It was all looking good for gold at the start of the week. The precious metal seemed ready to continue the recovery from $1123 after climbing to a new intraday high of $1220 on Tuesday, but unfortunately for the bulls, it was not meant to be. Instead, a long a sharp decline of nearly $40 dragged the price of gold to as low as $1180 as of today. So what went wrong and where should we look in order to explain that sudden crash?

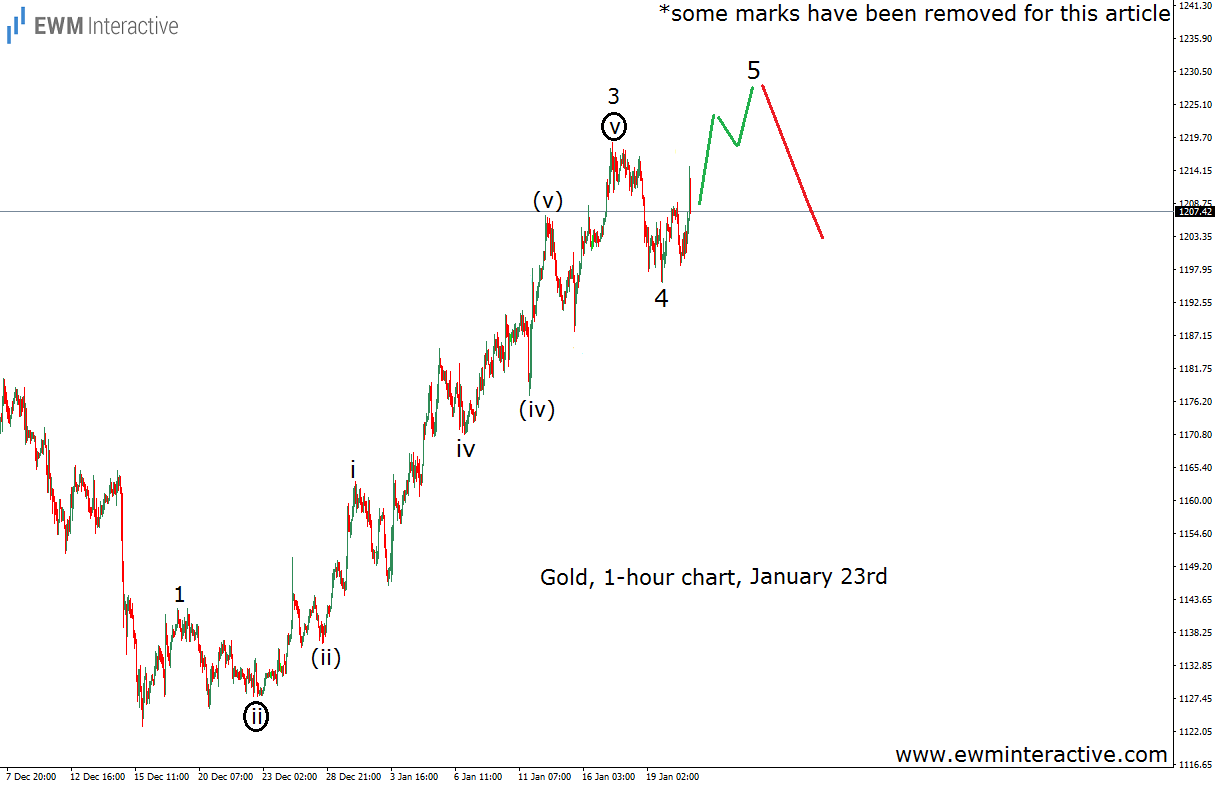

Before the open on Monday, January 23rd, our premium clients received an analysis, containing the following chart.(some marks have been removed for this article)

Thanks to the Elliott Wave Principle, all that is needed, in order to come up with an explanation, is a single chart. As visible, we thought a five-wave impulse was in progress, but its wave 5 was missing. Therefore, a new swing high above the top of wave 3 at $1219 could have been expected. On the other hand, the theory states that every impulse is followed by a correction in the other direction. In other words, the price of gold simply followed the Elliott Wave rules. And that is the explanation we have been searching for.

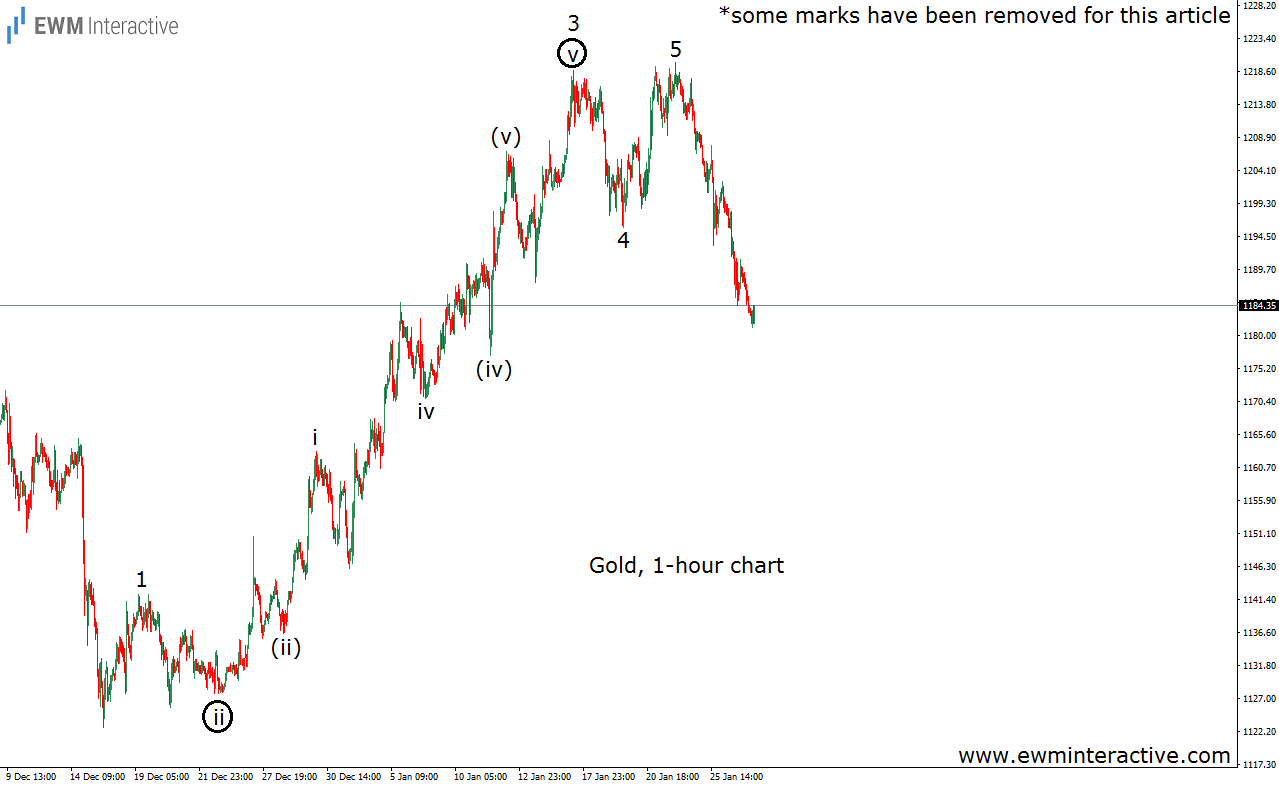

The updated chart shows exactly why traders and investors should learn and master the Wave Principle. Even if the situation does not allow you to make a profit, it is still going to warn you about an upcoming reversal and thus save you some losses, which is equally important. You would not want to join the bulls just before the uptrend ends, would you?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.