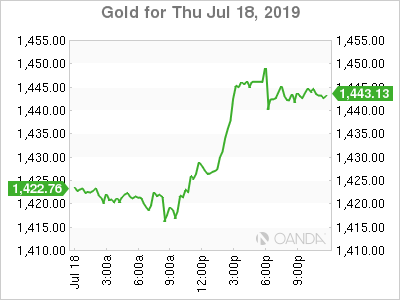

Gold fell on Thursday as investors booked profits after the metal hit a two-week high earlier in the session on increased expectations of a dovish monetary policy stance from the U.S. Federal Reserve.

Spot gold slipped by 0.28% to $1,422.6 an ounce. Prices had jumped about 1.5% in the previous session and extended gains early on Thursday to hit $1,426.80, gold’s highest since July 3.

Bullion had firmed on Wednesday after the Fed reported that the U.S. economy has continued to grow at a “modest” rate in recent weeks.

“At the moment, gold lacks a trigger to move beyond the levels we have seen earlier this year,” said Julius Baer analyst Carsten Menke, adding that prices between $1,420 and 1,425 are attracting profit-taking.

Menke said much attention is focused on the U.S. central bank and that there is “a little bit of disappointment potential” for gold bulls who jumped too strongly on expectations for cuts to interest rates.

Increased bets on a Fed rate cut have kept gold well supported above $1,400 and overall momentum is positive, analysts said.

The Fed is widely expected to cut a total of 75 basis points by the end of the year.

Global stock markets, meanwhile, found little relief as the trade tussle between the United States and China rumbles on, helping to support gold.

U.S. President Donald Trump kept up pressure on Beijing this week with a threat to put tariffs on another $325 billion of Chinese goods.

Bullion prices could climb to $1,439 an ounce after clearing resistance at $1,421, according to Reuters technical analyst Wang Tao.

Among other precious metals, silver rose 0.6% to $16.07, exceeding the $16 mark for the first time since February. Spot platinum was up 1% at $851.58 while palladium dipped 0.6% to $1,529.08.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.