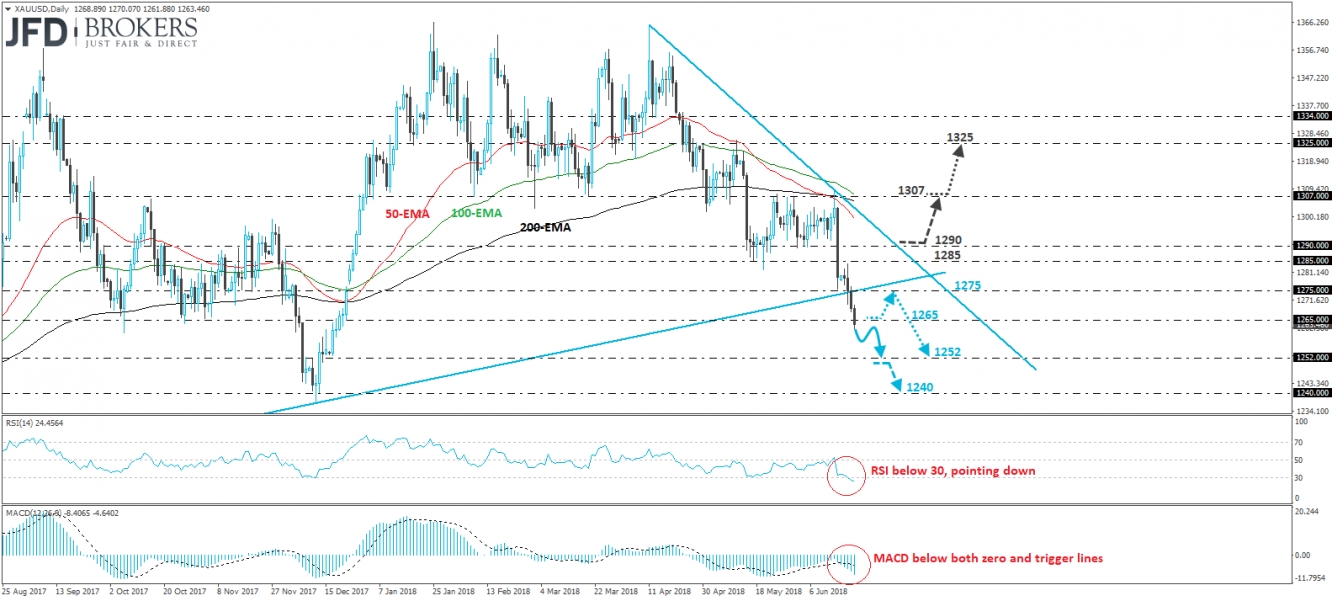

XAU/USD traded lower today, breaking below the 1265 barrier. Yesterday, the metal closed the day below the upside support line taken from the low of 10th of July 2017, which combined with the fact that the price is trading below the tentative downtrend line drawn from the peak of the 11th of April suggests that the outlook is negative for now.

If the bears manage to stay in the driver’s seat, then we would expect them to drive the battle lower towards the 1252 support zone. Another break below that hurdle is possible to set the stage for more downside extensions and perhaps aim for our next support territory of 1240.

Looking at our daily oscillators, we see that the RSI slid below its 30 line and is pointing down, while the MACD lies below both its zero and trigger lines, pointing south as well. These indicators suggest strong downside speed and support the case for the yellow metal to continue drifting lower in the foreseeable future.

On the upside, a move back above 1265 could open the way for the 1275 resistance or the prior upside support line taken from the low of the 10th of July 2017. However, even if this is the case, we would treat such a recovery as a corrective rebound and we would still see a decent chance for another leg down from near those levels.

We prefer to wait for a clear close above 1290 before we start examining whether sellers have abandoned the battlefield. Such a move is likely to initially pave the way for the 1307 area, where another break may lead the precious metal towards the next resistance zone of 1325.