Nvidia shares jump after resuming H20 sales in China, announcing new processor

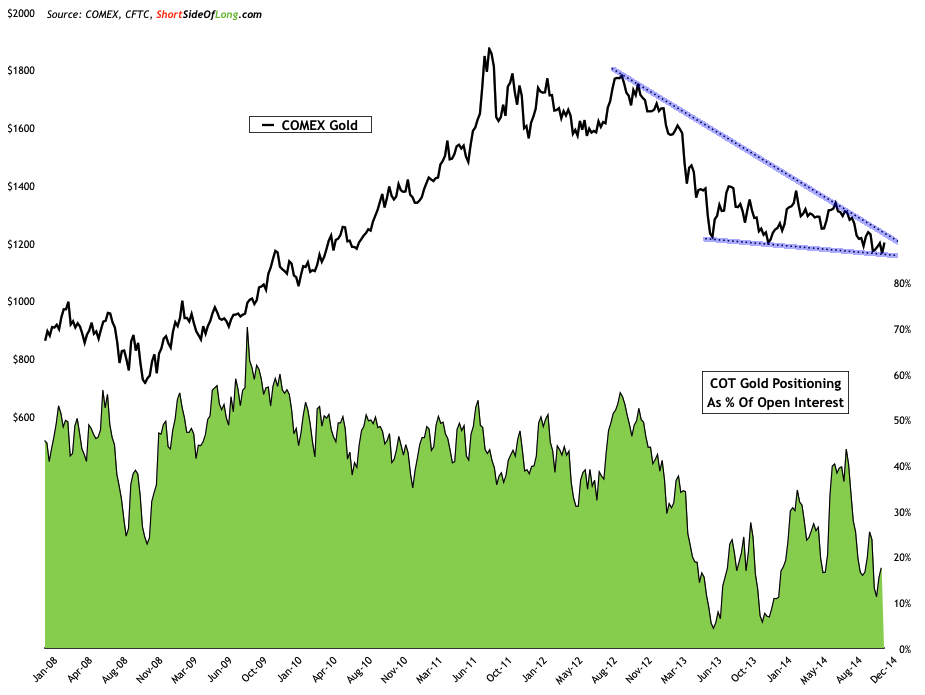

Let us be honest here for a second. Almost every Wall Street Strategists has been expecting Gold below $1,100 this year and even below $1,000 next year. Every trade has been positioning for the breakdown below the all important support level of around $1,200 per ounce and gross shorts are currently at very high levels. Every media outlet from Bloomberg to CNBC has been talking about how much of a poor investment Gold has been. Many sentiment surveys, including the Daily Sentiment Index, reached record low levels on the recent decline. Even I have been expecting prices towards a $1,000 physiologically important support level.

Could all of us be wrong?

Consider the fact that Gold has failed to break down below $1,200 properly on back of very negative news, where Swiss Referendum has voted no to Gold backing. Many great investors, such as Marc Faber, who taught me throughout my career that when an asset fails to break lower on very negative news, it is a sign that a major reversal in trend could be in the cards. Instead of the Gold falling to lower lows, price has recently shown that sellers have potentially exhausted themselves.

Could we see a breakout, instead of a group-think breakdown, from the wedge seen in the chart above?

We will find out soon enough!

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.