It’s getting ugly for my core market health indicators. My measures of market quality, trend, and strength are all in oversold territory. During bull markets, oversold conditions generally result in a resumption of an uptrend. Unfortunately, I suspect we’re at the beginning of a long term bear market so oversold conditions should now result in more price destruction before a rally can ensue.

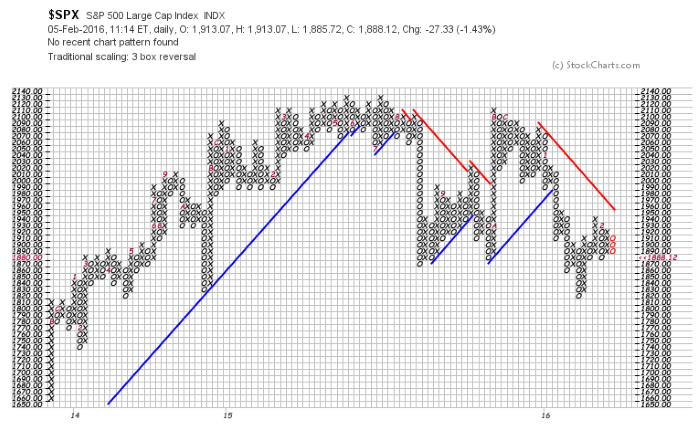

Here are a few charts that suggest we’re likely resuming the down trend. First is a point and figure chart of the S&P 500 Index (SPX). It now has a bearish reversal during an intermediate term down trend.

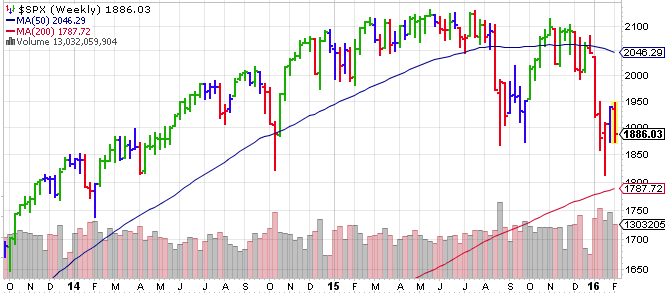

Next is a weekly chart of SPX Elder Impulse. It has turned red after a short term rally that couldn’t produce a green bar.

Conclusion

It’s ugly out there. We’re likely in a bear market. Dow Theory hasn’t signaled yet, but many other indicators are toppling one by one. As a result, bear market rules apply as I interpret charts and indicators… which are currently suggesting a resumption of the long term down trend.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI