Ryan Detrick, head of Statistical analysis for Kimble Charting Solutions and I were honored to be on a “Chart Art” panel this past week, at the Stocktoberfest meeting at Coronado Island.

The main thrust of our talk was this; 'Global markets have formed look-alike patterns and that support of 5-year rising channels remains in place.'

Each of the key indices above have ALL declined lately, hitting rising-channel support and Fibonacci retracement levels, where ALL have created bullish reversal patterns (bullish wicks) at these dual support levels.

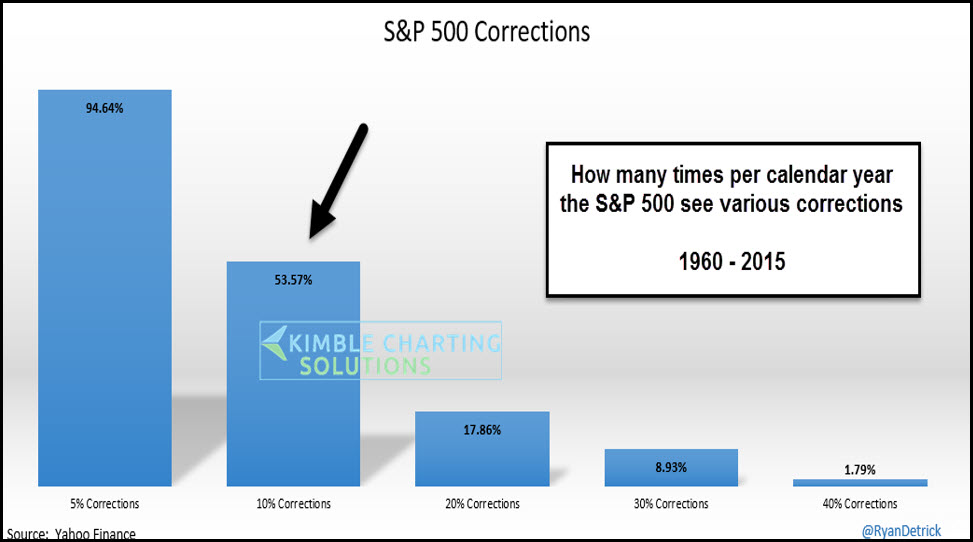

We also discussed the chart below:

This chart shows that 10% corrections have taken place on average once every two years, since 1960.

Bottom Line

Ten-percent corrections have been pretty normal during the past 50 years and the latest one that took place didn't break 5-year rising channels in any of the 6 global indices.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.