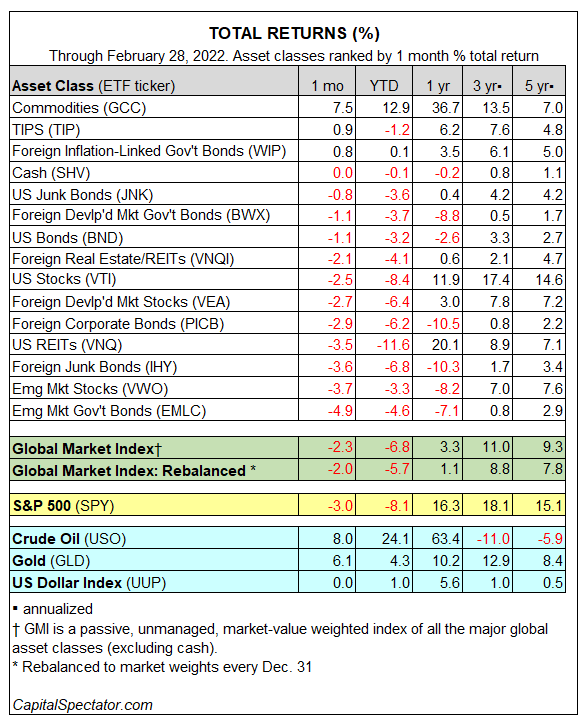

Most markets around the world continued to slide in February, marking the second month of widespread losses in 2022 for the major asset classes. The main exceptions: commodities and inflation-indexed government bonds.

A broad measure of commodities posted another strong monthly gain in February. WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose 7.5%, building on the previous monthly’s solid advance.

Elevated inflation around the world, exacerbated by the war in Ukraine, helped lift prices of inflation-indexed bonds last month. A pair of ETFs tracking US and foreign government securities indexed to inflation posted modest gains (TIP and WIP, respectively).

Otherwise, losses prevailed in February. The deepest setback: bonds issues by emerging market governments via VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC), which tumbled 4.9% last month.

The Global Market Index (GMI) also suffered in February. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, lost 2.3% last month. Year to date, GMI is off nearly 7%.

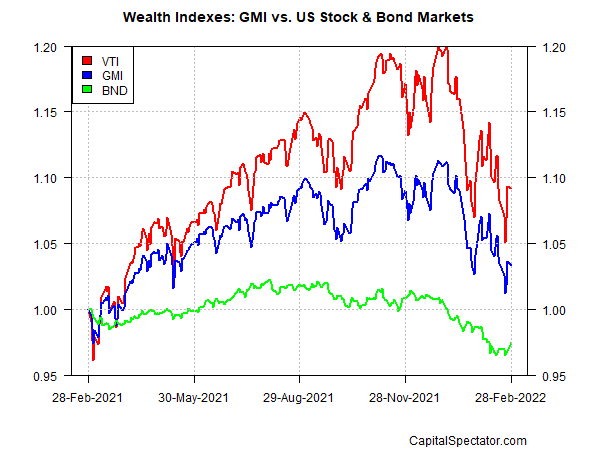

Reviewing GMI’s performance relative to US stocks and bonds over the past year continues to reflect a solid middling performance for this multi-asset-class benchmark (blue line in chart below). US stocks via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) earned nearly 11.9% for the trailing one-year window. By contrast, a broad measure of US bonds — Vanguard Total US Bond Market via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) — fell 2.6%. GMI earned 3.3% for the year ended Feb. 28.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.