EU poised to impose €21 billion tariffs on U.S. if no trade deal, Tajani says

The Atlanta Fed GDPNow forecast for second quarter GDP and the New York Fed Nowcast staff report both ticked up 0.1 percentage points following today’s economic releases.

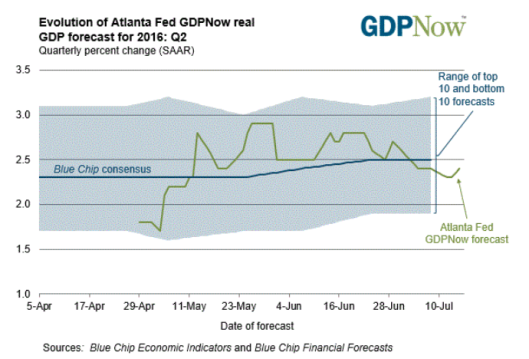

Latest forecast: 2.4 percent – July 15, 2016

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2016 is 2.4 percent on July 15, up from 2.3 percent on July 12. The forecast for second-quarter real consumer spending growth increased from 4.3 percent to 4.5 percent after this morning’s retail sales release from the U.S. Census Bureau and this morning’s Consumer Price Index release from the U.S. Bureau of Labor Statistics.

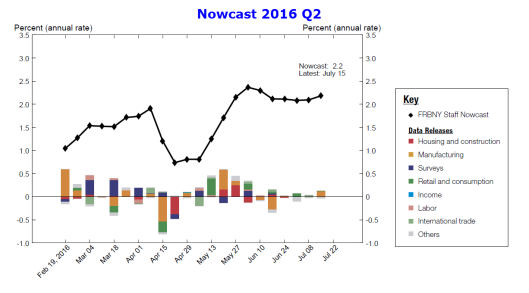

FRBNY Staff Nowcast – July 15, 2016

- The FRBNY Staff Nowcast stands at 2.2% and 2.6% for 2016:Q2 and 2016:Q3, respectively.

- This week’s news had positive effect on the nowcast pushing up the Q2 measure by 0.1 percentage point and the Q3 measure by 0.3

percentage point. - The largest contributions came from manufacturing data, in particular capacity utilization and industrial production.

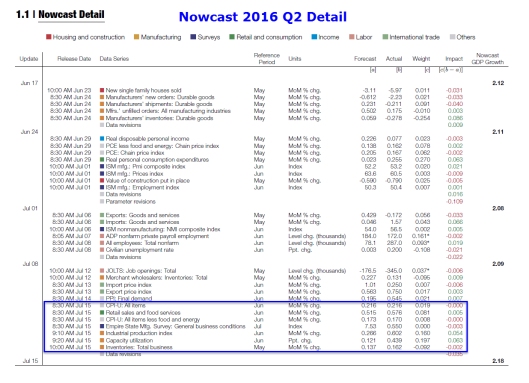

Nowcast 2016 Q2

Nowcast 2016 Q2 Detail

Notes

- The GDPNow model ticked up largely because of retail sales and the CPI, but they had almost no impact on Nowcast.

- Nowcast takes into consideration regional manufacturing reports but GDPNow doesn’t. The effect this week was negligible.

- Industrial production and capacity utilization were the big contributors to Nowcast.

- Retail sales had almost no impact on Nowcast (+0.005) because the gain was largely expected.

- Data revisions (all revisions) took off 0.035 percentage points, most likely led by negative retail sales revisions for May.

- The retail sales report was not as “fabulous” as appeared at first glance.

Related Articles

- Industrial Production Jumps 0.6%; Has Manufacturing Turned?

- June Retail Sales Jump 0.6% from Revised May Sales of 0.2% (0.3% Lower)

Key Modeling Idea

It is not the data itself that matters, but rather how well the data did vs. the forecast for that data.

For discussion, please see My Conversations with New York and Atlanta Fed Senior Economists on Their GDP Models.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.