The Federal Reserve will issue its latest verdict on monetary policy today at 2pm EST. In addition, the FOMC (Federal Open Market Committee) will provide its latest economic guesses …err….forecasts which will be heavily parsed over by market participants. This will be followed by Chairman Bernanke’s grand entrance to his press conference in which he will undoubtedly grace us with his usual vague doublespeak which will leave tired “Fed watchers” and market participants more confused than they were at 1:59pm EST.

Whether we like it or not the Federal Reserve and Chairman Bernanke are the primary catalysts for global financial markets for the foreseeable future. Gold, in particular, has become a slave to the Fed’s whims. Although we firmly believe that the Fed continues to lay the foundation for a massive rise in gold years down the road, over the near term the Fed is still driving the gold bus.

There are three primary scenarios for tomorrow’s Fed hooplah and how it will impact markets over the next 1-3 weeks (listed in order of probability):

1. $10-$15 billion taper with moderate hikes in economic forecasts, Chairman/FOMC statement indicating that QE will wind down by Q2/Q3 2014 – Neutral to slightly bearish for gold over the near term

2. No taper with no change/marginal hikes in economic forecasts, Chairman/FOMC statement offering little clarity as to forward guidance (“remain data dependent” etc.) – Bullish gold

3. $15+ billion taper with significant hikes in economic forecasts, Chairman/FOMC statement indicating that QE will wind down by Q2 2014 and FOMC begins pondering initial hike in Fed funds rate to occur in 2015 – Bearish gold

Longer term, tapering could have serious consequences. If the economic recovery ends up not being self-sustaining and the fiscal/monetary policy headwinds prove to be too much of a burden, it could be very bullish for gold. However, the monster bull move in gold is likely to still be a few years down the road.

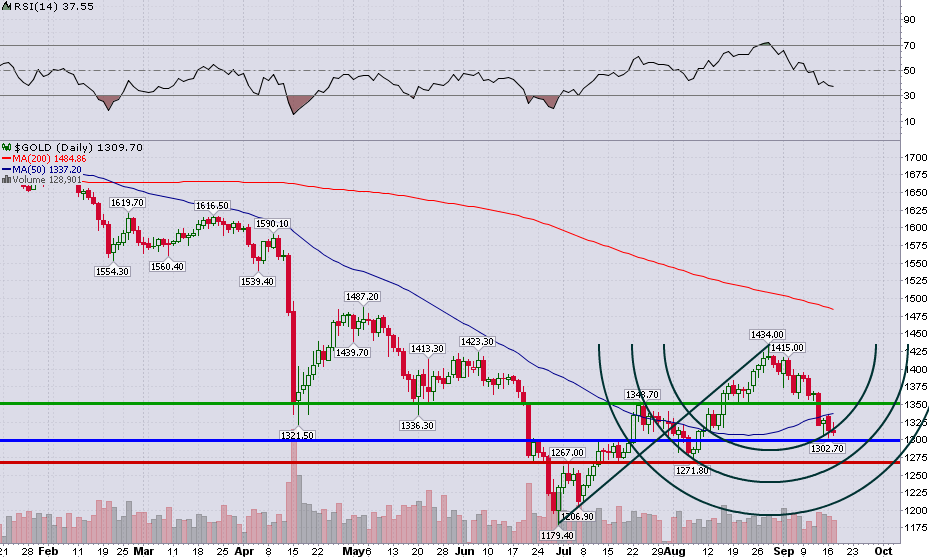

Updated Daily Gold Chart

$1300 is clearly the battleground level heading into today’s Fed circus, with $1350 serving as the first major upside target in the case of a bullish scenario playing out. Meanwhile, further downside is likely to find major support near $1260-$1270.

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI