Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

GBP/USD for Friday, July 19, 2013

After having done very little for a few days, the last couple of days have seen the GBP/USD surge higher and move through the 1.52 level to a two week high near 1.53. It has for the most part of the last week moved very little as it found solid support at 1.51 and traded within a narrow range above this level. To close out last week, the pound eased off a little as well and established a trading range in between 1.51 and 1.52 after it took a breather from its excitement from last week. Last week it experienced a strong surge higher moving back to within reach of the 1.52 level before easing off a little and then rallying a off support at 1.5080.

Earlier last week it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. A couple of weeks ago it experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. This recent movement saw it resume its already well established medium term down trend from the last few weeks and move it to a four month low. Over the last few weeks, it has moved back from above 1.57 and fallen strongly.

The UK released a host of inflation indicators on Wednesday, and most matched the forecast. CPI, the most important inflation index, climbed from 2.7% to 2.9%, but still remained below the estimate of 3.0%. The Bank of England recently commented on high inflation in the British economy, noting that it might have to adjust its target of 2.0% to a higher level. The BOE released the breakdown of how policymakers voted on the interest rate and asset purchase facility (APF) decisions. The votes for both carried with 9-0 unanimous decisions. This was expected with the vote on the key interest rate, but the APF vote was a surprise, as the markets had expected another split vote. In recent decisions, former BOE Governor Mervyn King found himself in the minority which voted to increase APF. This past meeting was the first under new governor Mark Carney, who not only voted against any changes to APF, but convinced all the other policymakers to vote with him. The vote underscores that Carney may run things differently than King, and the market reaction to Carney’s new leadership could impact on the pound.

GBP/USD July 19 at 01:20 GMT 1.5211 H: 1.5241 L: 1.5158

During the early hours of the Asian trading session on Friday, the GBP/USD is consolidating in a narrow range right above the recently broken through level of 1.52, after enjoying a solid move a couple of days ago from down near 1.51. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50. Current range: Right around 1.5210.

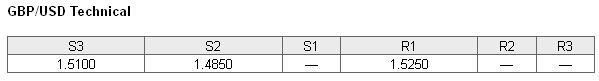

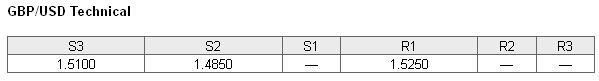

Further levels in both directions:

• Below: 1.5100 and 1.4850.

• Above: 1.5250.

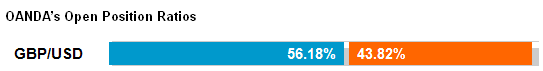

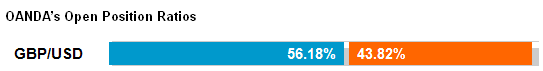

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has just eased back under 60% as the GBP/USD has pushed higher and moved through the 1.52 level. Trader sentiment remains in favour of long positions.

Economic Releases

After having done very little for a few days, the last couple of days have seen the GBP/USD surge higher and move through the 1.52 level to a two week high near 1.53. It has for the most part of the last week moved very little as it found solid support at 1.51 and traded within a narrow range above this level. To close out last week, the pound eased off a little as well and established a trading range in between 1.51 and 1.52 after it took a breather from its excitement from last week. Last week it experienced a strong surge higher moving back to within reach of the 1.52 level before easing off a little and then rallying a off support at 1.5080.

Earlier last week it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. A couple of weeks ago it experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. This recent movement saw it resume its already well established medium term down trend from the last few weeks and move it to a four month low. Over the last few weeks, it has moved back from above 1.57 and fallen strongly.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Throughout the first half of June, it enjoyed its best run in a long time as it surged from 1.50 to 1.57 in just a few weeks. Its multiple key levels during its movement up towards 1.57 have appeared to have little impact during its recent decline, although 1.52 seemed to halt the decline a little a couple of weeks ago. This level has resurfaced again and provided further resistance after the pound’s surge higher last week. With the exception of last week’s surge higher, the pound has completely reversed its fortunes from the strong first half of June which saw it climb so strongly from 1.50 up to the four month highs above 1.57. Throughout the month of May the pound fell strongly and return almost all of its gains from the few weeks before that. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. The UK released a host of inflation indicators on Wednesday, and most matched the forecast. CPI, the most important inflation index, climbed from 2.7% to 2.9%, but still remained below the estimate of 3.0%. The Bank of England recently commented on high inflation in the British economy, noting that it might have to adjust its target of 2.0% to a higher level. The BOE released the breakdown of how policymakers voted on the interest rate and asset purchase facility (APF) decisions. The votes for both carried with 9-0 unanimous decisions. This was expected with the vote on the key interest rate, but the APF vote was a surprise, as the markets had expected another split vote. In recent decisions, former BOE Governor Mervyn King found himself in the minority which voted to increase APF. This past meeting was the first under new governor Mark Carney, who not only voted against any changes to APF, but convinced all the other policymakers to vote with him. The vote underscores that Carney may run things differently than King, and the market reaction to Carney’s new leadership could impact on the pound.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

GBP/USD July 19 at 01:20 GMT 1.5211 H: 1.5241 L: 1.5158

During the early hours of the Asian trading session on Friday, the GBP/USD is consolidating in a narrow range right above the recently broken through level of 1.52, after enjoying a solid move a couple of days ago from down near 1.51. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50. Current range: Right around 1.5210.

Further levels in both directions:

• Below: 1.5100 and 1.4850.

• Above: 1.5250.

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has just eased back under 60% as the GBP/USD has pushed higher and moved through the 1.52 level. Trader sentiment remains in favour of long positions.

Economic Releases

- 04:30 JP All Industry activity index (May)

- 05:00 JP Leading indicator (Final) (May)

- 08:30 UK Public Borrowing (PSNB ex interventions) (Jun)

- 12:30 CA CPI (Jun)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI