Asia stocks mixed; Australia gains on soft CPI, Japan steady before BOJ

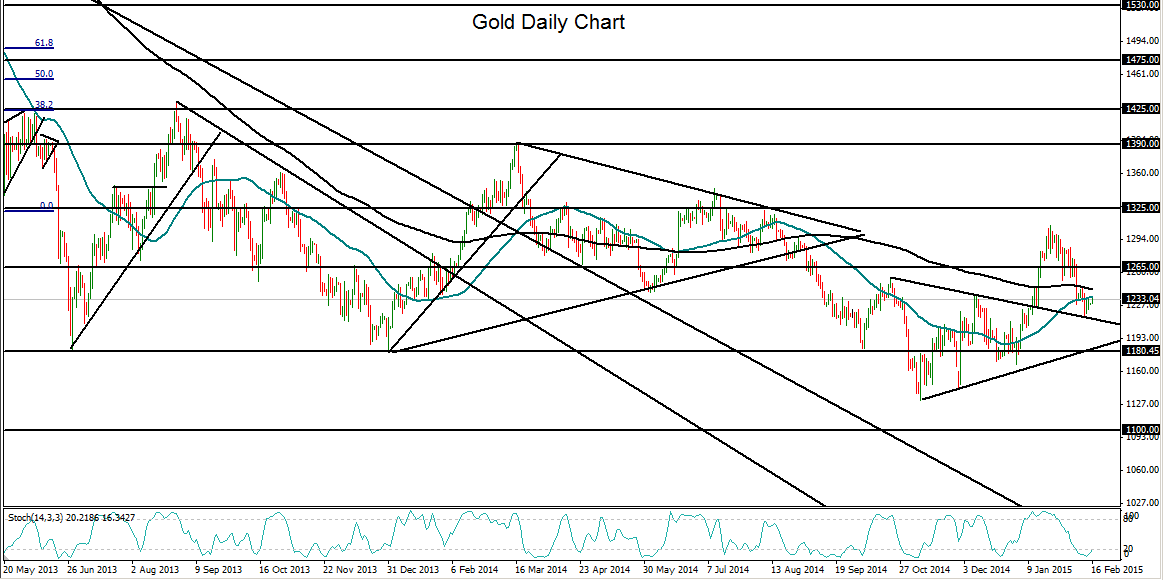

Gold (daily chart shown below) has begun a consolidation after having declined sharply for almost a month. The most recent declines began after the precious metal hit a five-month high around 1307 in late January.

Subsequent to reaching that high, price action began a plunge that erased around 7% of gold’s value by mid-week of last week, hitting a low around 1216.

That plunge dipped below both the 200-day and 50-day moving averages to hit the upper border of a large triangle consolidation pattern that gold had broken out of in early January.

After hitting that low, there has been a modest rebound off the support of the triangle pattern’s border.

Despite the recent plunge and the fact that gold has been entrenched in a long-term downtrend for several years, November’s rebound from the 1130-area multi-year low provided an indication of a potential bottoming out. This bottoming thesis was reinforced by the noted breakout above the triangle pattern in January.

Last week’s modest rebound from support and the current consolidation could be an indication that a recovery may still be in play. If price action is able to stay above the triangle pattern support and rise above the two noted moving averages, the major upside targets continue to reside around the 1265, 1300, and 1345 resistance levels.

Disclosure: FX Solutions assumes no responsibility for errors, inaccuracies or omissions in these materials. FX Solutions does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FX Solutions shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials.

The products offered by FX Solutions are leveraged products which carry a high level of risk to your capital with the possibility of losing more than your initial investment and may not be suitable for all investors. Ensure you fully understand the risks involved and seek independent advice if necessary.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI