Sterling endured its worst day in 3 weeks yesterday against the USD as the Bank of England minutes once again showed a Monetary Policy Committee that is looking for another round of quantitative easing sooner rather than later. The major takeaway from the document was that they saw the risk that CPI was “more balanced around target”. This is central bank speak for “Inflation is unlikely to get in the way if we need to loosen monetary policy further”.

We have of course heard this from the Bank before; their predictive powers are seen as poor, particularly when it comes to inflation having expected a return to target last year (CPI reached 5.2% in September 2011). Therefore it is now fairly certain in our eyes that the Bank will continue its asset purchase program in November following the end of the current program, even were we to see a dramatic recovery in the prospects for the global economy.

Sterling slid lower against after the announcement; a move that had been on the cards for a while following an impressive near 5 cent rally in the past month. We are still bullish for GBP versus USD and view this pullback as healthy and a good opportunity for traders to reload positions to take the cross higher. That being said, we are looking at further losses today due to the volatile nature of the data calendar.

Spain’s longer-term debt auction is due today at 09.30 and we will look at the results through a sphere of “How much more time does the market think the Spanish can waste before asking for a bailout?”. The situation in Spain is not as critical as it was at the previous 10yr auction thanks to the availability of an ECB bond purchase safety net. The fact is the safety only applies if the Spanish take to the bailout high-wire.

Elsewhere risk to current price levels comes from a run of preliminary PMI numbers from the Eurozone and UK retail sales for the key period over the Olympics. Chinese manufacturing PMI disappointed overnight continuing the trend of poor manufacturing numbers globally. Similar weakness is to expected from the European numbers.

UK retail sales are a difficult one to call given the exceptional circumstance that was the 2012 Games. The High St is likely to have taken a bit of a beating but online elements may have bounced back. I for one was happily ensconced on the sofa and only made missions for provisions when necessary. The expectation is of a decline of 0.3% and we expect a disappointment to drive GBP lower over the session.

The general trend at the moment is for further risk off shifts and we would agree with this over the course of today’s session.

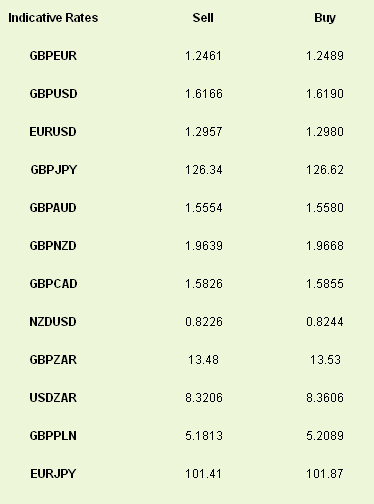

Latest exchange rates at time of writing

We have of course heard this from the Bank before; their predictive powers are seen as poor, particularly when it comes to inflation having expected a return to target last year (CPI reached 5.2% in September 2011). Therefore it is now fairly certain in our eyes that the Bank will continue its asset purchase program in November following the end of the current program, even were we to see a dramatic recovery in the prospects for the global economy.

Sterling slid lower against after the announcement; a move that had been on the cards for a while following an impressive near 5 cent rally in the past month. We are still bullish for GBP versus USD and view this pullback as healthy and a good opportunity for traders to reload positions to take the cross higher. That being said, we are looking at further losses today due to the volatile nature of the data calendar.

Spain’s longer-term debt auction is due today at 09.30 and we will look at the results through a sphere of “How much more time does the market think the Spanish can waste before asking for a bailout?”. The situation in Spain is not as critical as it was at the previous 10yr auction thanks to the availability of an ECB bond purchase safety net. The fact is the safety only applies if the Spanish take to the bailout high-wire.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Elsewhere risk to current price levels comes from a run of preliminary PMI numbers from the Eurozone and UK retail sales for the key period over the Olympics. Chinese manufacturing PMI disappointed overnight continuing the trend of poor manufacturing numbers globally. Similar weakness is to expected from the European numbers.

UK retail sales are a difficult one to call given the exceptional circumstance that was the 2012 Games. The High St is likely to have taken a bit of a beating but online elements may have bounced back. I for one was happily ensconced on the sofa and only made missions for provisions when necessary. The expectation is of a decline of 0.3% and we expect a disappointment to drive GBP lower over the session.

The general trend at the moment is for further risk off shifts and we would agree with this over the course of today’s session.

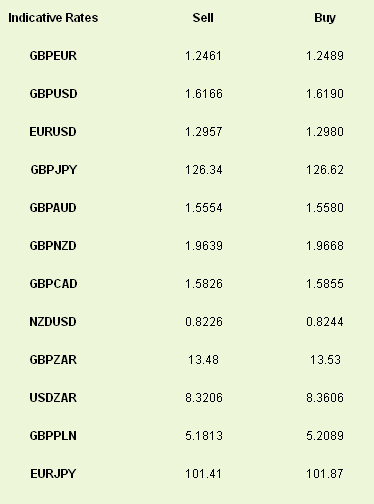

Latest exchange rates at time of writing

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI