Trump says he will sue Wall Street Journal, NewsCorp, over Epstein letter report

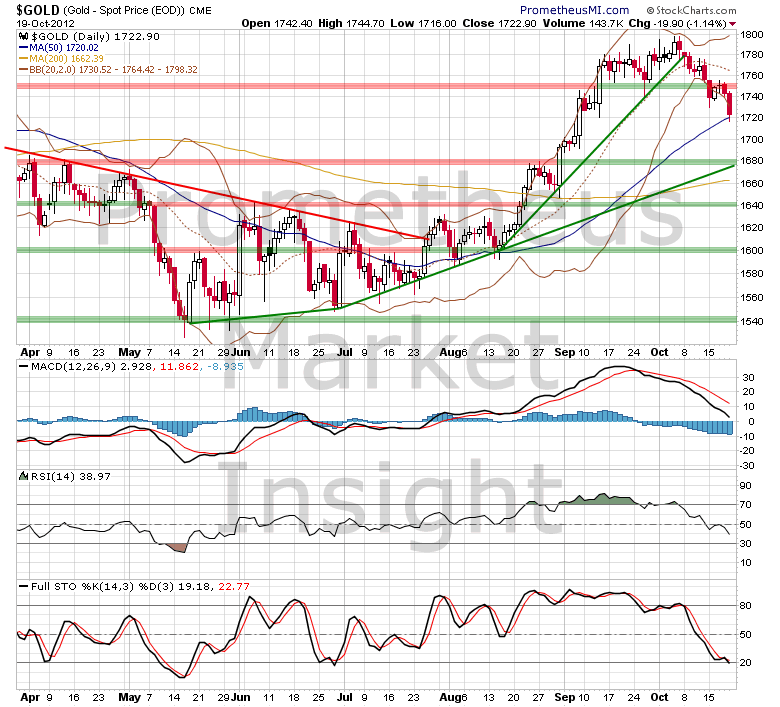

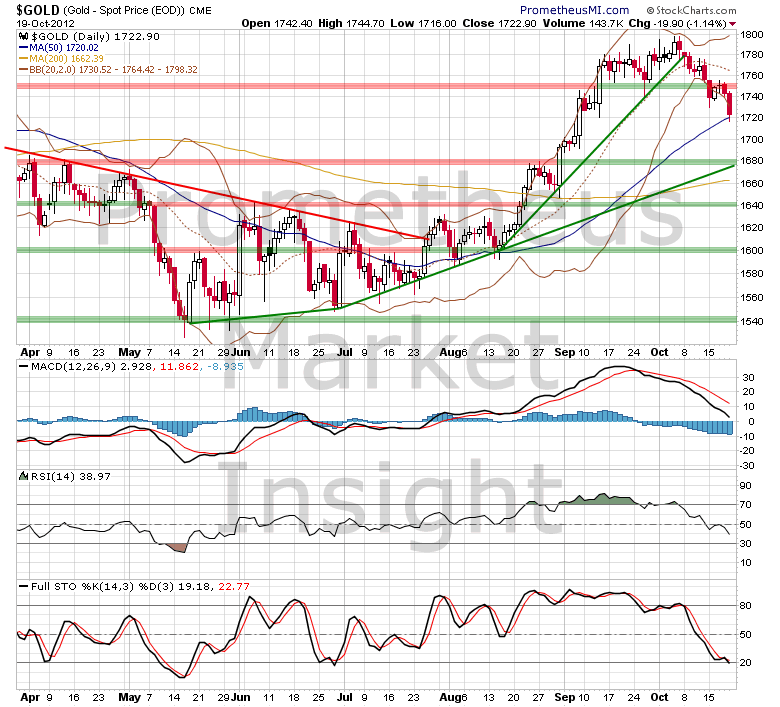

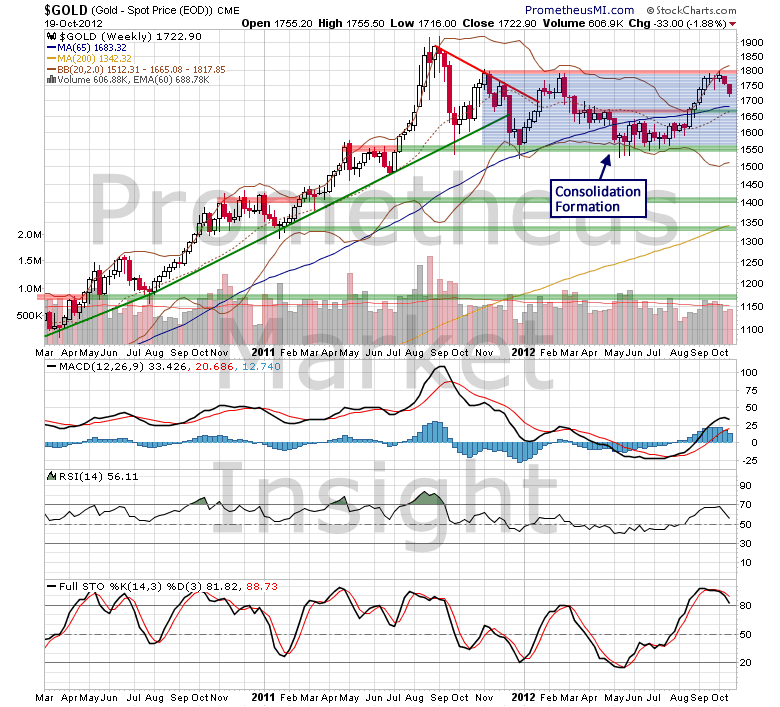

Gold closed sharply lower Friday, retreating further from recent intermediate-term highs and moving down toward support at the lower boundary of the uptrend from May. In early October, we noted that the power uptrend from August was rising at an unsustainable rate and predicted that it would likely be followed by a potentially violent overbought correction. The anticipated correction commenced when power uptrend support was violated last week and the decline has developed as expected since then.

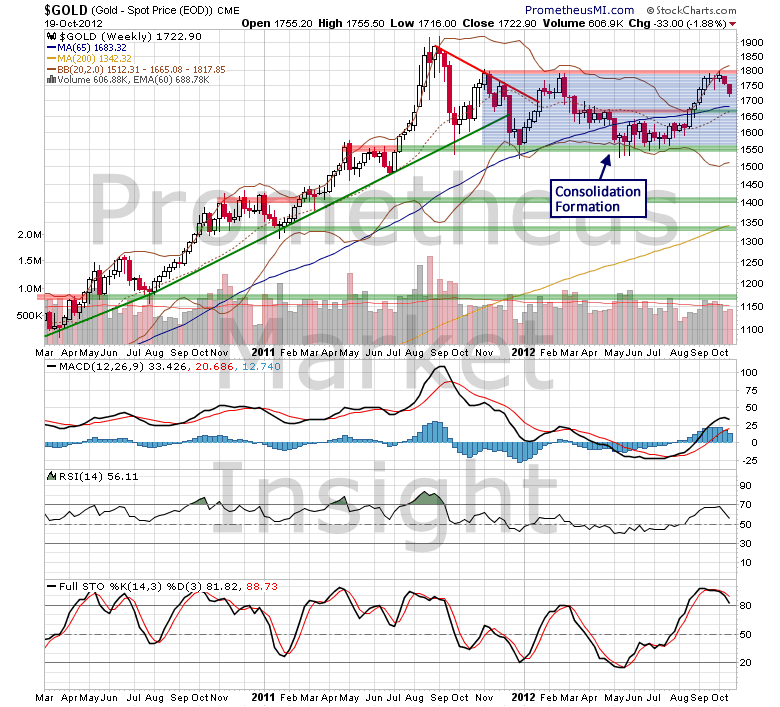

As we note often, short-term price behavior only has meaning when it is analyzed in the proper context afforded by the long-term view. Although gold prices have moved violently lower during the last two weeks, the consolidation formation on the weekly chart that we have been monitoring since early September continues to track the bullish scenario that we outlined at the time, favoring an eventual resumption of the long-term uptrend.

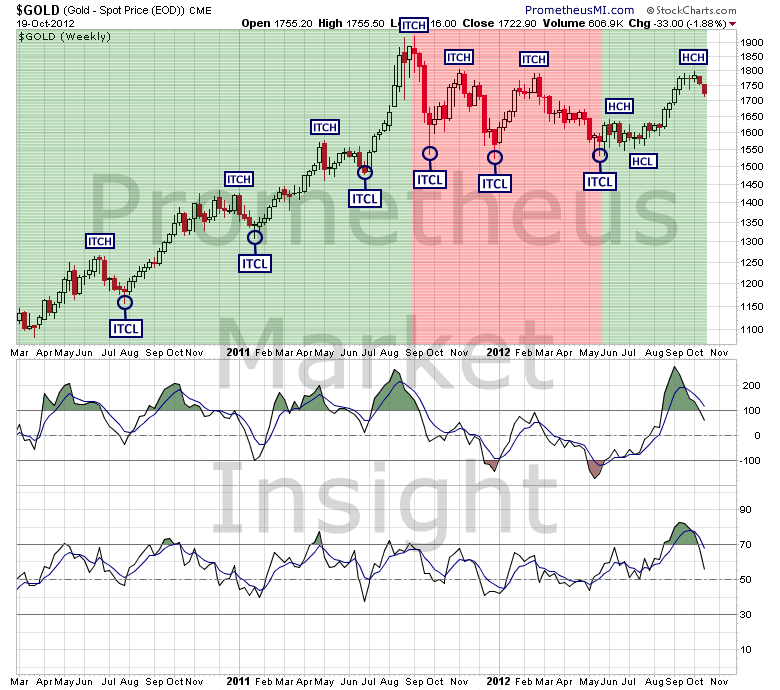

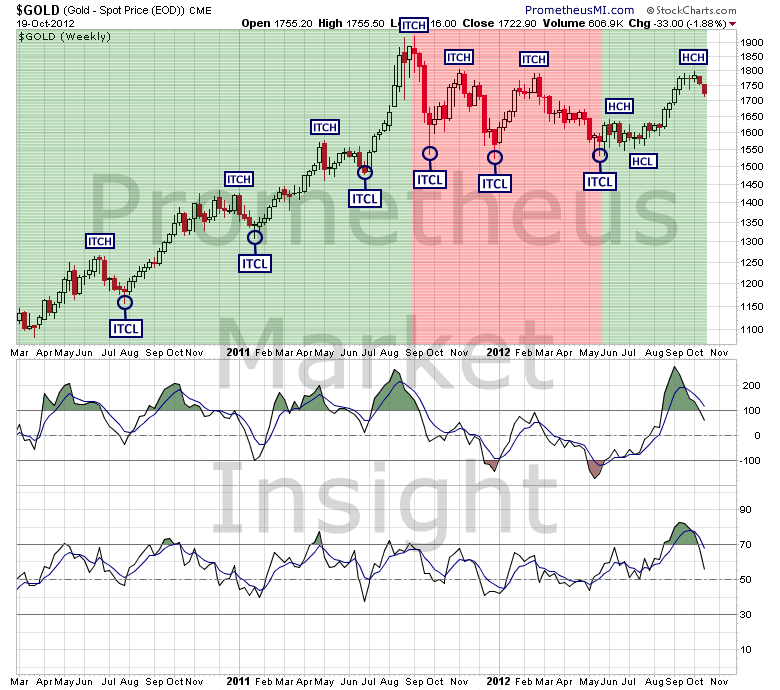

With respect to intermediate-term cycle analysis, prices have moved lower following the formation of the second half cycle high (HCH) of the cycle from May.

If the forthcoming intermediate-term cycle low (ITCL) forms well above the previous low in May and it is followed by a strong move above congestion resistance in the 1,795 area, a breakout to new all-time highs would become highly likely in late 2012 or early 2013. Therefore, although the short-term outlook is currently bearish, the secular uptrend may be preparing to resume, so it will be important to monitor price behavior closely during the next several weeks for the next signals with respect to long-term direction.

As we note often, short-term price behavior only has meaning when it is analyzed in the proper context afforded by the long-term view. Although gold prices have moved violently lower during the last two weeks, the consolidation formation on the weekly chart that we have been monitoring since early September continues to track the bullish scenario that we outlined at the time, favoring an eventual resumption of the long-term uptrend.

With respect to intermediate-term cycle analysis, prices have moved lower following the formation of the second half cycle high (HCH) of the cycle from May.

If the forthcoming intermediate-term cycle low (ITCL) forms well above the previous low in May and it is followed by a strong move above congestion resistance in the 1,795 area, a breakout to new all-time highs would become highly likely in late 2012 or early 2013. Therefore, although the short-term outlook is currently bearish, the secular uptrend may be preparing to resume, so it will be important to monitor price behavior closely during the next several weeks for the next signals with respect to long-term direction.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.