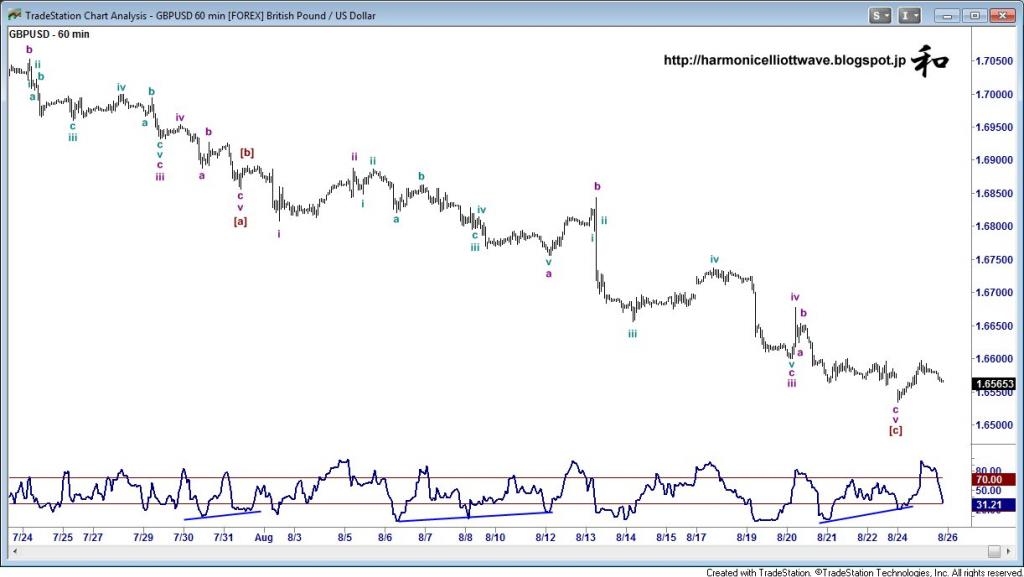

BIAS: This appears still to be in a correction higher - take care with the potential for complicated structures.

Resistance: 1.6575-80 1.6597 1.6620-25 1.6650

Support: 1.6560-65 1.6535 1.6520 1.6498

MAIN ANALYSIS: Instead of a minor new low we saw a choppy rally to the to of the 1.6565 - 1.6600 area from where we have seen a correction back to 1.6565. This may have done enough for a correction although the 4-hour Price Equilibrium Cloud is still providing resistance. Thus, any break below 1.6560 would extend losses and may then retest the 1.6535 low. I still have a cautious preference for gains to the 1.6625-50 area but ensure we see a decent reversal indication. A move above 1.6597 would then take price to that 1.6620-50 area and also allow for 1.6670-78.

COUNTER ANALYSIS: A break below 1.6535 would risk losses to 1.6511 at least - any breach would see losses extend to 1.6480 and later to the 1.6465 daily low. Below would suggest follow-through to the 1.6392 daily retracement support.

MEDIUM TERM ANALYSIS:

20th August: With the development in the EUR/USD, I am more encouraged by the corrective bearish structure that should probe the lower areas of the daily correction. The minimum is at 1.6495 but I suspect the 1.6392 area minimum and could be lower. However, before reaching that target area we are probably due a modest correction higher.

26th August: I am wary due to the vague correction and continued requirement for losses. I would suggest waiting for a break of yesterday's low at least and preferably 1.6498-11. Until then there is risk of the current correction continuing.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.