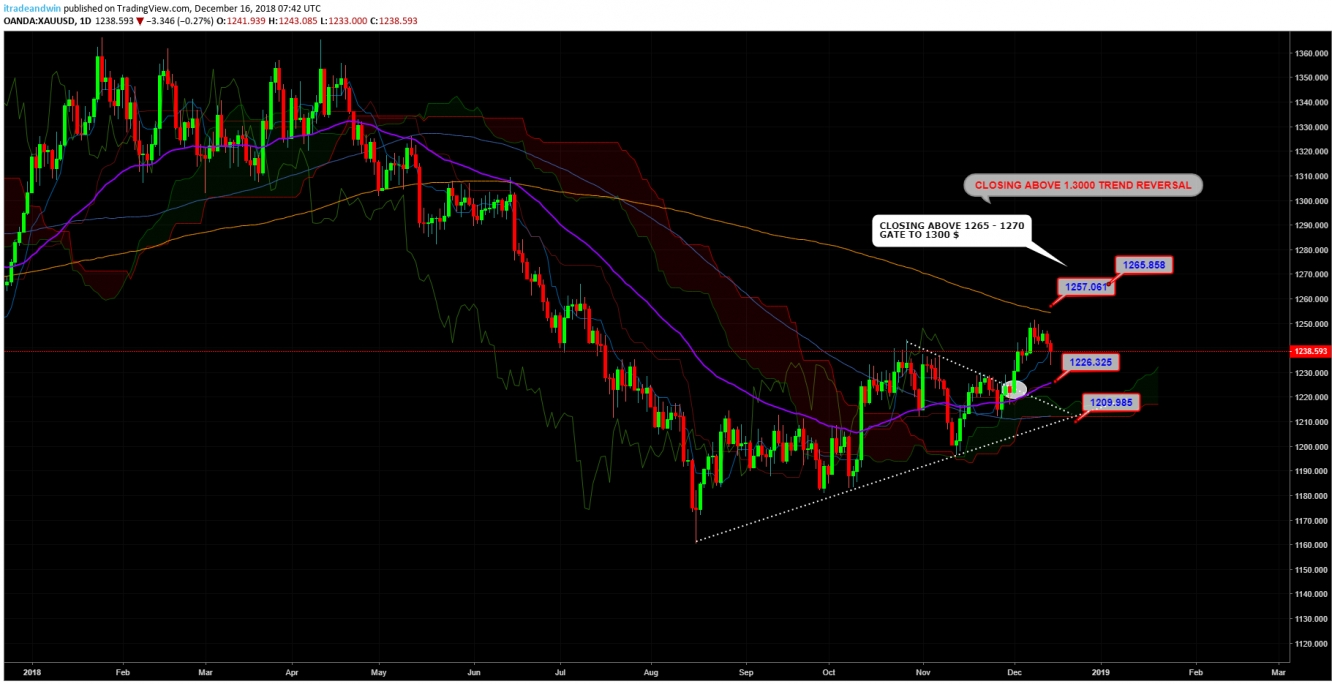

Technical Analysis:

On the daily chart, Gold is trading on an ascending bullish trendline. XAU/USD ended the week at 1238 USD above EMA 50 and positive territory of the Ichimoku Cloud. We can say the short-term trend is still Bullish.

Key Levels on The Daily Chart:

*1252 – SMA 200 on Daily Chart

*1265 – SMA 100 on Weekly Chart

The midterm bearish trend will remain as long as the prices stay below 1265 USD. A few daily closing above 1265 USD will be the signal of the midterm trend reversal from bearish to bullish. In this case, we can start to talk about 1281, 1296 and 1300 USD.

- On the H4 Chart, Gold ended the week at 1238 the bearish territory below EMA 50. Technical readings indicate the continuation of the bearish move. On the downside, we have 2 key levels 1230 and 1226 USD. I believe that the potential breakout of 1226 USD will call the bears back to the arena with much more appetite sending the prices 1218 and 1210 USD.

My Plan: I will keep my short positions – my stop loss at the entry 1250 USD– targeting 1226 USD. I will add short positions if the prices break below 1226 USD and my targets will be 1218 and 1210 USD. If the Fed does not sound like soft dovish as market participants are expecting, we may see the prices breaking key support at 1210 USD and heading South towards 1.178 and 1.150 USD.

Disclaimer: This chart has been published for educational purposes only and cannot be considered as a trading advice. This analysis prepared by the global analysts of Chartreaderpro.com and published on Investing.com. Commercial distribution is strictly prohibited.