What’s wrong with the housing market?

Despite the pundit call for earnings season to kickoff with Alcoa (NYSE:AA) and an end 3 or 4 weeks later, there are actually companies reporting earnings nearly every day. Sometimes they are big ones and sometimes little companies that would go completely unnoticed if they reported that first week of the season.

Tonight there are 3 reporting — Adobe (NASDAQ:ADBE), La Z Boy (NYSE:LZB) and Bob Evans (NASDAQ:BOBE), and then one in the morning, FedEX (NYSE:FDX) — all over $1 billion in market capitalization. This is more than two months after Alcoa started the Quarter off, and much closer to the start of the next quarter. Yes, earnings season never ends!

A second message you hear all the time is that traders should not hold stock through earnings. That is also a load of hogwash. Almost every stock can be protected through earnings using options. What is more, you can use those options to actually trade just for the volatility that can come from earnings reports. Bob Evans is an interesting one, so lets take a closer look.

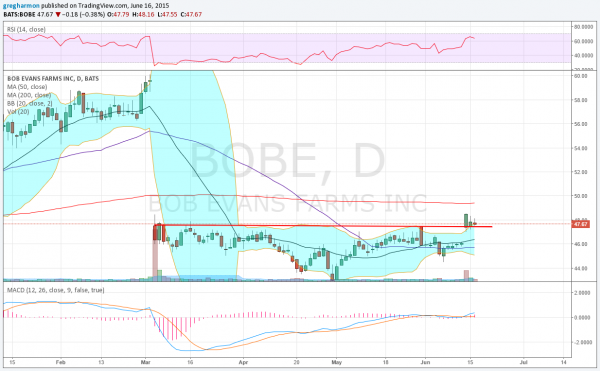

The chart of Bob Evans above shows a big gap down following the last report in March. But since then, it has consolidated in a tight range between 44 and 47.50 for over 3 months. That is, until it jumped higher 3 days ago. It has held that move over resistance heading into the report tonight.

From a technical perspective, it has good momentum indicators, with the RSI in the bullish zone and the MACD crossed up and rising. The Bollinger Bands® are also opening. Without the earnings report, the chart looks like it is consolidating the move higher, back into the Bollinger Bands to prep for another step higher. The June contracts suggest that traders are looking for about a $4 move by Friday.

Over the last 6 reports, the stock has averaged a move of about 9.71% or $4.65 at today’s price. The options market shows high open interest at the 40 and 45 Put Strikes expiring Friday and at the 50 and 65 Call Strikes.

With the 200 day SMA at about 49.40 above and the upward bias, I like a June/July 50 Call Calendar selling a June 45 Put to trade the event. This is buying the July 50 Call and selling the June 50 Call, but also selling the June 45 Put. There is no cost to put this trade on, but it does use margin or requires cash to cover owning the stock at 45 if you do it in an IRA. The risk is that it falls under 45 and you are put the stock. If it rises but not above 50, you can continue in the trade with long July Calls. If it moves over 50, you can sell the Call Calendar for a few cents or look at moving it to a July Call Spread.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.