I’m sure some call me an uber-bull but I am bullish as I see the trend higher, and will continue to do until it looks different. When it changes, so will I. This can lead to some consternation though, when a possible pullback appears during the uptrend. One easy way to deal with it is to sit back and wait for the pullback to end. The problem is that this is a market of stocks, and they do not all follow the indexes. A recent example of that dilemma, which faces me front and center are the athletic apparel companies. Athletic apparel companies are strong and continue to be so despite Wednesday's down day and the longer 3 day pullback in the small caps. Take a look at Nike (NKE) and Under Armour, (UA).

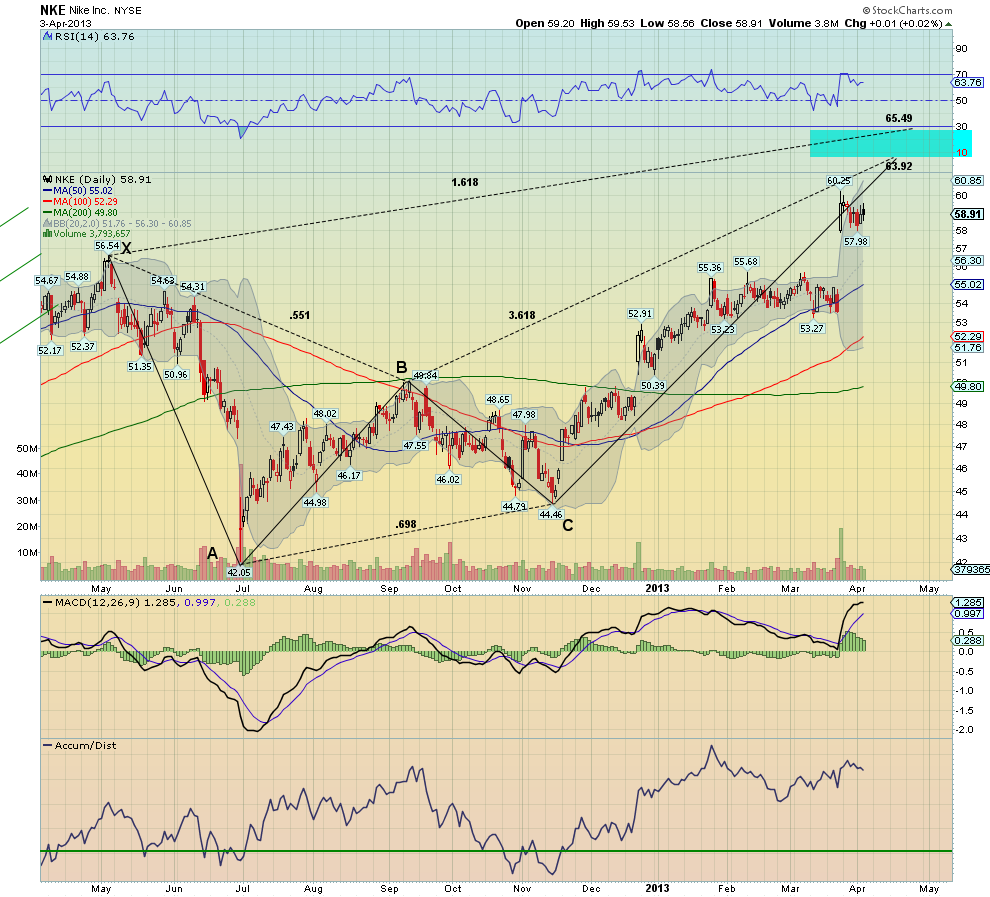

Nike, NKE

Nike (NKE) gapped higher after earnings and has been consolidating since. The consolidation has brought it back into the Bollinger bands and helps work off a technically overbought condition on the Relative Strength Index (RSI). The Moving Average Convergence Divergence indicator (MACD) is just starting to rollover. It is nearing its 3-box reversal Point and Figure chart (PnF) Price Objective at 61, and the Potential Reversal Zone (PRZ) from the bearish crab between 63.92 and 65.49. How can you play this? One way is to look at the support area below between 53 and 55. If you are comfortable owning the stock there, then you can start your entry by selling the May 55 Puts (bid at 41 cents late Wednesday) for a portion of a position. If you are afraid of missing the upside break despite a market pullback, use some of those sale proceeds to buy the April 62.5 Call (9 cents). In this way you have long exposure with credit in your pocket and a possible 7% lower entry.

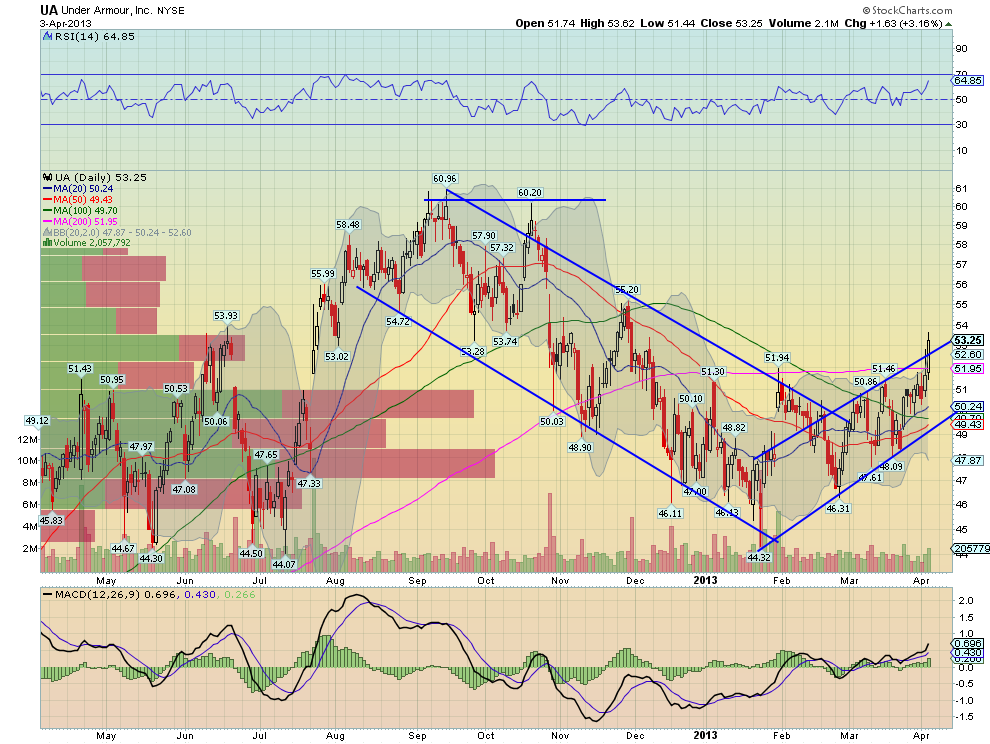

Under Armour, UA

Under Armour, UA, has been reversing the channel lower, moving higher throughout March. It could be accelerating that move as it tries to break the rising channel. With resistance next at 55.20 and then 58 and 60.20, there could be a lot of upside left. Support lower can be seen at the thick volume at price bars between 47 and 51. Again if you are comfortable with that support, you can start a long exposure by selling the May 47.50 Puts (65 cents) for a partial position. This gives you a cash credit and a potential entry at a price 12% lower. If you do not want to miss the upside, then add a May 57.5/60 Call Spread (55 cents) to capture that and still maintain credit in pocket.

Both of these are examples of how to gain long exposure at a comfortable risk level, and not worry about that gap down that can wreak havoc to a long stock position with a stop. These are the types of trades offered in the subscription service every week, along side straight stock trades.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI